Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

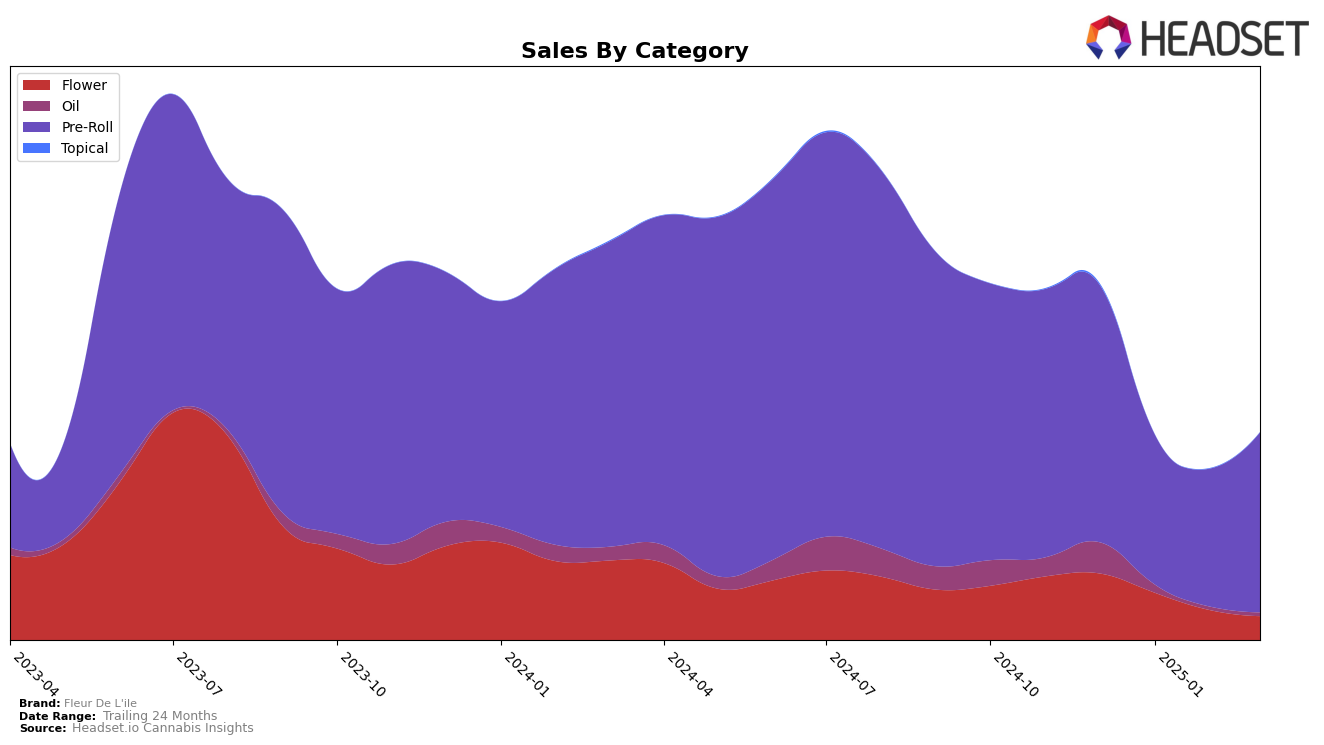

Fleur De L'ile has shown varied performance across different categories and regions. In Ontario, the brand's presence in the Pre-Roll category has been relatively stable, although it did not break into the top 30 rankings from December 2024 to March 2025. Despite this, their sales figures in March 2025 show a positive uptick, suggesting a potential upward trend. This could indicate growing consumer interest or successful marketing strategies in the region. In contrast, the brand's performance in Saskatchewan shows a more dynamic picture, with their Pre-Roll category moving from 25th to 20th place over the same period, highlighting a stronger foothold in this market.

In Saskatchewan, Fleur De L'ile's performance in the Flower category has seen a decline, as they fell out of the top 30 rankings by March 2025. This drop could signal increased competition or a shift in consumer preferences within the province. However, the brand's strong position in the Oil category, where they held the 3rd place in December 2024, underscores their competitive edge in specific segments. This duality in performance across categories and regions suggests that Fleur De L'ile may benefit from focusing on their strengths while addressing areas of decline to optimize their market strategy.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Fleur De L'ile has experienced fluctuating rankings, indicating a dynamic market presence. Starting at rank 62 in December 2024, Fleur De L'ile saw a slight decline to rank 66 by January 2025, maintaining a similar position through March 2025. This contrasts with competitors like Vox, which started at rank 57 and gradually declined to 64, and Community Cannabis c/o Purple Hills, which consistently held a stronger position, ranking between 63 and 65. Meanwhile, 7 Acres and Castle Rock Farms showed notable improvements, with Castle Rock Farms jumping from rank 99 to 67 by March 2025. Despite these shifts, Fleur De L'ile's sales figures reveal a recovery from a dip in January, climbing back to a healthier position by March, suggesting resilience amidst competitive pressures. This competitive analysis highlights the importance for Fleur De L'ile to strategize effectively to enhance its market position and capitalize on the upward sales trend.

Notable Products

In March 2025, Blue Dream Pre-Roll 7-Pack (3.5g) maintained its position as the top performer for Fleur De L'ile, consistently holding the number one rank since December 2024, with a notable sales figure of 2,578 units. Following closely, Bruce Banner Pre-Roll 7-Pack (3.5g) retained its second-place ranking, experiencing a significant increase in sales compared to previous months. The French Twist Pre-Roll 12-Pack (6g) remained steady in third place, while Jack Herer Pre-Roll 7-Pack (3.5g) held onto the fourth spot across all months. Lastly, Mix & Twist Pre-Roll 3-Pack (1.5g) consistently ranked fifth since its introduction in January 2025, showing a gradual increase in sales. Overall, the rankings for these products have remained stable, with only minor fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.