Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

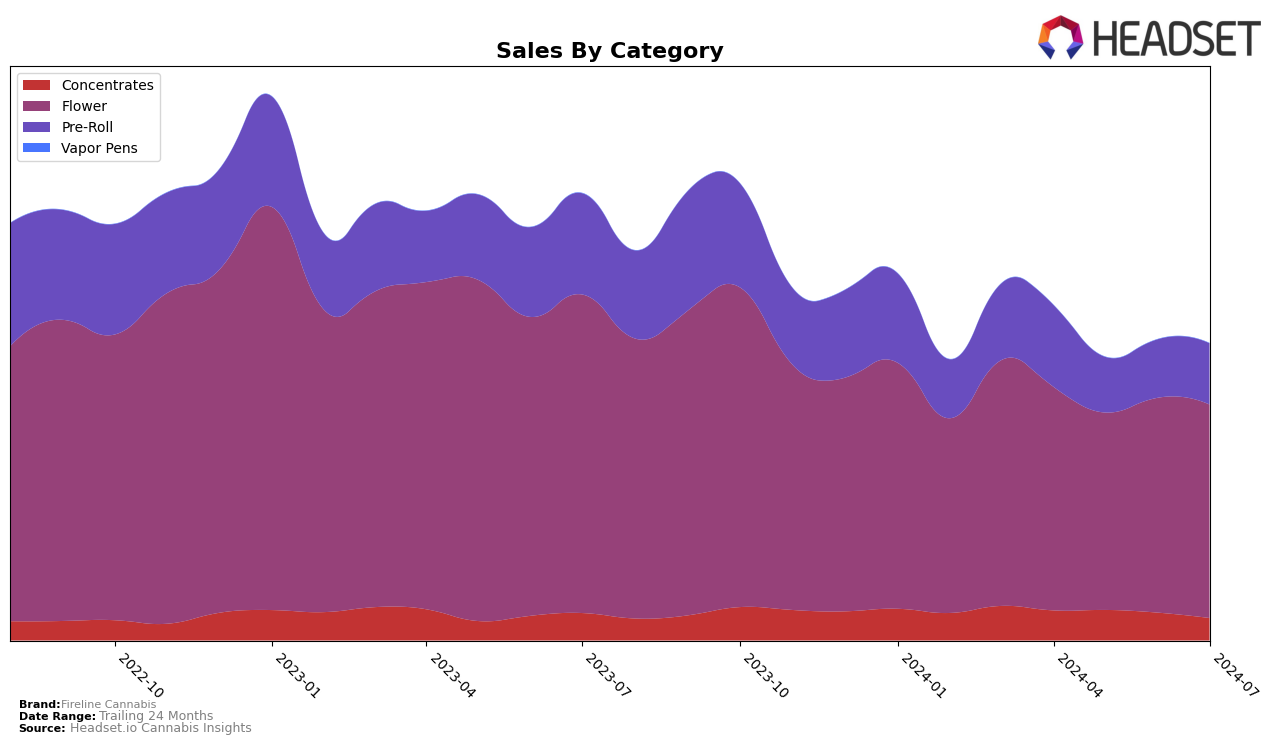

Fireline Cannabis has shown varying performance across different product categories in Washington. In the Concentrates category, the brand has consistently struggled to break into the top 30, with rankings hovering around the low 50s from April to July 2024. This trend indicates a competitive market where Fireline Cannabis is facing challenges in gaining a substantial foothold. On the other hand, the Flower category tells a slightly different story, with the brand maintaining a presence in the top 30 for most months, although there was a dip to rank 33 in May before recovering slightly. This suggests that while Fireline Cannabis has a stronger position in the Flower market, it still faces volatility and competition.

In the Pre-Roll category, Fireline Cannabis experienced a significant drop in ranking, falling from 37th in April to 63rd in May, then recovering slightly to 54th by July. The sales figures reflect this instability, with a notable dip in May but a gradual increase in the following months. This fluctuation indicates that while there is some consumer interest, it is not consistent enough to ensure a stable ranking. These movements highlight the brand's need to possibly reevaluate its strategy in the Pre-Roll segment to achieve more stable and higher rankings. Overall, Fireline Cannabis's performance across categories in Washington underscores the competitive nature of the market and the necessity for strategic adjustments to improve standings.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Fireline Cannabis has experienced notable fluctuations in its rank over the past few months, moving from 23rd in April 2024 to 29th in July 2024. This downward trend in rank suggests a need for strategic adjustments to regain market position. Competitors such as Harmony Farms and Falcanna have shown more stable or improving ranks, with Harmony Farms maintaining a relatively consistent position, ending at 28th in July 2024, and Falcanna improving from 26th in April to 27th in July. Meanwhile, Western Cultured and Bacon Buds have also faced rank volatility, with Western Cultured dropping out of the top 20 in May and June before recovering slightly to 30th in July, and Bacon Buds showing a similar pattern. These insights indicate that while Fireline Cannabis is facing stiff competition, there is potential for strategic initiatives to improve its market standing amidst fluctuating competitor performance.

Notable Products

In July 2024, the top-performing product from Fireline Cannabis was Skatalite (3.5g) in the Flower category, maintaining its first-place rank with notable sales of 1326 units. Skunk GMO (3.5g) emerged as the second top product, making its debut in the rankings. Pearl Scout Cookies (3.5g) secured the third position, showing a slight decline from its previous second-place rank in April 2024. Krazy Runtz (3.5g) improved its position from fifth in June to fourth in July 2024. Jedi Breath (3.5g) entered the rankings at fifth place in July 2024, indicating a new addition to the top-performing products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.