Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

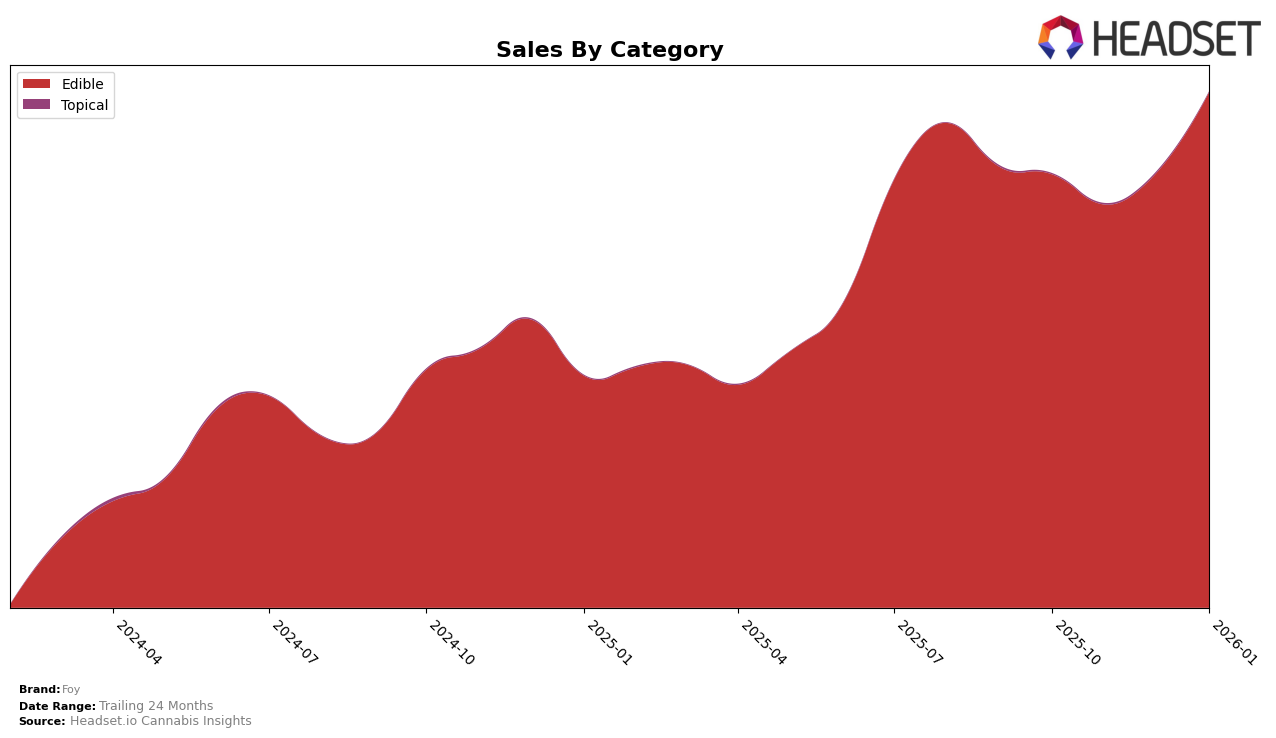

In examining the performance of Foy across various categories and states, it is evident that the brand has maintained a consistent presence in the New York edible market. Despite a slight dip in sales from October to November 2025, Foy managed to sustain its ranking at 17th place from November 2025 through January 2026. This stability in rank, despite fluctuations in sales, indicates a strong foothold in the New York edible market. However, the fact that Foy did not break into the top 15 during these months suggests there might be opportunities for growth or increased competition that the brand needs to address.

Interestingly, Foy's performance in other states or categories is not detailed in the top 30 rankings, which could imply potential areas for improvement or expansion. The absence of rankings in other states might be seen as a negative aspect, suggesting that Foy has yet to establish a significant presence outside of New York. This could be a strategic point for the brand to consider if they aim to broaden their market reach. The upward trend in sales from December 2025 to January 2026 in New York is a positive indicator, hinting at possible seasonal factors or successful marketing strategies that could be leveraged in other regions.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Foy has experienced a relatively stable yet challenging position over the past few months. Despite a slight drop in rank from 16th in October 2025 to 17th by January 2026, Foy's sales have shown a promising upward trend, increasing from $285,165 in October to $339,449 in January. This growth, however, is overshadowed by competitors like Hashtag Honey, which climbed from 17th to 15th place while achieving a significant sales surge from $213,164 to $404,283 in the same period. Meanwhile, Heavy Hitters maintained a steady rank at 15th and 16th, with consistent sales growth, and Snoozy held its 18th position with a moderate increase in sales. The dynamic shifts in rankings and sales among these brands highlight the competitive pressure Foy faces, particularly from brands that are either maintaining or improving their market positions more aggressively.

Notable Products

In January 2026, the top-performing product for Foy was the CBD/THC/CBG 1:1:1 Daytime Mango Blood Orange Chews 20-Pack, which climbed to the number one rank with sales of 7908 units. The CBD/THC/CBN 1:1:1 Night Time Strawberry Adaptogen Chews 20-Pack, previously holding the top position, moved to second place. Consistently holding the third position was the CBD/THC/CBN 1:1:1 Night Time Sleep Strawberry Chews 4-Pack, which saw a significant increase in sales. The CBD/THC/CBG 1:1:1 Daytime Mango Chews 4-Pack maintained its fourth-place rank across the months. Notably, the CBD Relief Cream entered the rankings at fifth position, marking its first appearance in the dataset.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.