Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

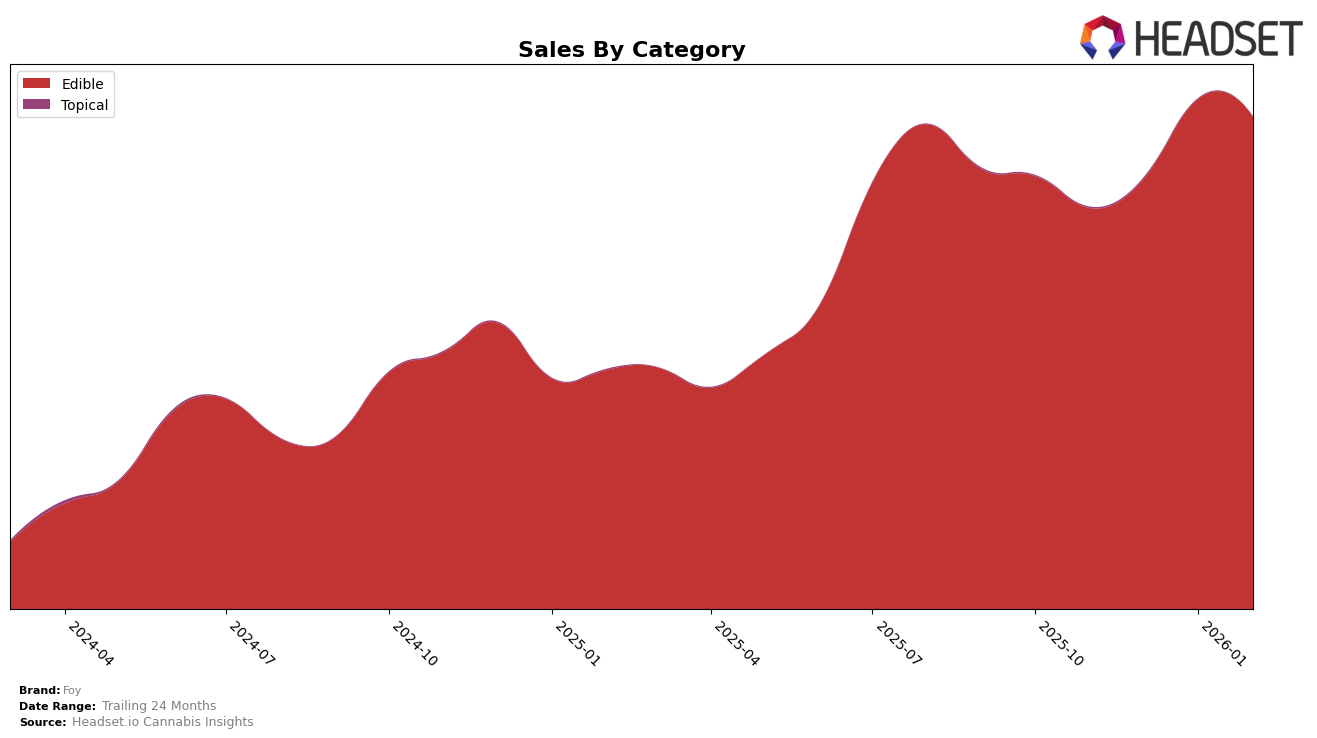

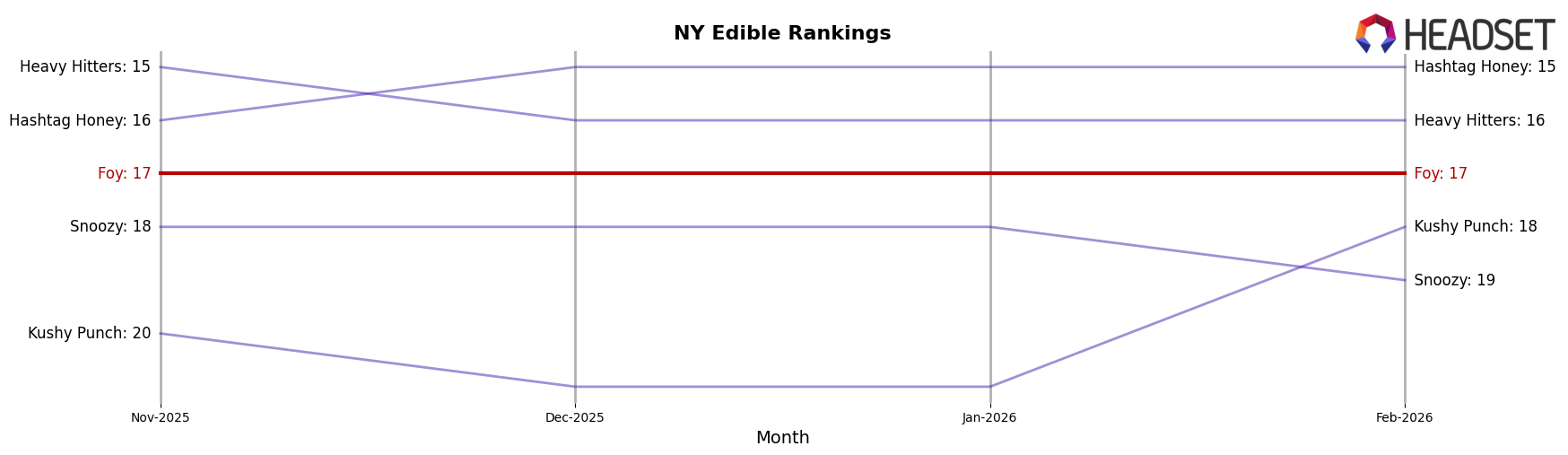

Foy has maintained a consistent performance in the Edible category within New York, holding the 17th position from November 2025 through February 2026. This stability in ranking is noteworthy, especially considering the competitive nature of the cannabis market. The steady ranking suggests that Foy has established a reliable consumer base in the Edible category in New York, which is further supported by their sales trajectory. Despite the competitive landscape, Foy's sales figures have shown a positive trend, with a noticeable increase from November 2025 to January 2026, before a slight dip in February 2026.

While Foy's consistent ranking in New York's Edible category is commendable, it's important to note that the brand does not appear in the top 30 rankings in any other states or categories. This absence could indicate potential areas for growth or highlight the brand's strategic focus on the New York market. The lack of presence in other states might also suggest challenges in scaling or penetrating new markets. However, the data for New York suggests that Foy has found a formula that resonates well with consumers in this state, which could be leveraged for future expansion efforts.