Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

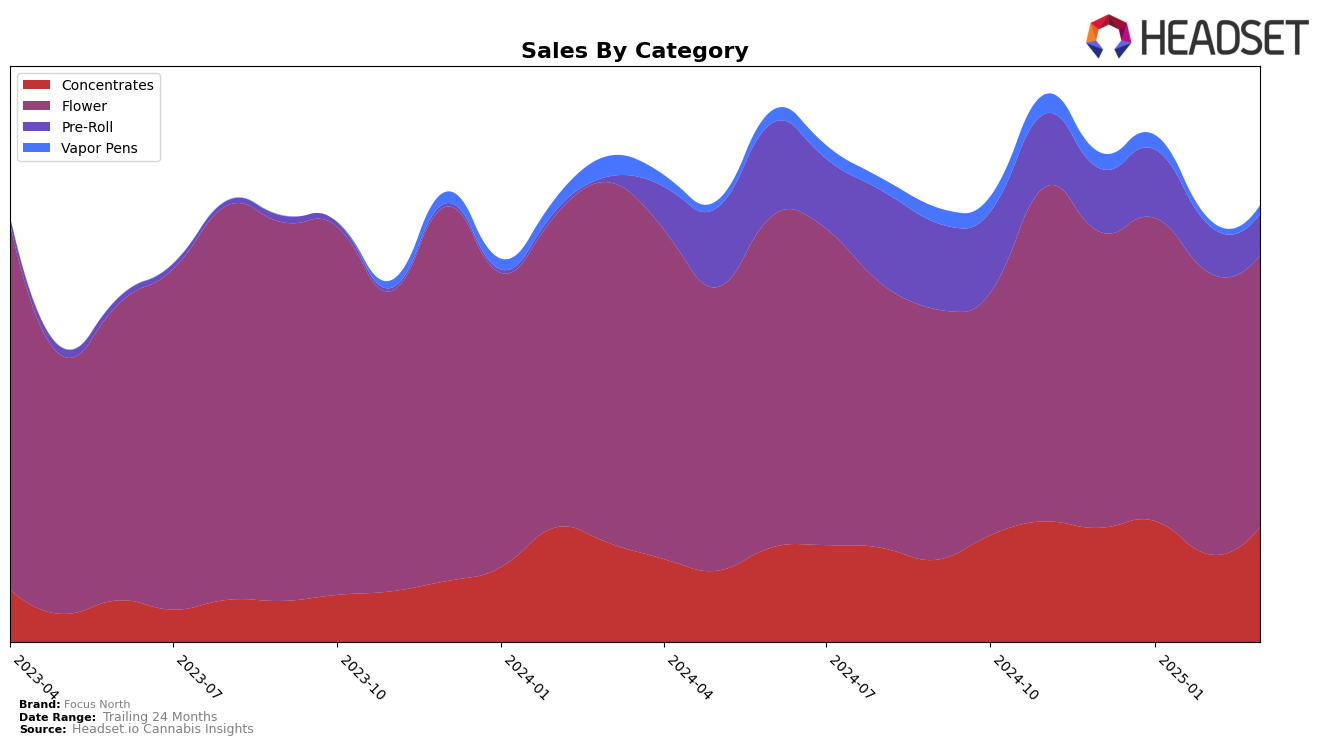

Focus North has demonstrated a varied performance across different product categories in Oregon. In the Concentrates category, the brand showed a promising trend, improving its rank from 12th in December 2024 to 10th in January 2025, although it experienced a dip in February before recovering to 13th in March. This suggests a strong resilience in the Concentrates market, with sales peaking in January. The Flower category saw a relatively stable performance, with Focus North maintaining a consistent presence in the mid-teens ranking, indicating a steady demand for their flower products. However, the Pre-Roll category presented a more challenging landscape, as the brand's rank fluctuated significantly, dropping out of the top 30 by March, which could be a point of concern for the brand's market strategy in this segment.

In contrast, the Vapor Pens category highlighted some challenges for Focus North, as it failed to secure a spot in the top 30 after January, indicating potential difficulties in capturing market share in this competitive segment. The absence from the rankings in February and March could point to a need for strategic adjustments or innovations to regain traction. This mixed performance across categories in Oregon suggests that while Focus North has strengths in certain areas, particularly Concentrates, there are opportunities for growth and improvement in others, such as Pre-Rolls and Vapor Pens. Understanding these dynamics can provide valuable insights into the brand's market positioning and potential areas for strategic focus in the coming months.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Focus North has maintained a relatively stable position, ranking between 14th and 16th from December 2024 to March 2025. This stability contrasts with the more fluctuating ranks of competitors such as Eugreen Farms, which saw a notable drop from 7th in January to 15th by March, and Cultivated Industries, which experienced a dip to 17th in February before recovering to 14th in March. Despite these fluctuations, Focus North's consistent ranking suggests a steady market presence, though it trails behind Eugreen Farms in terms of sales volume, which peaked significantly higher in January. Meanwhile, Urban Canna and Dog House have shown more variability, with Dog House making a notable leap to 17th in March from a previous 31st in February. This competitive analysis highlights Focus North's need to leverage its stable ranking to potentially capture market share from more volatile competitors.

Notable Products

In March 2025, the top-performing product for Focus North was Hash Burger (1g) in the Flower category, which secured the number one rank with sales of 1524 units. Colorado Sunshine (Bulk) followed closely, dropping from its top spot in December 2024 to second place in March 2025. Pot Roast (Bulk) maintained a consistent presence, holding the third position for two consecutive months. Mac 1 (Bulk) entered the rankings at fourth place, marking its debut in March. Fatso (1g) rounded out the top five, making a notable entry in the rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.