Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

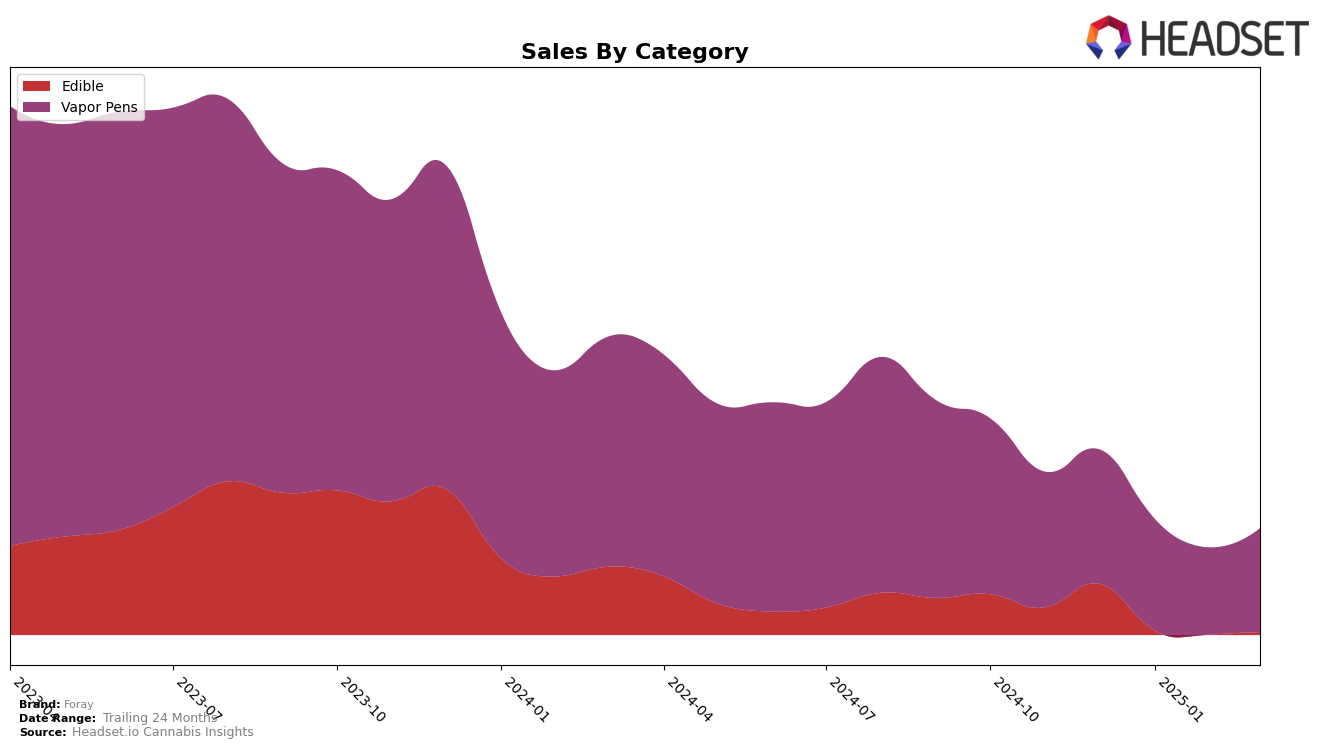

Foray's performance in the edibles category across various Canadian provinces shows a mix of stability and volatility. In Alberta, Foray has demonstrated a steady upward trajectory, moving from the 24th position in December 2024 to the 21st by February 2025 before dropping out of the top 30 in March. This suggests a strong start to the year, though the absence in March raises questions about market dynamics or competition impacts. Meanwhile, in Ontario, Foray has maintained a consistent 7th place ranking in the edibles category from December 2024 through March 2025, indicating a stable position and potentially loyal consumer base in this province. In contrast, Foray's edibles were not ranked in the top 30 in British Columbia and Saskatchewan after December 2024, which could point to either a drop in popularity or increased competition in these regions.

In the vapor pens category, Foray's performance has been more varied. In Alberta, Foray's ranking improved from 33rd to 29th between December 2024 and March 2025, indicating a positive growth trend despite a dip in sales in February. Conversely, in Ontario, Foray's position slipped from 22nd in December to 26th in March, suggesting challenges in maintaining market share in this competitive category. Notably, in British Columbia, Foray experienced fluctuations, peaking at 16th in February before dropping to 20th in March, which could reflect shifting consumer preferences or seasonal demand variations. These movements across provinces highlight the dynamic nature of the cannabis market and the varying consumer tastes and competitive landscapes that Foray navigates.

Competitive Landscape

In the Ontario edible cannabis market, Foray consistently maintained its rank at 7th place from December 2024 to March 2025, showcasing a stable presence amidst fluctuating sales figures. Despite a dip in sales from December to February, Foray experienced a rebound in March, indicating resilience and potential customer loyalty. Competitors like No Future and Monjour held higher ranks, with No Future climbing to 5th place by March, suggesting stronger market traction. Meanwhile, Bhang and Chowie Wowie remained below Foray, with Bhang improving slightly to 9th place by March. Foray's consistent ranking amidst these dynamics highlights its steady performance, though it faces competitive pressure from brands with higher sales and rank mobility.

Notable Products

In March 2025, Foray's top-performing product was the Blackberry Cream Distillate Disposable (0.3g) in the Vapor Pens category, maintaining its first-place position consistently from December 2024 to March 2025, with sales reaching 12,194 units. The CBD/THC 1:1 Salted Caramel Chocolate Bar (10mg CBD, 10mg THC) held steady in second place, showing a slight decline in sales compared to previous months. Edi's - CBD Blood Orange Soft Chews 30-Pack (600mg CBD) also maintained its third-place ranking, with sales figures consistently decreasing over the months. The Indica Distillate Disposable (0.3g) rose to fourth place in February 2025 and held that position in March, showing a recovery in sales. Meanwhile, Fast Edi's- CBD/CBN/THC Blackberry Lavender Soft Chews 30-Pack (300mg CBD, 75mg CBN, 10mg THC) remained in fifth place, with a slight increase in sales from February to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.