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Foy has maintained a consistent rank of 17th from November 2025 through February 2026. This stability in rank indicates a steady performance amidst a dynamic market. Notably, Hashtag Honey and Heavy Hitters have consistently outperformed Foy, maintaining higher ranks at 15th and 16th respectively, with Hashtag Honey even improving its position from 16th to 15th over the same period. Meanwhile, Kushy Punch and Snoozy have shown fluctuations, with Kushy Punch dropping out of the top 20 in December and January before rebounding to 18th in February, while Snoozy slipped from 18th to 19th in February. Despite these shifts, Foy's sales have shown a positive trend, peaking in January 2026, which suggests potential for upward mobility in rank if this growth trajectory continues.

Notable Products

In February 2026, Foy's top-performing product was the CBD/THC/CBN 1:1:1 Night Time Strawberry Adaptogen Chews 20-Pack, maintaining its leading position with sales reaching 6548 units. The CBD/THC/CBG 1:1:1 Daytime Mango Blood Orange Chews 20-Pack secured the second spot, showing a slight dip from its top position in January. Consistently holding the third rank was the CBD/THC/CBN 1:1:1 Night Time Sleep Strawberry Chews 4-Pack, while the CBD/THC/CBG 1:1:1 Daytime Mango Chews 4-Pack remained steady in fourth place. Notably, the Strawberry Gummy 20-Pack maintained its fifth position since its debut in January, indicating stable consumer interest. Overall, the rankings for February reflect a consistent preference for Foy's top products, with minor shifts in sales figures compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.