Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

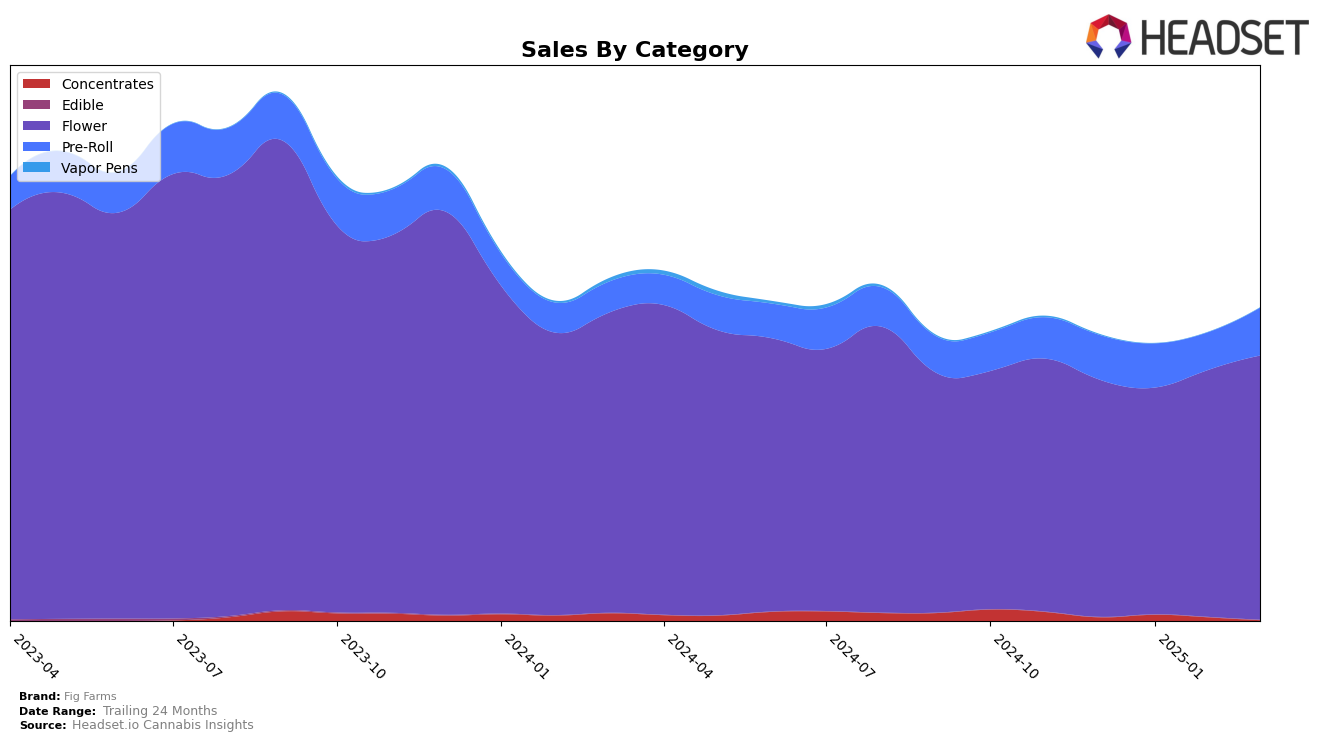

In the competitive landscape of cannabis brands, Fig Farms has demonstrated notable performance in the California market, particularly in the Flower category. Over the months from December 2024 to March 2025, Fig Farms maintained a strong presence, consistently ranking within the top 15, with a peak at 9th position in February 2025. This upward trajectory in the Flower category is underscored by a steady increase in sales, culminating in March 2025. Meanwhile, in the Pre-Roll category, Fig Farms showed a positive trend by breaking into the top 30 by March 2025, indicating a potential area of growth. However, it's worth noting that Fig Farms was not in the top 30 for Pre-Rolls in December 2024, highlighting the brand's recent progress in this segment.

In contrast, Fig Farms' performance in Illinois presents a different picture. In the Flower category, the brand has struggled to break into the top 30, with rankings fluctuating from 39th to 45th over the same period. This suggests challenges in gaining traction in this market segment. Additionally, in the Concentrates category, Fig Farms only appeared in the rankings in January 2025, securing the 28th position, but did not maintain a top 30 presence in subsequent months. This indicates a potential area for improvement or strategic reassessment in Illinois, as maintaining a consistent presence in the top rankings remains elusive for the brand in this state.

Competitive Landscape

In the competitive landscape of the California flower category, Fig Farms has demonstrated a dynamic shift in rankings over the past few months. Starting from December 2024, Fig Farms held the 13th position, maintaining this rank into January 2025. However, by February 2025, Fig Farms climbed to the 9th position, showcasing a significant improvement, before slightly dropping to 11th place in March 2025. This fluctuation indicates a competitive edge but also highlights the volatility in the market. Notably, UpNorth Humboldt consistently hovered around the 10th position, while Pacific Stone showed a steady ascent, reaching the 9th spot by March 2025. Meanwhile, Glass House Farms (CA) maintained a stable presence around the 12th rank, and West Coast Treez improved from 19th to 13th over the same period. Fig Farms' sales trajectory, with an upward trend from February to March 2025, suggests a positive reception in the market, though the competition remains fierce with brands like Pacific Stone experiencing a notable sales surge during this period.

Notable Products

In March 2025, Blue Face (3.5g) retained its top position in the Fig Farms lineup, with sales skyrocketing to 8,135 units, a significant increase from previous months. Holy Moly Pre-Roll (1g) made a notable entry into the rankings, securing the second spot with impressive sales figures, marking a strong comeback after an absence in earlier months. Blue Face Pre-Roll (1g) maintained a steady presence, ranking third, consistent with its performance in February 2025. Krypto Chronic #1 (3.5g) slipped to fourth place, despite strong sales in prior months. Donut Shop (3.5g) debuted in the rankings at fifth place, indicating a promising start for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.