Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

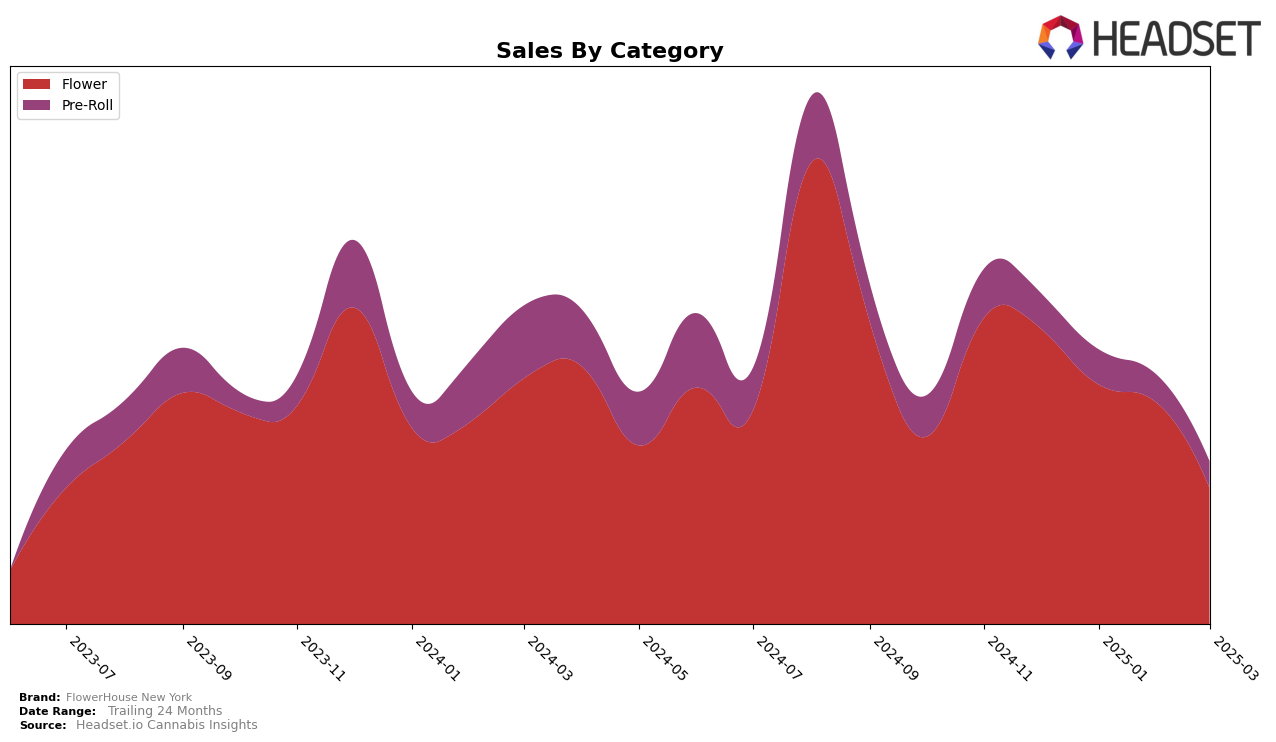

FlowerHouse New York has experienced noticeable shifts in its performance across categories and states over recent months. In the New York market, the brand's flower category has seen a significant decline in its ranking, moving from 9th place in December 2024 to 23rd by March 2025. This downward trend is accompanied by a decrease in sales, which may be indicative of increasing competition or changing consumer preferences in the region. The flower category's drop out of the top 10 can be seen as a potential concern for the brand, as it suggests a loss of market share in a highly competitive space.

In contrast, FlowerHouse New York's performance in the pre-roll category within New York has been less volatile but still shows room for improvement. The brand consistently ranked at 31st in December 2024 and January 2025 but slipped to 33rd in February and further to 37th in March. This indicates that while the brand maintains a presence in the pre-roll sector, it struggles to break into the top 30, which could be a strategic focus for future growth. The consistent ranking outside the top 30 highlights a need for innovation or marketing efforts to boost their standing in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in New York, FlowerHouse New York has experienced a notable decline in rank and sales over the past few months. Starting from a strong position at 9th place in December 2024, FlowerHouse New York dropped to 23rd by March 2025, indicating a significant shift in its market standing. This downward trend contrasts with competitors like Grassroots and Runtz, which, despite fluctuations, managed to maintain their presence within the top 20 for most of the period. Grassroots, for instance, started at 14th and slipped to 21st, while Runtz showed resilience by climbing from 19th to 16th in January before eventually dropping out of the top 20. Meanwhile, Veterans Choice Creations (VCC) and To The Moon also faced challenges, with both brands falling out of the top 20 by March. The overall market dynamics suggest that FlowerHouse New York needs to reassess its strategies to regain its competitive edge and counteract the declining sales trajectory observed in the first quarter of 2025.

Notable Products

In March 2025, the top-performing product for FlowerHouse New York was Dough Boy Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, ascending to the number one spot with a notable sales figure of 1577 units. Sunset Punch (3.5g) in the Flower category followed closely in second place, although its sales slightly decreased from February 2025. Gary Payton Infused Pre-Roll 7-Pack (3.5g) climbed to third place, showing a consistent upward trend since its introduction in February 2025. Garlic Knots (3.5g) debuted in fourth place, while Sunshine Daydream (3.5g) rounded out the top five. This month marked the first time Dough Boy Infused Pre-Roll 2-Pack (1g) secured the top rank, reflecting its increasing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.