Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

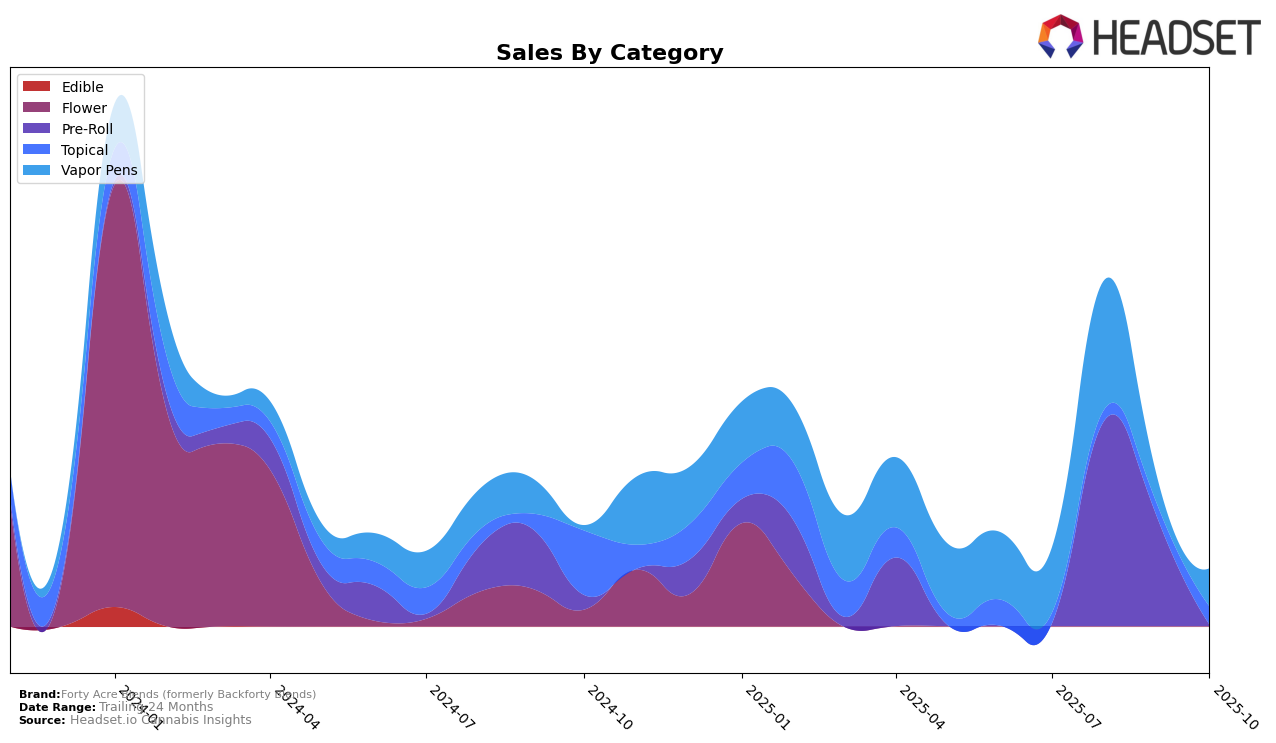

In recent months, Forty Acre Blends has shown fluctuating performance across various states and categories. Notably, in the Vapor Pens category within British Columbia, the brand did not secure a position within the top 30 brands from July to October 2025. This absence indicates a potential area for improvement or a need to reassess their market strategy in this region. Despite this, the brand's sales figures in July were notable, hinting at some consumer interest that could be leveraged for future growth. Understanding the dynamics of this particular market could be crucial for Forty Acre Blends to improve its standing in coming months.

While the brand's performance in British Columbia's Vapor Pens category might require attention, it's important to examine how Forty Acre Blends is faring in other regions and product categories. The lack of ranking data for subsequent months suggests that the brand is not consistently maintaining a strong presence across these categories. This could either be a strategic choice to focus on other markets or an indication of competitive pressures. Observing how Forty Acre Blends adjusts its strategies to gain traction in these areas will be key to understanding its overall market approach and potential for growth.

