Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

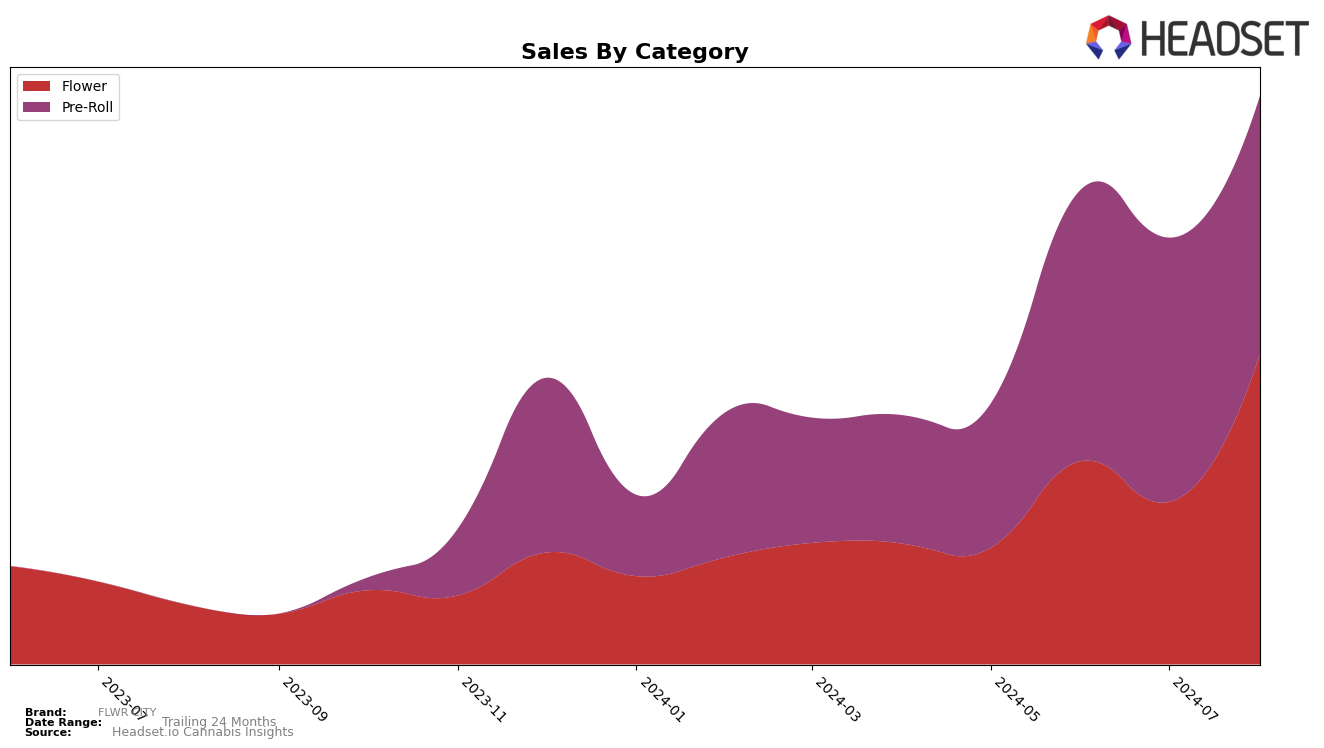

FLWR CITY has shown notable performance fluctuations across various categories and states. In New York, the brand's ranking in the Flower category has seen a significant climb from not being in the top 30 in May 2024 to securing the 28th position by August 2024. This upward trend suggests a growing acceptance and demand for FLWR CITY's Flower products in the state. Contrastingly, their Pre-Roll category has experienced more stability, maintaining a presence within the top 30 throughout the months, with minor ranking changes. Such performance indicates a consistent consumer base for their Pre-Roll products, though it highlights potential areas for improvement to climb higher in the rankings.

While FLWR CITY's performance in New York has shown positive trends, the brand's absence from the top 30 in the Flower category during May, June, and July 2024 could be seen as a challenge. However, the significant leap to the 28th position in August indicates a strong recovery and potential growth trajectory. This movement could be attributed to strategic changes or successful marketing campaigns. On the other hand, the Pre-Roll category's relatively stable ranking, despite slight fluctuations, underscores a steady market presence. The brand's ability to maintain and improve its standings in these categories will be crucial for sustained success and market expansion.

Competitive Landscape

In the competitive landscape of the New York flower category, FLWR CITY has shown notable fluctuations in its ranking and sales over the past few months. From May to August 2024, FLWR CITY's rank improved from 37th to 28th, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Canna Cure Farms, which dropped out of the top 20 in August, and Live (NY), which saw a decline from 12th to 30th. Meanwhile, iTHaCa Cultivated and Etain both experienced upward trends, with Etain moving from 44th to 27th and iTHaCa Cultivated climbing from 49th to 26th. These shifts suggest that while FLWR CITY is gaining traction, it faces stiff competition from brands that are also improving their market positions. The dynamic changes in rank highlight the importance of strategic marketing and product differentiation for FLWR CITY to maintain and further its growth in the New York flower market.

Notable Products

In August 2024, Biscotti Pre-Roll (1g) emerged as the top-performing product for FLWR CITY, climbing from the second position in the previous two months and achieving sales of $3,284. Peanut Butter Bomb Pre-Roll (1g), which had consistently held the top spot from May to July, dropped to second place with notable sales figures. Cheetah Fat Pre-Roll 7-Pack (2.45g) maintained a steady third position across June, July, and August. Millies Pre-Ground (21g) rose to fourth place in August after entering the rankings in July at fifth. Blueberry Muffin Pre-Roll 7-Pack (2.45g) rounded out the top five, dropping one spot from its fourth-place ranking in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.