Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

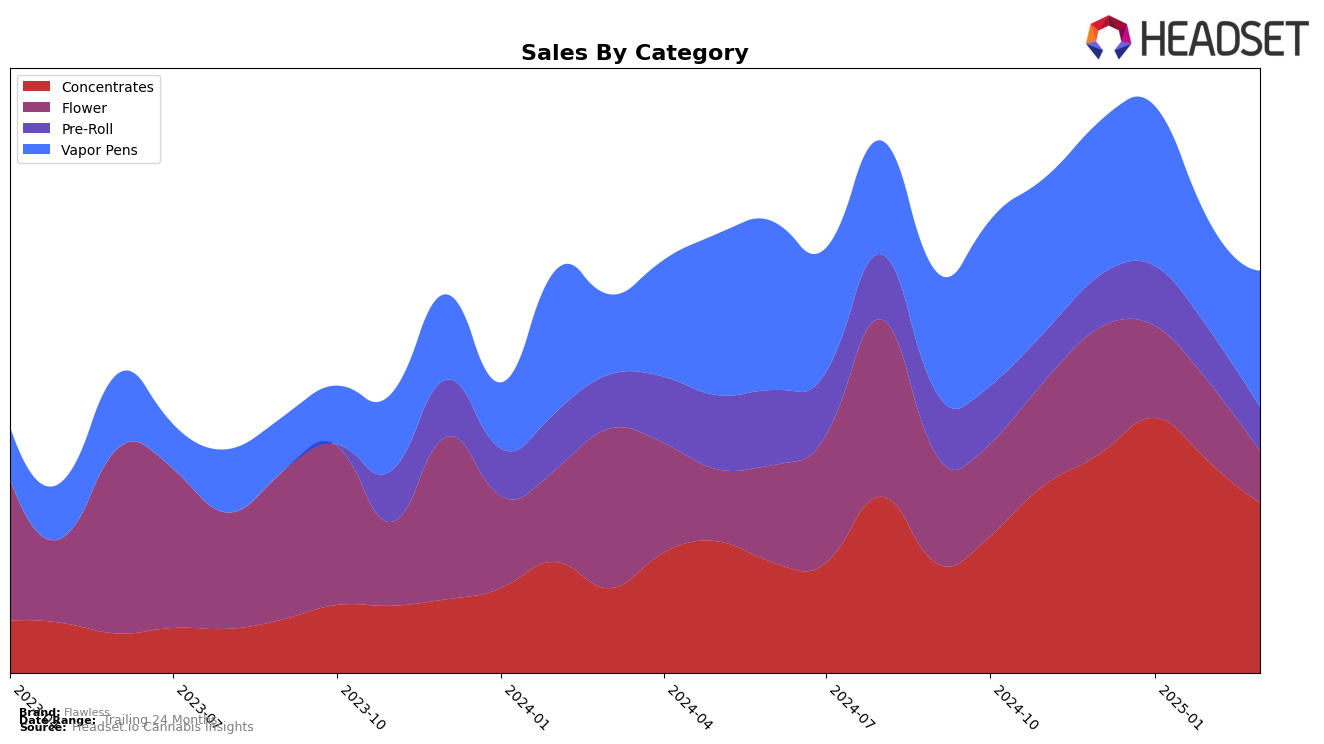

In the Washington market, Flawless has demonstrated fluctuating performance across different categories. In the Concentrates category, the brand maintained a presence within the top 30, although it experienced a decline from a rank of 19 in January 2025 to 26 by March 2025. This downward trend suggests that while Flawless is still competitive, it may be facing increasing challenges from other brands in this category. Interestingly, the sales figures reflect a peak in January, followed by a gradual decrease, indicating potential seasonal or market-driven factors affecting consumer demand.

Conversely, Flawless's performance in the Vapor Pens category is less robust, as the brand has not managed to break into the top 30 ranks during the observed months. This suggests that Flawless may need to reevaluate its strategy or product offerings to gain a stronger foothold in this segment. Despite the lower rankings, there is a noteworthy recovery in sales from February to March 2025, which could imply an effective promotional effort or an improved product reception. However, the brand's overall rank still indicates significant room for growth and improvement in this category.

Competitive Landscape

In the Washington concentrates market, Flawless has experienced notable fluctuations in its rank and sales over the past few months. Starting from December 2024, Flawless was ranked 22nd, then improved to 19th in January 2025, before dropping back to 22nd in February, and further down to 26th by March. This downward trend in rank is mirrored by a decrease in sales from January to March. In comparison, Mama J's showed a more stable performance, climbing from 29th in December to 23rd in February, though it slipped to 27th in March. Meanwhile, Incredibulk demonstrated a significant upward trajectory, moving from 48th in December to 24th in March, with a consistent increase in sales. These shifts suggest that while Flawless remains a competitive player, it faces increasing pressure from brands like Mama J's and Incredibulk, which are gaining traction in the market. Understanding these dynamics can help Flawless strategize to regain its competitive edge.

Notable Products

In March 2025, the top-performing product for Flawless was the Grape Gas x Horchata Infused Pre-Roll 2-Pack, leading the sales with a notable figure of 818 units sold. Following closely was the Glitter Blast Pre-Roll 3-Pack, securing the second position. The Strawnana Live Resin Cartridge ranked third, while the Platinum Zkittlez Live Resin and Dosi X Gelato Live Resin Cartridge took the fourth and fifth spots, respectively. Compared to previous months, these products have consistently maintained their rankings, indicating strong consumer preference and steady demand. The Pre-Roll category notably dominated the top positions, suggesting its popularity among customers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.