Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

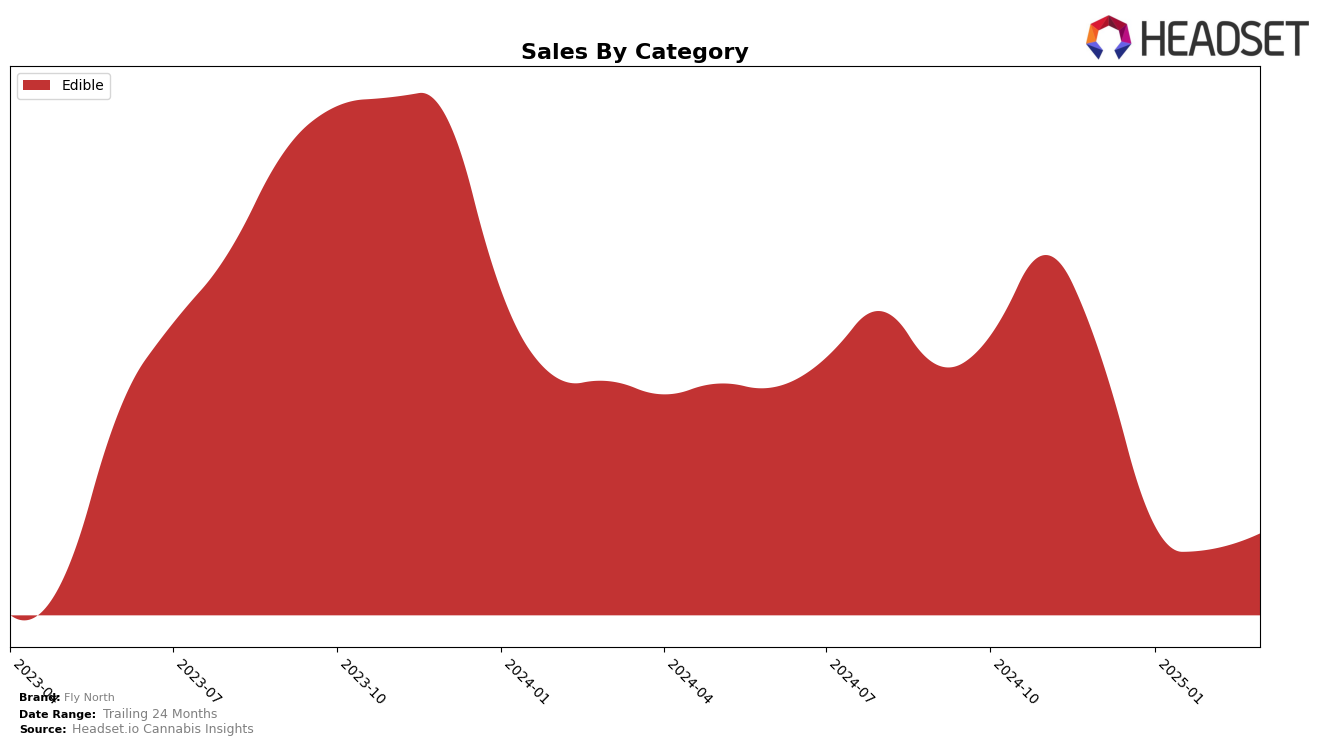

In the Canadian cannabis market, Fly North has shown a consistent presence in the Ontario edible category. Despite a slight drop from 12th to 15th place from December 2024 to March 2025, Fly North has maintained its position in the top 15, indicating a stable consumer base. The brand's sales in Ontario saw a notable decline from December 2024 to February 2025, but experienced a modest recovery in March 2025. This suggests potential fluctuations in consumer demand or competitive pressures within the market. However, Fly North's ability to remain within the top 15 brands highlights its resilience and potential for growth in the coming months.

In Saskatchewan, Fly North made an appearance in the top 30 for edibles in December 2024, ranking at 12th. However, the absence of rankings from January to March 2025 indicates that the brand did not maintain a top 30 position during these months. This could be seen as a challenge for Fly North, suggesting a need to reevaluate its market strategies in Saskatchewan. The initial ranking suggests there is potential for Fly North to capture a significant share of the edible market, but the brand will need to address whatever factors led to its drop in rankings to regain momentum.

