Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

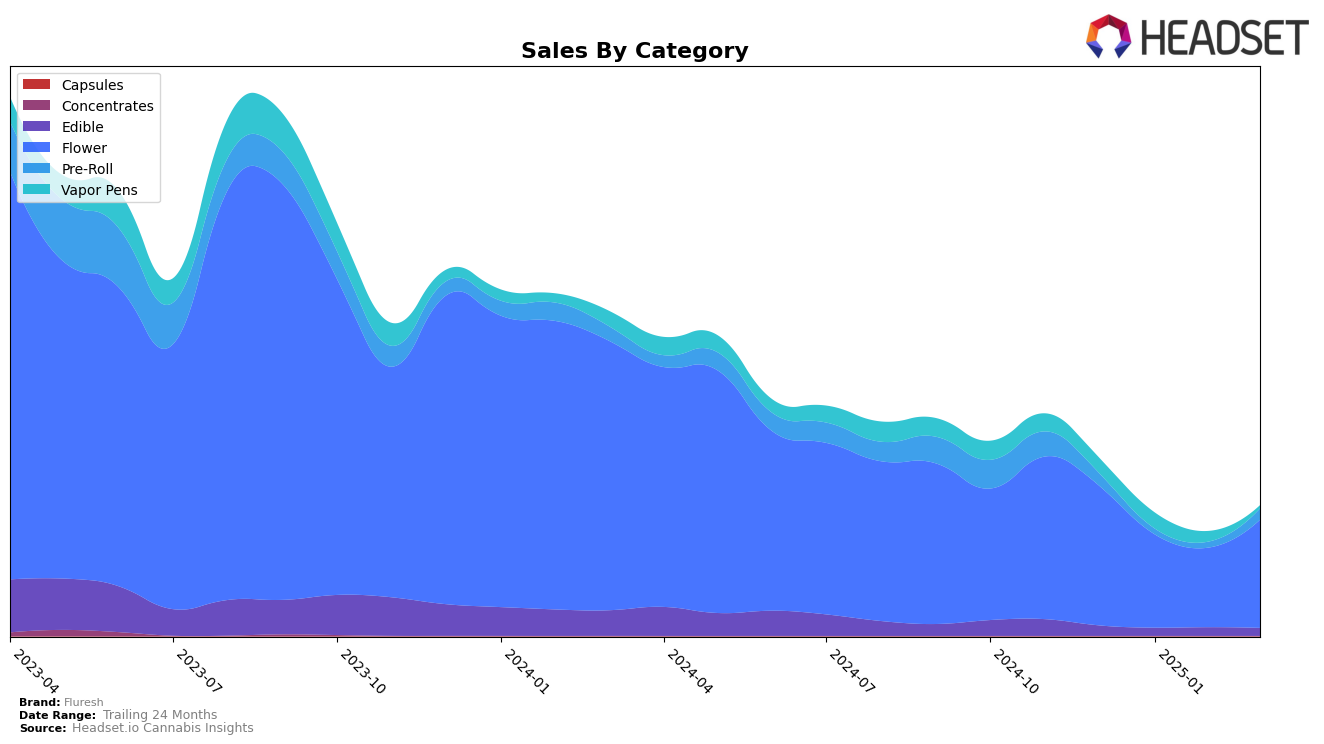

Fluresh's performance in Michigan across various cannabis categories shows a mix of stability and volatility. In the Flower category, Fluresh maintained a relatively stable presence, ranking 26th in both February and March 2025, despite a slight decline from 13th in December 2024. This indicates a consistent demand for their flower products, albeit with some competitive pressure. On the other hand, the Edible category saw a decline in rankings, dropping from 48th in December 2024 to 56th in March 2025, suggesting potential challenges in maintaining market share in this segment. Such movements highlight the competitive nature of the edible market and the need for strategic adjustments.

In the Pre-Roll category, Fluresh experienced a notable fluctuation, with rankings dropping to 91st in January 2025 before recovering to 63rd in March 2025. This rebound could indicate a successful response to market demands or promotional efforts. The Vapor Pens category presents a different story, where Fluresh was ranked 45th in January 2025 but did not make it into the top 30 by March 2025, suggesting a significant drop in competitive standing. This absence from the top 30 could be a signal for the brand to reassess its strategy in the vapor pen market to regain traction. Overall, while Fluresh shows strength in certain categories, the varying performances across segments highlight areas for potential improvement and strategic focus.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Fluresh has experienced a notable decline in rank and sales over the observed months. Starting from a rank of 13 in December 2024, Fluresh dropped out of the top 20 by January 2025 and maintained a rank of 26 through March 2025. This decline contrasts with the performance of competitors like Glacier Cannabis, which, despite fluctuating ranks, managed to improve its sales from January to March 2025, surpassing Fluresh in sales during this period. Meanwhile, Emerald Mountain Labs (MI) made a significant leap from a rank of 68 in December 2024 to 24 in March 2025, indicating a strong upward trend in both rank and sales. These shifts suggest that while Fluresh faces challenges in maintaining its market position, competitors are capitalizing on opportunities to enhance their visibility and sales in the Michigan flower market.

Notable Products

In March 2025, the top-performing product for Fluresh was Nana Mama Pre-Roll (1g) in the Pre-Roll category, which saw a significant rise to the number one spot with sales of 20,921. Purple Pineapple (3.5g) in the Flower category secured the second position, marking its first appearance in the rankings. Strawberry Watermelon Gummies 10-Pack (200mg) maintained a consistent presence, holding steady at the third rank for two consecutive months. Mango Mintz (3.5g) entered the rankings at fourth place, while Don Mega (3.5g) in the Flower category slipped from fourth in January to fifth in March. These shifts highlight a dynamic change in consumer preferences within Fluresh's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.