Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

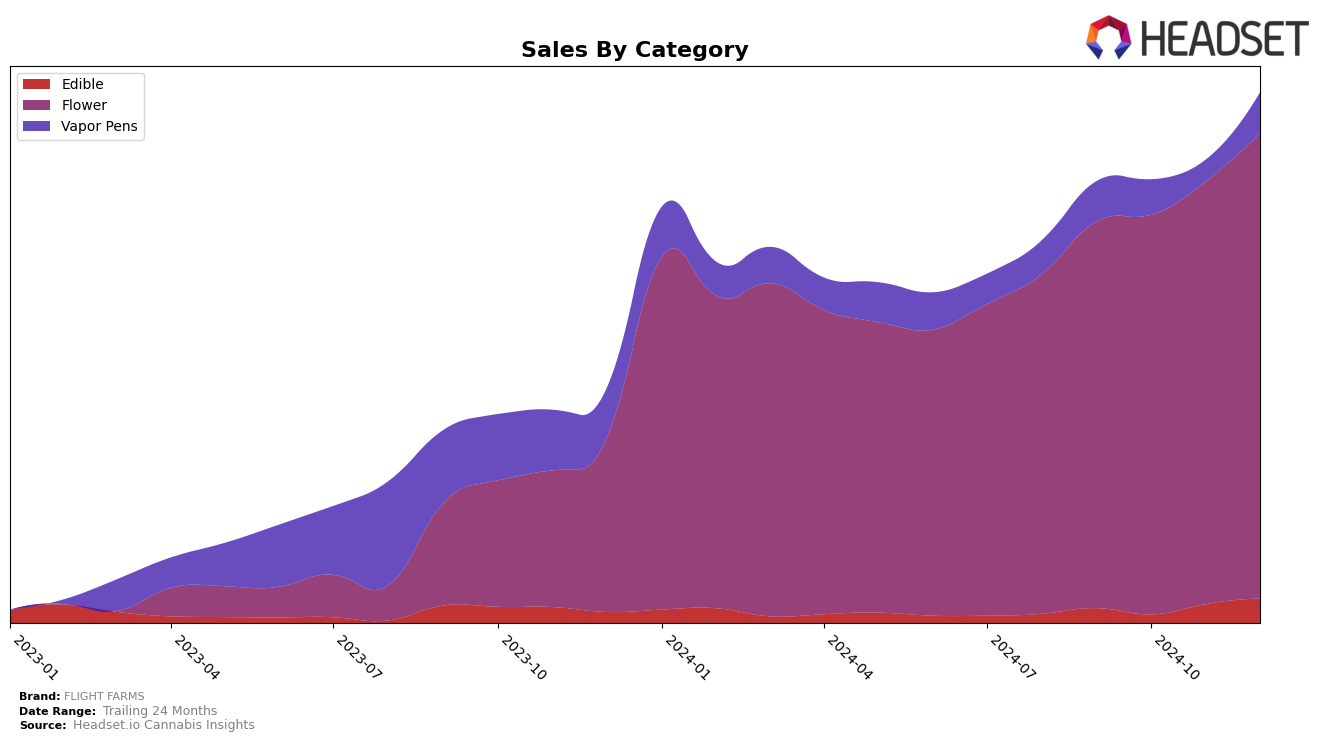

FLIGHT FARMS has demonstrated notable performance in the California Flower category, consistently maintaining a presence within the top 30 brands throughout the last quarter of 2024. Despite a minor fluctuation, the brand improved its ranking from 30th in November to 28th in December, indicating a positive trajectory. This upward movement is supported by a steady increase in sales, culminating in a significant rise from September to December. Such consistency in a competitive market like California's flower category suggests a strong brand presence and effective market strategies.

In Michigan, FLIGHT FARMS' performance varied across categories. In the Edible category, the brand was absent from the top 30 in October but made a comeback in November, climbing to 59th place by December. This rebound, coupled with increasing sales, highlights a potential for growth in this segment. Conversely, their performance in the Vapor Pens category saw a dip in rankings, falling to 96th in November before recovering to 71st in December. This fluctuation indicates a volatile market position, suggesting the need for strategic adjustments to maintain competitiveness in Michigan's vapor pen market.

Competitive Landscape

In the competitive landscape of the California Flower category, FLIGHT FARMS has experienced fluctuations in its market position, with its rank oscillating between 27th and 30th from September to December 2024. Despite these changes, FLIGHT FARMS has shown a positive trend in sales, culminating in a notable increase by December. In contrast, Maven Genetics has improved its rank from 31st to 26th, surpassing FLIGHT FARMS in October and maintaining a higher sales volume through December. Meanwhile, Delighted made a significant leap from 37th to 26th in November, briefly outperforming FLIGHT FARMS before settling just below it in December. Cruisers consistently held a higher rank than FLIGHT FARMS, except in December when it dropped to 29th, while Originals experienced a decline in rank, falling below FLIGHT FARMS in November and December. These dynamics suggest that while FLIGHT FARMS is facing stiff competition, particularly from Maven Genetics and Cruisers, its upward sales trajectory indicates potential for improved market positioning in the near future.

Notable Products

In December 2024, the top-performing product for FLIGHT FARMS was the Blue Lemonade Gummies 10-Pack (200mg) in the Edible category, which climbed to the number one rank from the second position in November, achieving sales of 12,141 units. Gelato Smalls (14g) in the Flower category, which previously held the top spot in November, shifted to the second rank, maintaining strong sales figures. Flight OG Smalls (14g) moved up to the third position, recovering from a fourth-place ranking in November. Turbulence OG Smalls (14g) dropped to the fourth rank, showing a decrease in sales compared to November. Wild Berry Gummies 10-Pack (200mg) entered the rankings at the fifth position, indicating a new entry in the top products list for December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.