Competitive Landscape

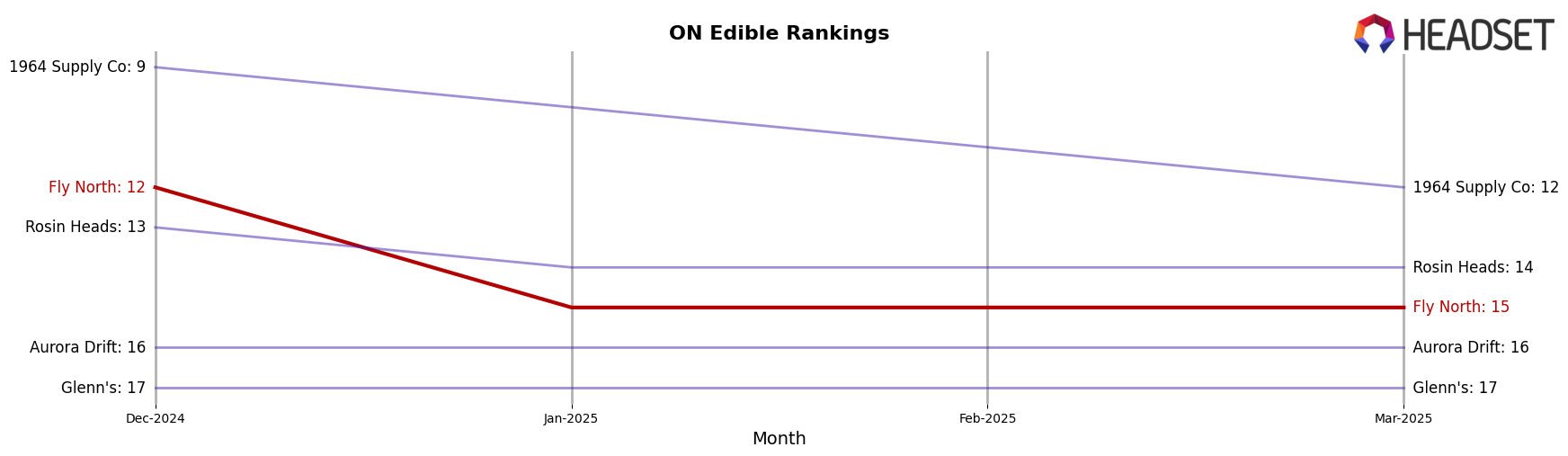

In the competitive landscape of the Edible category in Ontario, Fly North has experienced a notable shift in its market position over the past few months. Starting from December 2024, Fly North held the 12th rank, but by January 2025, it slipped to the 15th position, where it remained through March 2025. This decline in rank is mirrored by a decrease in sales, particularly when compared to competitors like 1964 Supply Co and Rosin Heads, both of which maintained higher ranks throughout the period. Notably, 1964 Supply Co consistently outperformed Fly North, with a rank of 9th in December 2024, gradually moving to 12th by March 2025, indicating a more stable market presence. Meanwhile, Aurora Drift and Glenn's maintained lower ranks, suggesting that Fly North's competitive challenges are primarily with mid-tier brands. This trend highlights the need for Fly North to strategize on regaining its competitive edge and improving its market share in the Ontario Edible category.

Notable Products

In March 2025, the top-performing product for Fly North was Key Lime Pie Soft Chew (10mg), maintaining its number one rank from February, with sales reaching 5041 units. Strawberry Live Rosin Chews 2-Pack (10mg) held steady at the second position, showing consistent performance over the past three months. Sour Passion Fruit Soft Chew (10mg) remained in the third position, although its sales figures have seen a slight decline since December 2024. Sour Thimbleberry Fruit Soft Chew (10mg) climbed to fourth place, marking its first appearance in the rankings since January. Grape Canyon Soft Chew (10mg) entered the top five for the first time, indicating a growing popularity in the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.