Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

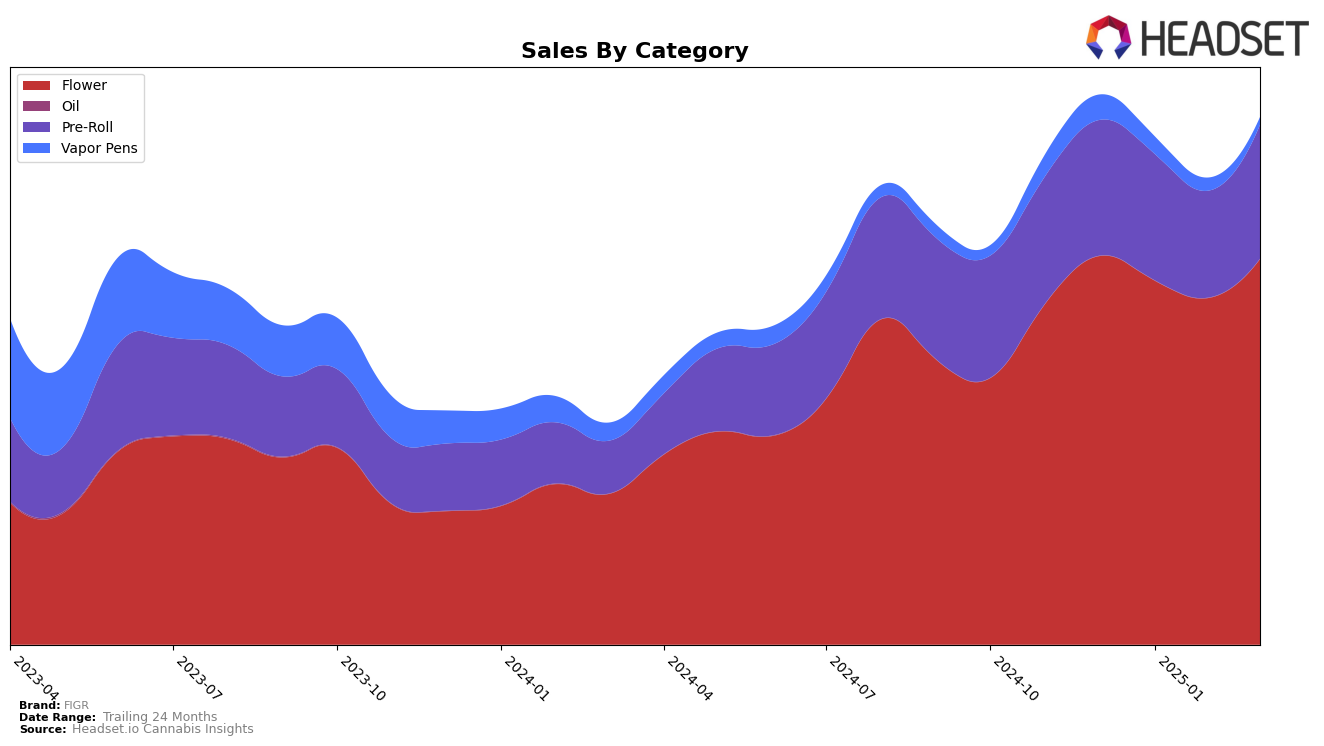

In Alberta, FIGR has shown a mixed performance across different cannabis categories. In the Flower category, the brand maintained a strong presence, starting with a rank of 7 in December 2024 and slightly fluctuating to 8 by March 2025. This suggests a stable market position despite a decline in sales over the months. However, in the Pre-Roll category, FIGR demonstrated a positive trend, improving its rank from 29 in December 2024 to 19 by March 2025. This upward movement indicates a growing consumer preference for FIGR's Pre-Roll products in Alberta, as evidenced by the increase in sales during this period.

In Ontario, FIGR has seen varied success across its product lines. The Flower category has been a stronghold for the brand, maintaining a relatively high rank, fluctuating between 12 and 15 from December 2024 to March 2025, with a notable peak in sales in March. Conversely, the Vapor Pens category did not see FIGR in the top 30 rankings after December, indicating a potential area for improvement or reduced consumer interest. Meanwhile, in Saskatchewan, FIGR's performance in the Flower category has been particularly noteworthy, with the brand improving its rank from 14 in January to 6 in March 2025, suggesting a significant gain in market share within this province.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, FIGR has shown a consistent performance, maintaining a rank within the top 20 brands from December 2024 to March 2025. FIGR's rank fluctuated slightly, starting at 15th in December, improving to 12th by February, before settling back to 14th in March. This stability is noteworthy considering the dynamic shifts among competitors. For instance, The Loud Plug experienced significant volatility, dropping from 7th in December to 15th in February, before recovering to 12th in March. Meanwhile, Pure Laine consistently outperformed FIGR, holding a higher rank each month, although it too saw a decline from 9th in January to 13th in March. MTL Cannabis mirrored FIGR's trajectory, maintaining a close competition but ultimately falling to 16th in March. Despite these fluctuations, FIGR's sales showed resilience, with a notable increase in March, suggesting a positive reception in the market and potential for future growth against its competitors.

Notable Products

In March 2025, Jungle Fumes Pre-Roll 10-Pack (3.5g) maintained its top position as the leading product for FIGR, with sales rising to 15,021 units. Mellow Man Pre-Roll 10-Pack (3.5g) made a significant leap to second place, up from fourth in February 2025. Jungle Fumes (3.5g) shifted slightly to third place, while Mellow Man (3.5g) dropped one spot to fourth. Jungle Fumes (7g) remained consistent in fifth place. Overall, the rankings highlight a strong performance by the pre-roll category, particularly the Jungle Fumes Pre-Roll, which continues to dominate the sales chart.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.