Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

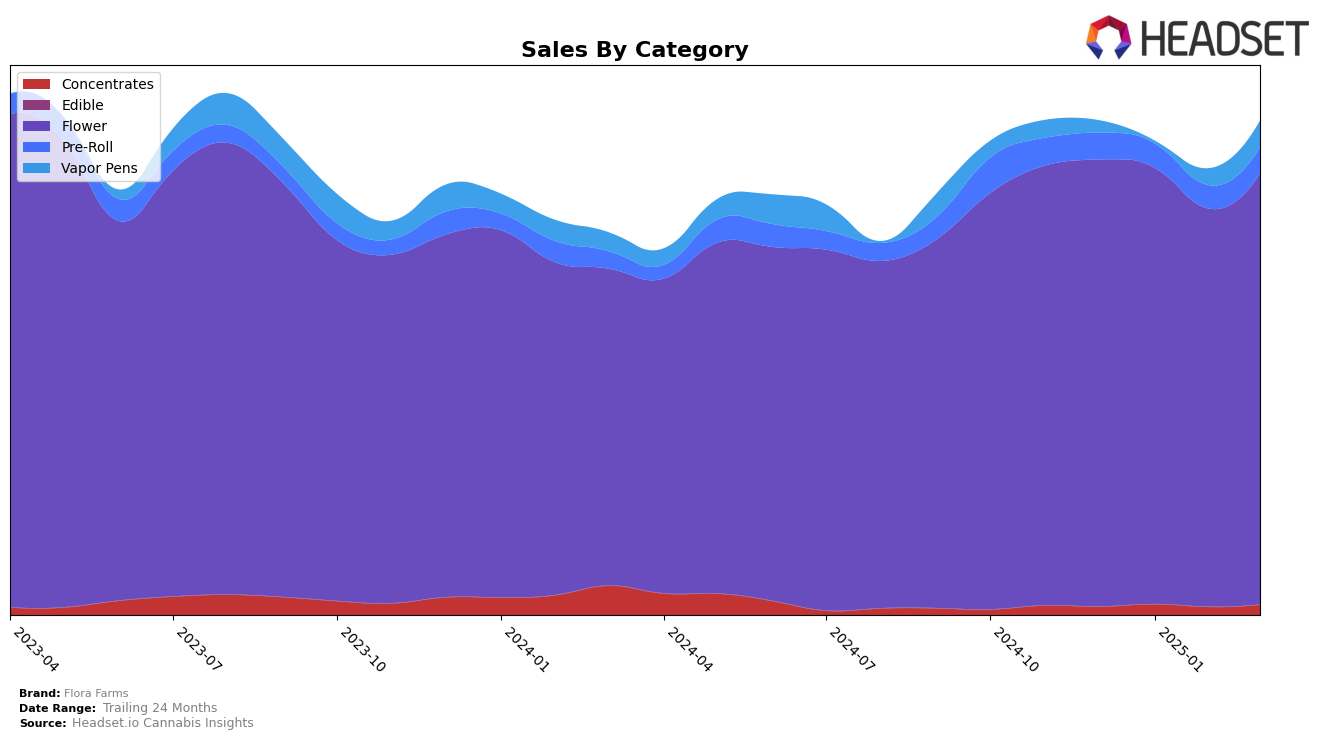

Flora Farms has demonstrated a consistent performance in the Missouri market, particularly in the Flower category, where it has maintained the top rank from December 2024 through March 2025. This indicates a strong presence and consumer preference for their products in this category. However, the brand's performance in Concentrates has been less stable, with rankings absent in December 2024 and February 2025, but showing improvement in March 2025 by moving up to 14th place. This fluctuation suggests potential challenges or competition in this category that Flora Farms may need to address to secure a more stable position.

In the Pre-Roll category, Flora Farms has seen minor shifts, starting at 11th place in December 2024 and moving to 13th place by March 2025. While these movements are not drastic, they reflect a slight decline in market position that could be worth monitoring. Meanwhile, the brand's performance in Vapor Pens has been more dynamic, moving from an unranked position in January 2025 to 27th place by March 2025, indicating a positive upward trend. This suggests that Flora Farms is making strides in expanding its presence in the Vapor Pens market, although it still has room for growth to break into the top 30 consistently.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Flora Farms has consistently maintained its top position from December 2024 through March 2025, demonstrating its strong market presence and customer loyalty. Despite a slight dip in sales in February 2025, Flora Farms rebounded in March, indicating resilience and effective market strategies. Meanwhile, CODES has consistently held the second rank, with a steady increase in sales over the same period, suggesting a growing competitive threat. Amaze Cannabis has shown notable upward momentum, climbing from fifth to third place by February 2025, with sales increasing significantly, which could pose a future challenge to Flora Farms' dominance. These dynamics highlight the importance for Flora Farms to innovate and adapt to maintain its leading position in the Missouri flower market.

Notable Products

In March 2025, White 99 (14g) emerged as the top-performing product for Flora Farms, achieving the number one rank with sales of 5545 units. This is a significant improvement from its fourth position in December 2024 and second in February 2025. Slurricane Pre-Roll (1g) secured the second spot, maintaining its position from February 2025. Cheers - Chem OG Pre-Roll (1g) followed closely, ranking third, while Silver Ghost (14g) and Carbon Fiber (14g) took the fourth and fifth positions, respectively. Notably, White 99 (14g) has shown consistent upward movement in rankings over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.