Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

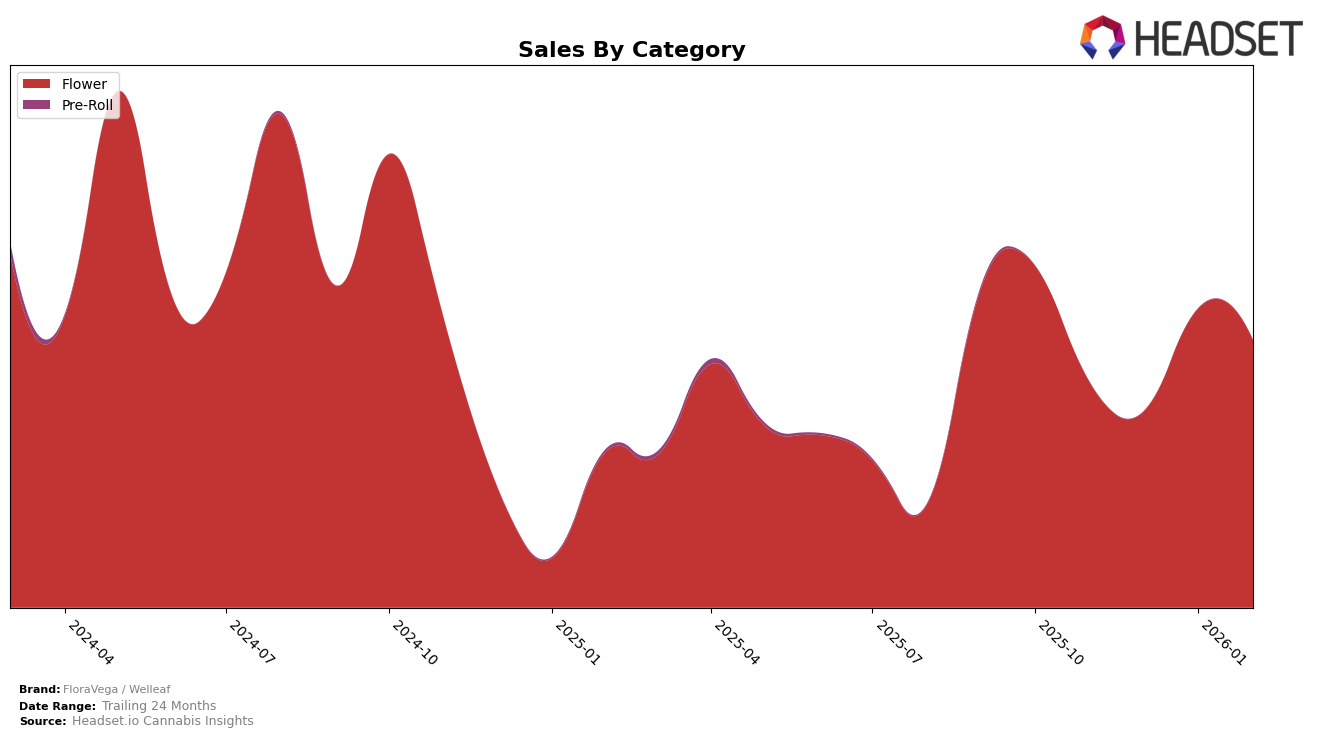

FloraVega / Welleaf has shown notable performance in the Flower category within Nevada. Over the months from November 2025 to February 2026, the brand maintained a presence in the top 20, with rankings fluctuating between 16th and 13th place. The highest ranking was achieved in January 2026, where FloraVega / Welleaf climbed to 12th position, indicating a strong upward trend in consumer preference during this period. This improvement in ranking is supported by a significant increase in sales from December 2025 to January 2026, suggesting a successful strategy or product launch that resonated well with the market.

Interestingly, FloraVega / Welleaf was not ranked in the top 30 for any other state or category during this period, which highlights both a challenge and an opportunity for the brand. While the brand's performance in Nevada is commendable, the absence from the top rankings in other regions suggests potential areas for expansion and growth. This could indicate a strong brand loyalty within Nevada, but also underscores the need for strategic initiatives to elevate their presence and competitiveness in other markets. The focus on Nevada's Flower category might offer insights into consumer preferences that could be leveraged for broader geographic success.

Competitive Landscape

In the competitive landscape of the flower category in Nevada, FloraVega / Welleaf has shown notable fluctuations in its market position over recent months. Starting from November 2025, the brand was ranked 16th, experiencing a slight dip to 19th in December, before making a significant leap to 12th in January 2026, and stabilizing at 13th in February. This upward trend in the early months of 2026 suggests a positive reception of their products, potentially driven by strategic marketing or product enhancements. In comparison, Summa Cannabis maintained a relatively stable position, hovering around the mid-teens, while Grassroots experienced a drop from 6th to 14th by February, indicating potential challenges in maintaining their earlier momentum. Meanwhile, Kushberry Farms showed a consistent improvement, closely competing with FloraVega / Welleaf by February. Notably, Neon Moon made a remarkable jump from outside the top 20 in November to 11th by February, signaling a strong market entry. These dynamics highlight the competitive pressures FloraVega / Welleaf faces, emphasizing the importance of sustaining their growth trajectory to secure a stronger foothold in the Nevada flower market.

Notable Products

In February 2026, FloraVega / Welleaf's top-performing product was Primus (14g) in the Flower category, securing the first rank with sales of 2237 units. Following closely, Speaker Knockerz (3.5g) also in the Flower category, achieved the second rank. Rick James (3.5g) saw a notable rise, climbing from the fifth rank in December 2025 to third place in February 2026, with sales increasing to 1756 units. Typhoon #8 (3.5g) and Chernobyl (3.5g) rounded out the top five, ranking fourth and fifth respectively. This month saw a reshuffling of ranks, especially with Rick James (3.5g) making a significant leap in the rankings compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.