Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

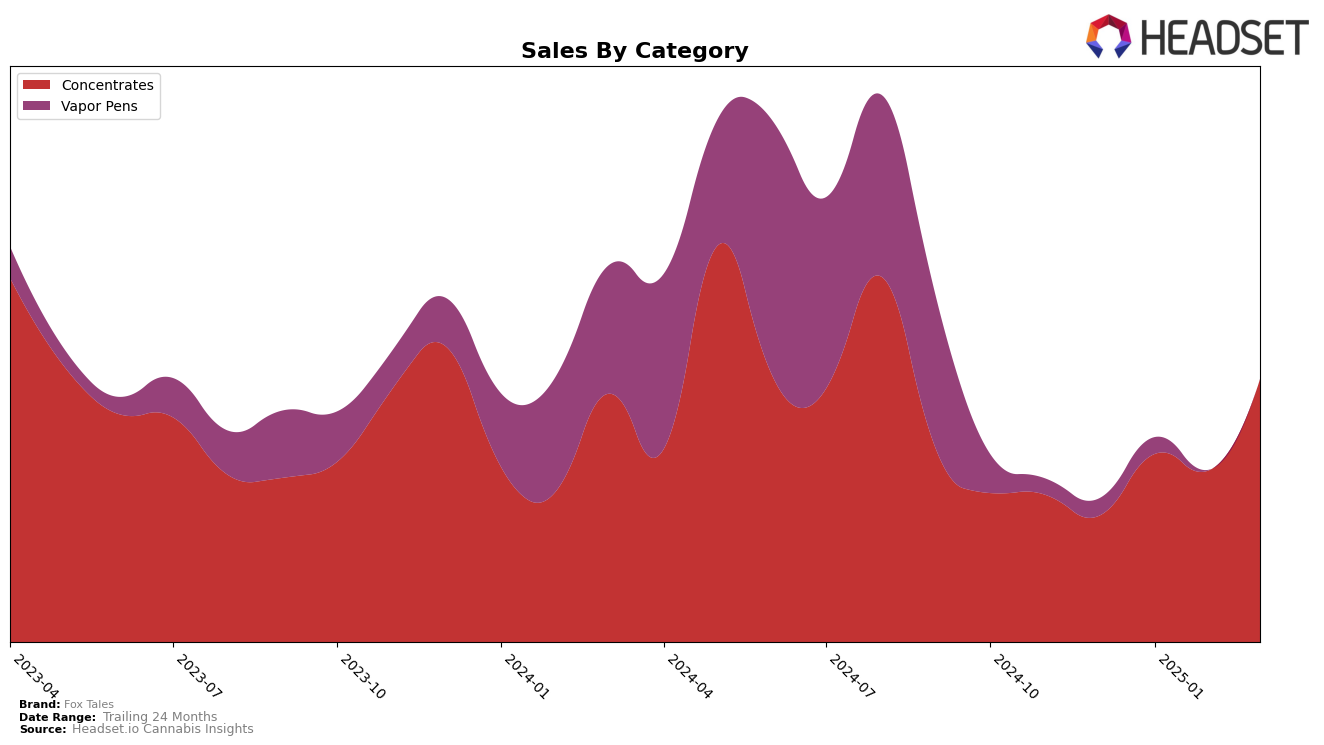

Fox Tales has shown a notable upward trajectory in the Concentrates category within Massachusetts. Beginning in December 2024, Fox Tales was ranked 23rd, but by March 2025, it had climbed to 13th place. This consistent rise in the rankings indicates a strong market presence and growing consumer preference for their products in this category. The brand's performance in Massachusetts is particularly impressive given the competitive nature of the Concentrates market, and their ability to climb the rankings suggests effective strategies in product development or marketing.

While Fox Tales has been making strides in Massachusetts, it is important to note that their absence from the top 30 brands in other states or provinces could be seen as a potential area for growth or concern. The lack of ranking in additional regions might suggest limited distribution or brand presence outside of Massachusetts. This could either be a strategic focus on a single market or a signal that expansion efforts are necessary to capture a broader audience. Analyzing the brand's strategy in Massachusetts could provide insights into potential opportunities for replication in other markets.

Competitive Landscape

In the Massachusetts concentrates market, Fox Tales has demonstrated a significant upward trajectory in rankings, moving from 23rd place in December 2024 to 13th by March 2025. This positive trend is indicative of a substantial increase in market presence and consumer preference. Notably, Cloud Cover (C3) maintained a relatively stable position, oscillating between 8th and 11th place, suggesting consistent performance. Meanwhile, DRiP (MA) experienced fluctuations, dropping from 9th to 12th place, which may indicate challenges in sustaining sales momentum. INSA showed a remarkable climb from 32nd to 15th, reflecting a strong growth phase, while Volcanna saw a decline from 12th to 16th, potentially signaling a need for strategic adjustments. Fox Tales' ascent in rank, coupled with its increasing sales figures, positions it as a rising competitor in the concentrates category, highlighting its potential to capture more market share and challenge established brands.

Notable Products

In March 2025, Blend Crumble (3.5g) maintained its position as the top-performing product for Fox Tales, holding the number one rank for four consecutive months, with a notable sales figure of 376. Grape Juice Live Wax (1g) secured the second spot, showing significant growth from its fourth-place position in December 2024. Grape Juice Live Wax (2g) sustained its third-place ranking from February to March 2025. LA Pop Rockz Sugar (1g) debuted in the fourth position, while Juniper Jive Sugar (1g) entered the rankings at fifth place. Overall, the concentrates category dominated the top ranks, demonstrating consistent consumer demand for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.