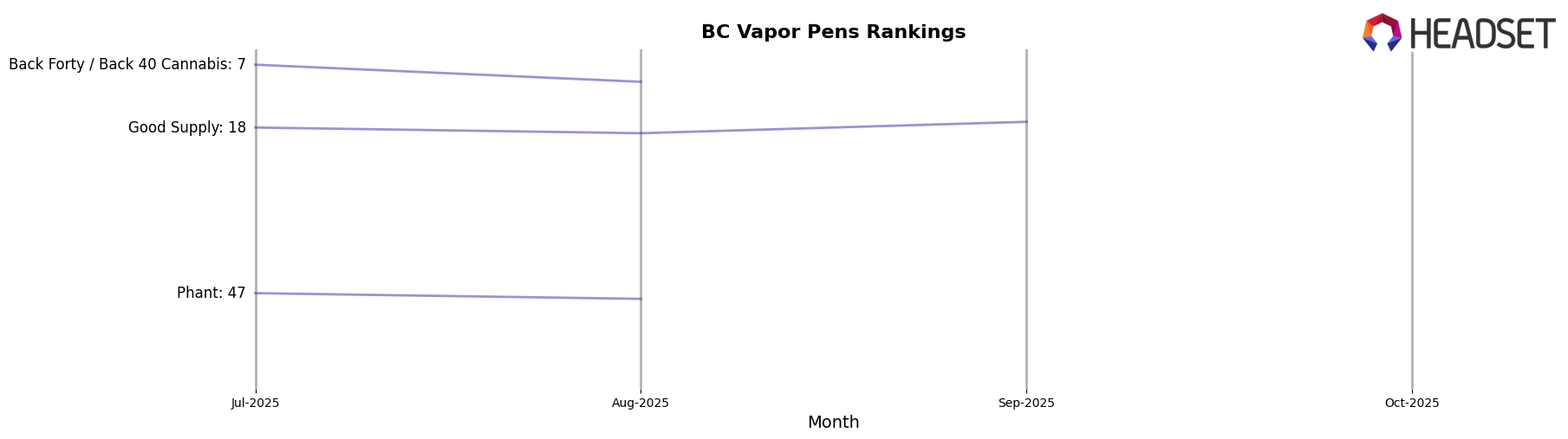

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Forty Acre Blends (formerly Backforty Blends) has faced significant challenges in maintaining its market position. Despite its rebranding efforts, the brand did not rank in the top 20 from July to October 2025, indicating a struggle to capture a significant market share. In contrast, Back Forty / Back 40 Cannabis, a closely related competitor, maintained a strong presence with rankings of 7th and 10th in July and August, respectively, before dropping out of the top 20. Meanwhile, Good Supply consistently hovered around the 17th to 19th positions, demonstrating a stable, albeit modest, market presence. Phant also showed consistent rankings in the 47th and 48th positions, indicating a niche but steady following. The data suggests that Forty Acre Blends needs to reassess its market strategies to improve visibility and sales in a competitive field where even minor fluctuations can significantly impact brand standings.

Notable Products

In October 2025, the top-performing product for Forty Acre Blends (formerly Backforty Blends) was the Kush Mint Distillate Cartridge (1g) in the Vapor Pens category, reclaiming its number one rank from July after briefly falling to second place in August and September. The Mandarin Cookies Pre-Roll 10-Pack (3.5g) maintained its strong performance in the Pre-Roll category, consistently holding the top spot in August and September, though its sales were not recorded in October. The Sour Apple Pre-Roll (1g) remained steady at the second position in the Pre-Roll category, despite a noticeable decline in sales to 53 units. CBD Muscle Miracle Cream (750mg CBD, 75g) climbed back to third place in the Topical category with a sales increase to 47 units, marking a recovery from its absence in August rankings. The CBD Hi Roller Cream (600mg CBD, 60g) did not appear in the rankings for September and October, following its fourth-place ranking in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.