Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

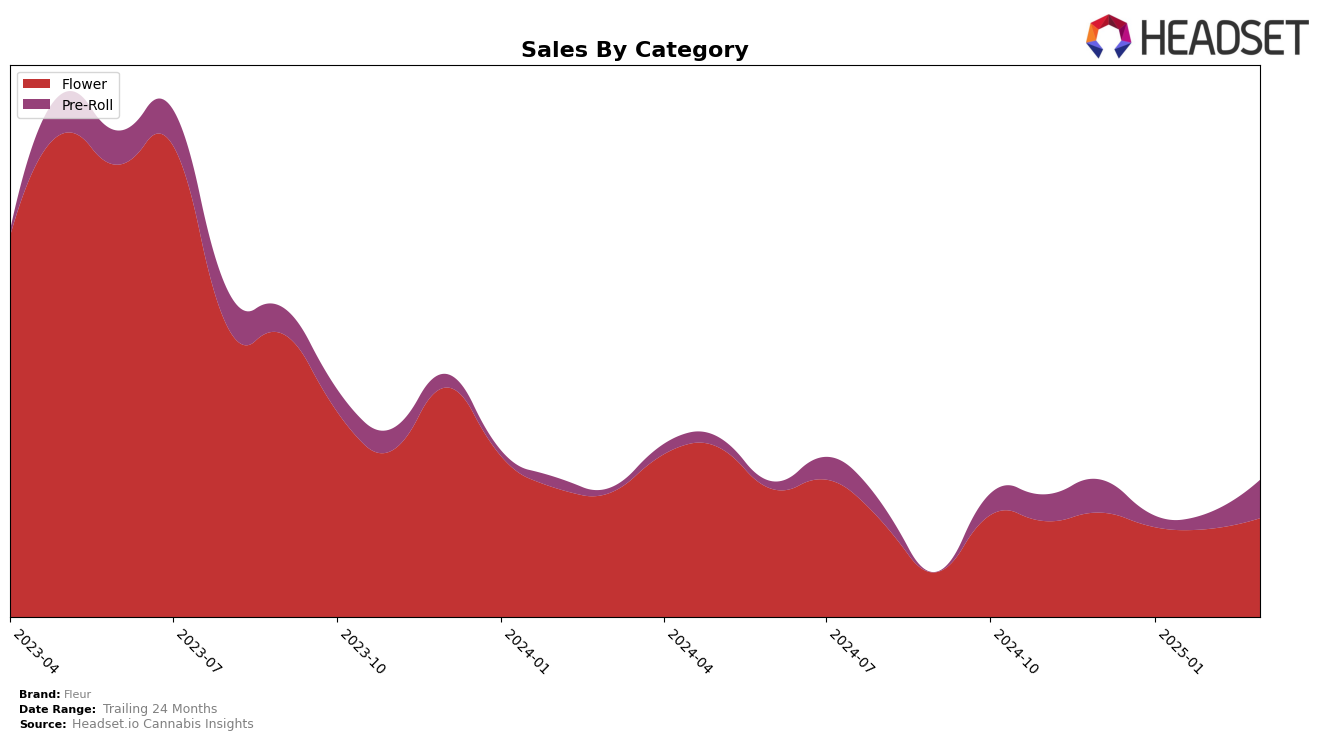

Fleur's performance in the Nevada market has shown some interesting trends across different categories. For the Flower category, Fleur has consistently hovered just outside the top 30, with rankings at 43 in December 2024 and moving slightly to 42 by March 2025. This indicates a stable, albeit not top-tier, presence in the Flower category, with a slight dip in sales in early 2025 followed by a recovery in March. The brand's ability to maintain close proximity to the top 30 suggests potential for growth, but also highlights the competitive nature of the market.

In contrast, Fleur's performance in the Pre-Roll category in Nevada has shown more volatility but with a positive trajectory. Starting at rank 32 in December 2024, Fleur dropped to 35 in January 2025 but managed to climb to 29 by March 2025, breaking into the top 30. This upward movement in rankings is complemented by a notable increase in sales, particularly in March, suggesting that Fleur's Pre-Roll products are gaining traction among consumers. The fluctuations in ranking reflect a dynamic market environment, where Fleur has managed to capitalize on opportunities to enhance its standing.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Fleur has shown a consistent presence, although it remains outside the top 20 brands, with ranks fluctuating between 40th and 44th from December 2024 to March 2025. Despite a slight dip in sales from December to February, Fleur's sales rebounded in March, suggesting a potential recovery. Notably, Pheno Exotic experienced a significant sales surge in March, moving up to 41st rank, surpassing Fleur for the first time in this period. Meanwhile, Vlasic Labs also improved its rank, closing in on Fleur. On the other hand, LP Exotics, despite a temporary dip in February, maintained a stronger position overall, indicating a competitive edge. These dynamics highlight the importance for Fleur to strategize effectively to enhance its market share and rank in the coming months.

Notable Products

In March 2025, the top-performing product for Fleur was Bushido OG Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one rank with sales reaching 1292 units. Following closely, Bushido OG (3.5g) in the Flower category, which had consistently held the top spot in previous months, moved to second place. Grape Monster Pre-Roll (1g) maintained its position at rank three, showing a steady increase in sales figures over the months. Sky Kush Cake Pre-Roll (1g) re-entered the rankings at fourth place, indicating a resurgence in popularity. BTY OG Pre-Roll (1g) rounded out the top five, dropping slightly from its earlier positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.