Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

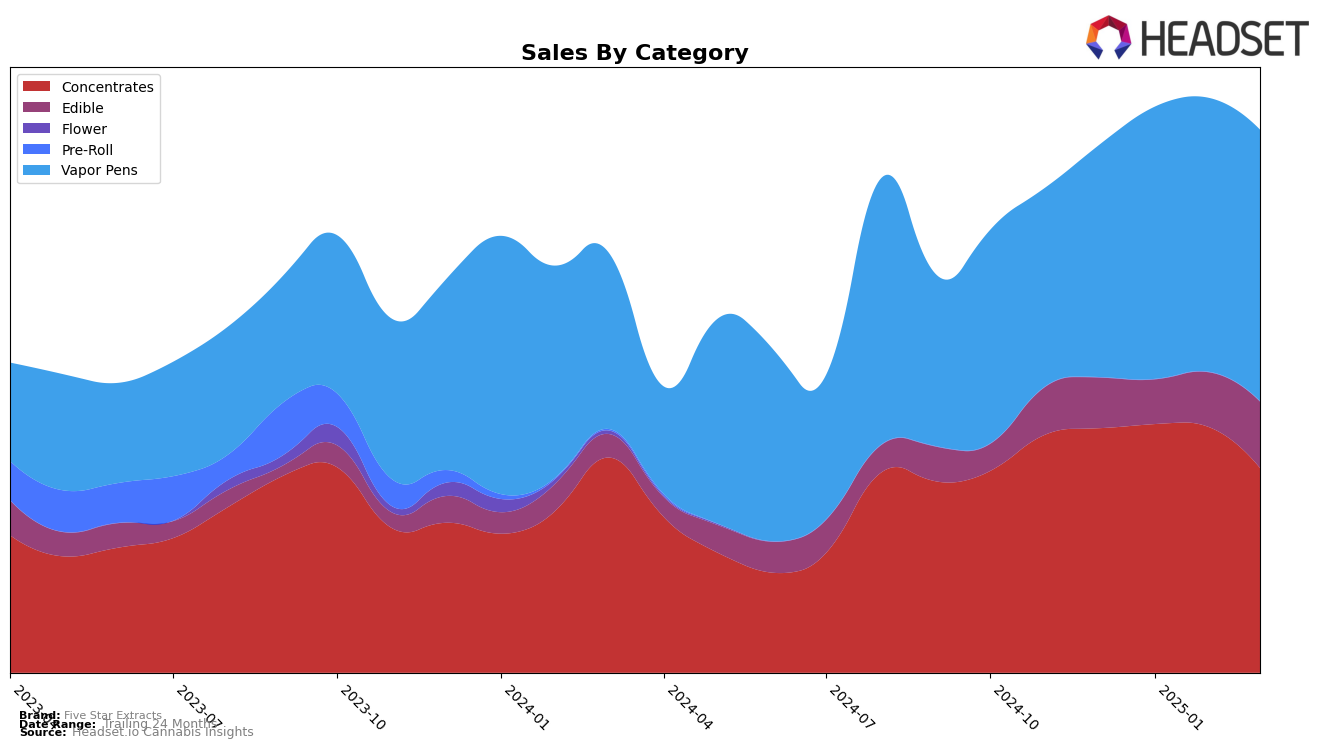

Five Star Extracts has demonstrated varied performance across different product categories within the state of Michigan. In the Concentrates category, the brand experienced a decline in rankings from 17th in December 2024 to 23rd by March 2025, alongside a noticeable drop in sales. This trend suggests a potential shift in consumer preferences or increased competition within this category. Conversely, in the Edibles segment, Five Star Extracts maintained a relatively stable position, hovering around the 62nd rank in early 2025, indicating a steady, albeit modest, presence in the market. This stability in Edibles could hint at a loyal customer base or consistent product offerings that meet consumer expectations.

Meanwhile, the Vapor Pens category tells a slightly different story for Five Star Extracts in Michigan. The brand improved its rank from 45th in December 2024 to 32nd in February 2025, before slightly dropping to 35th in March 2025. This fluctuation suggests a dynamic market environment where Five Star Extracts is gaining traction but facing stiff competition. The upward trend in early 2025 could be a result of successful marketing strategies or product innovations that resonated with consumers. However, the subsequent drop indicates that maintaining momentum in this competitive category requires continuous effort and adaptation. The absence of Five Star Extracts from the top 30 in some categories highlights areas for potential growth and strategic focus.

Competitive Landscape

In the Michigan vapor pens category, Five Star Extracts has demonstrated a notable upward trend in rankings over the past few months, moving from 45th place in December 2024 to 32nd place by February 2025, before slightly dropping to 35th in March 2025. This improvement in rank is indicative of a positive sales trajectory, as their sales figures consistently increased from December to February, peaking at 266,017 units. Despite a slight dip in March, Five Star Extracts still outperformed brands like Thunder Canna, which saw fluctuating ranks and sales. However, Five Star Extracts faces stiff competition from brands like Fresh Coast, which, despite a decline in rank from 27th to 36th, maintains higher sales figures. Meanwhile, Society C experienced a significant leap in rank, reaching 33rd place in March, surpassing Five Star Extracts, which could signal a competitive threat if this trend continues. Overall, Five Star Extracts' strategic positioning and sales growth suggest a promising potential for further market penetration, but the brand must remain vigilant of emerging competitors to sustain its upward momentum.

Notable Products

In March 2025, the top-performing product from Five Star Extracts was Blueberry Lemon Haze Badder Infused Gummies 4-Pack (200mg), which reclaimed its top position after slipping to second place in February. This product achieved impressive sales of 3356 units. Cherry Limeade One Hitter Gummies 4-Pack (200mg) maintained a strong performance, ranking second this month after leading in February. Traverse City Cherry Full Spectrum Gummies 4-Pack (200mg) rose to third place, showing a consistent upward trend since its introduction in February. Glitter Bomb Cured Badder (1g) and Moroccan Peaches Badder (1g) debuted in the rankings at fourth and fifth places, respectively, indicating a growing interest in concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.