Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

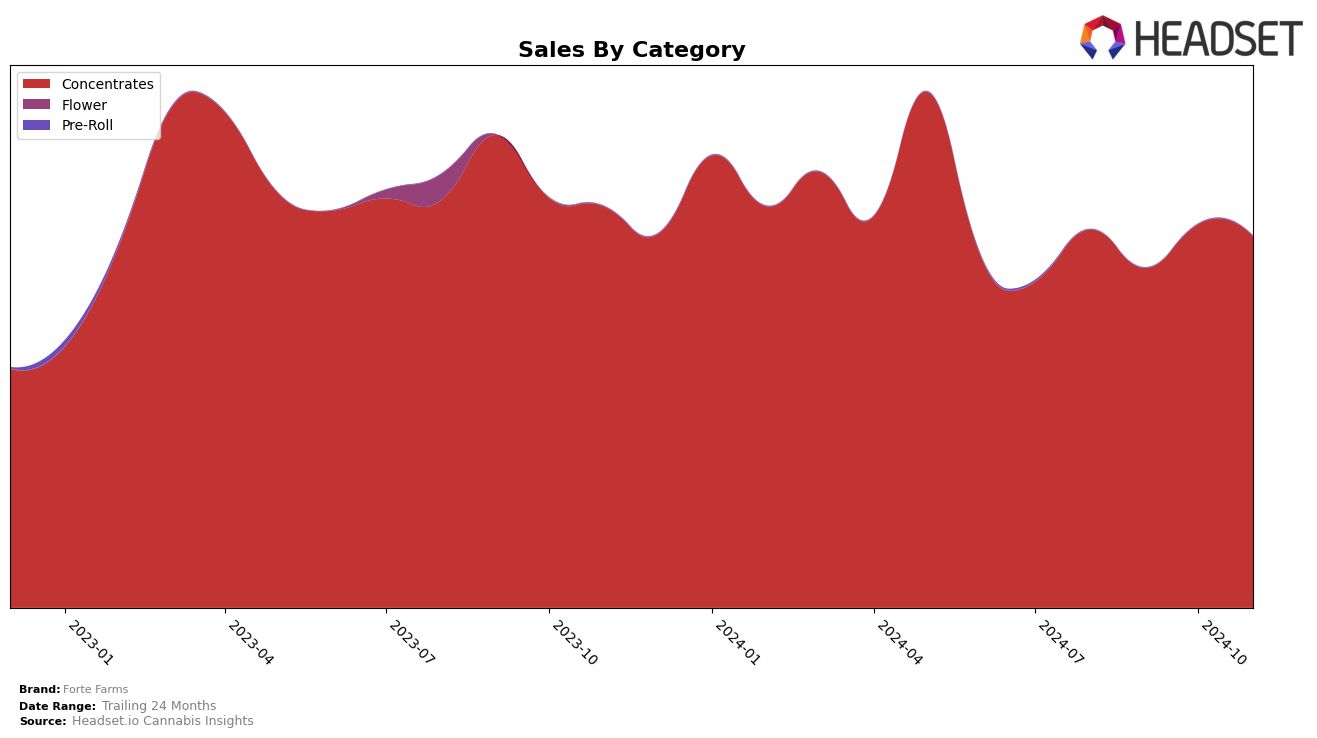

Forte Farms has shown a notable performance trajectory across its product categories, particularly in the Concentrates category in Oregon. In August 2024, the brand was ranked 30th in this category, but it dipped slightly out of the top 30 in September, indicating a temporary decline. However, Forte Farms quickly rebounded in October, climbing to the 26th position, and maintained a respectable 27th place in November. This fluctuation suggests that while the brand faced challenges in September, it managed to recover and sustain its market presence in subsequent months. Such movements could be indicative of strategic adjustments or market conditions that favored their product offerings during these months.

Analyzing the sales data, there is a clear trend of resilience and recovery for Forte Farms in Oregon's Concentrates market. Despite the dip in September, the brand's sales figures bounced back in October, surpassing the August numbers. This upward trend continued into November, albeit with a slight decrease from October. The fact that Forte Farms was able to re-enter the top 30 after dropping out suggests strong brand loyalty or successful marketing strategies that resonated with consumers. However, the absence of rankings in other states or categories might indicate areas where the brand could expand or improve its market penetration. This presents both challenges and opportunities for Forte Farms as it seeks to solidify its standing and explore growth in other markets.

Competitive Landscape

In the competitive landscape of the Oregon concentrates market, Forte Farms has demonstrated a notable resilience and upward trend in rankings over the past few months. Despite starting at the 30th position in August 2024, Forte Farms improved its rank to 26th by October, before slightly adjusting to 27th in November. This positive trajectory is indicative of a strategic push in market presence, contrasting with brands like Farmer's Friend Extracts, which saw a decline from 24th to 28th over the same period. Meanwhile, Afterglow experienced fluctuations but ended November in a strong 26th position, directly competing with Forte Farms. Notably, Mule Extracts surged from 38th to 25th, surpassing Forte Farms in November, suggesting a competitive threat. These dynamics highlight the importance for Forte Farms to continue leveraging its growth strategies to maintain and enhance its market position amidst fluctuating competitor performances.

Notable Products

In November 2024, Forte Farms' top-performing product was Globstopperz Live Rosin (1g) in the Concentrates category, maintaining its first-place ranking from October with notable sales of 715 units. Miracle Oregon Cookies Live Rosin (1g) debuted in the rankings at second place, showcasing strong market entry. Get Jiffy With It Live Rosin (1g) also entered the list, securing the third position. Triple Chocolate Chip Cured Hash (2g) dropped slightly from its second-place rank in September and third in October to fourth in November, indicating a minor decline in consumer preference. Mr. Clean Cured Hash (2g) entered the top five in November at fifth place, demonstrating a newfound interest among buyers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.