Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

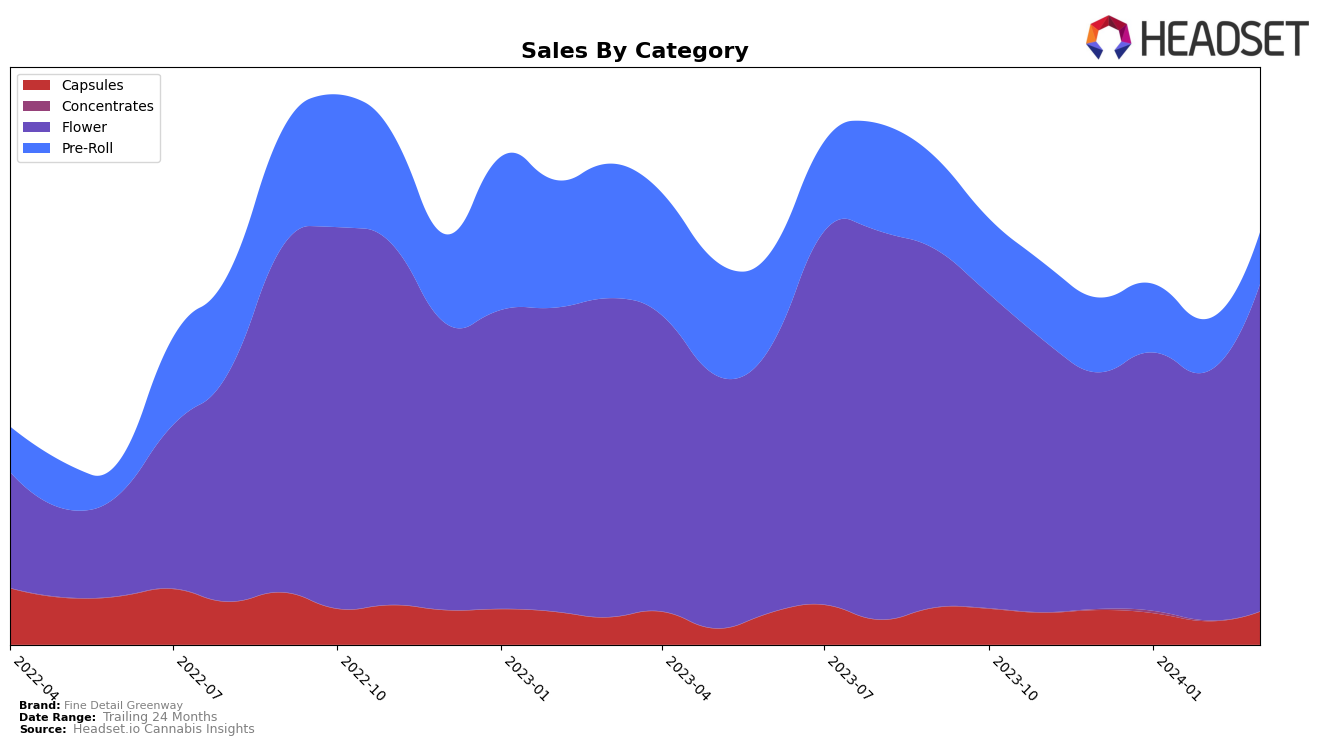

In the dynamic and ever-evolving cannabis market, Fine Detail Greenway has managed to carve out a notable presence, particularly in the Washington state market within the Capsules category. Consistently holding the 5th rank from December 2023 through March 2024, Fine Detail Greenway demonstrates a strong and stable position among the top brands. This consistency is not only a testament to the brand's quality and consumer loyalty but also highlights its competitive edge in a crowded marketplace. However, it's worth noting a slight fluctuation in sales figures across these months, with a notable dip in February 2024 before rebounding in March. This could indicate varying consumer demand or purchasing patterns, which are crucial for understanding market dynamics and the brand's adaptability.

On the other hand, Fine Detail Greenway's performance in the Massachusetts market tells a different story, specifically within the Flower category. The brand did not rank in the top 30 for December 2023 through February 2024, only emerging in March 2024 at the 97th position. This sudden appearance could be interpreted in several ways; it might indicate a recent entry into the market or perhaps a significant improvement in its product offerings or marketing strategies. The leap into the rankings, coupled with a reported sales figure for March 2024, suggests a potential turning point for Fine Detail Greenway in Massachusetts. However, the relatively low rank compared to its performance in Washington indicates there's substantial room for growth and improvement in this market.

Competitive Landscape

In the competitive landscape of the Flower category in Massachusetts, Fine Detail Greenway has shown a notable absence in the rankings from December 2023 through March 2024, indicating they were not among the top 20 brands for these months. This positions them behind key competitors such as Binske, which made a significant leap into the rankings in February 2024, and Bonsai Cultivation, which entered the rankings in March 2024. FloraCal Farms demonstrated a fluctuating but overall strong performance, peaking in February 2024, while RiverRun Gardens maintained a consistent presence in the rankings from December 2023 through March 2024. The absence of Fine Detail Greenway from the rankings, contrasted with the dynamic shifts and entries of its competitors, suggests challenges in maintaining visibility and sales momentum in a highly competitive market. This analysis underscores the importance for Fine Detail Greenway to strategize on increasing their market share and improving their rank among Massachusetts' Flower category brands.

Notable Products

In Mar-2024, Fine Detail Greenway's top-performing product was Cherry Pie OG (3.5g) from the Flower category, maintaining its number one rank since Jan-2024 with impressive sales figures reaching 1990 units. Following in second place was Atticus Indica Capsules 10-Pack (100mg) within the Capsules category, showing a slight rank improvement from third in Feb-2024 to second, with sales figures indicating strong consumer interest. The Dulce Ice Pre-Roll 2-Pack (1g) from the Pre-Roll category made a notable jump to the third rank, a significant improvement considering it was not ranked in Feb-2024. Sativa Atticus Capsules 10-Pack (100mg), another product in the Capsules category, secured the fourth rank, slightly improving from its previous position in Feb-2024. Lastly, The Cat's Pajamas Pre-Roll 2-Pack (1g) from the Pre-Roll category rounded out the top five, indicating a diversification in the top products' categories, despite a drop in its ranking from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.