Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

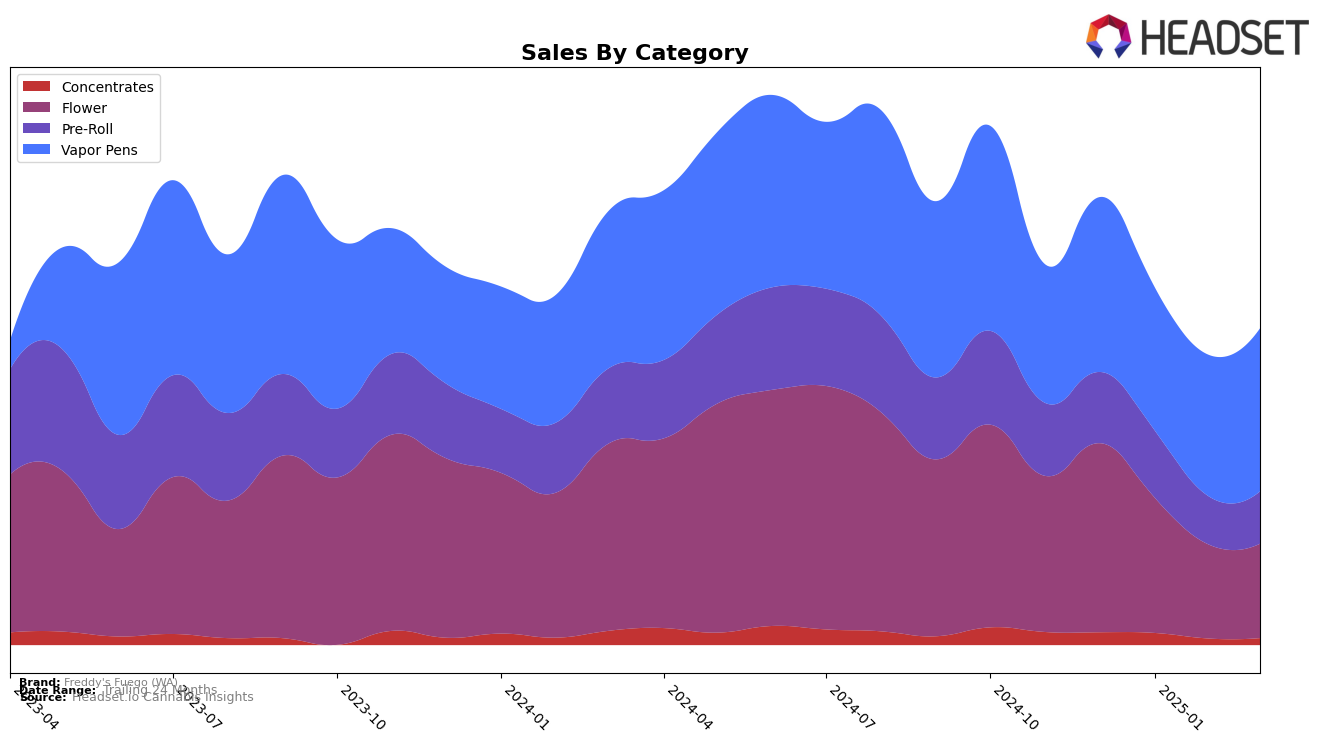

Freddy's Fuego (WA) has shown varied performance across different product categories in Washington. In the Concentrates category, the brand did not make it into the top 30 rankings from December 2024 through March 2025, which could be a concern for stakeholders focusing on this segment. The sales figures in this category have seen a decline from December to February, with a slight uptick in March, suggesting potential market challenges or shifts in consumer preferences. On the other hand, the Vapor Pens category shows more promising results, with Freddy's Fuego maintaining a relatively stable position, peaking at 24th place in March 2025, indicating a stronger foothold in this segment.

In the Flower category, Freddy's Fuego experienced a notable drop in rankings, from 25th in December 2024 to 44th in March 2025. This decline aligns with a downward trend in sales over the same period, which may reflect increased competition or changing consumer tastes in Washington. Conversely, the Pre-Roll category has shown a more moderate decline, with the brand holding the 43rd position by March 2025, after starting at 37th in December. This suggests a more resilient performance relative to other categories, although still outside the top 30. These insights underscore the importance of strategic adjustments to capture market share and improve brand positioning across different product lines.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Freddy's Fuego (WA) has experienced fluctuating rankings, indicating a dynamic market position. While Freddy's Fuego (WA) saw a slight improvement in rank from January to March 2025, moving from 28th to 24th, it still trails behind competitors like Lifted Cannabis Co and Thrills, which have consistently maintained higher ranks, with Thrills notably starting strong at 18th in January before dropping to 26th by March. Meanwhile, Hitz Cannabis showed a significant upward trend, surpassing Freddy's Fuego (WA) by March. Despite these challenges, Freddy's Fuego (WA) managed to increase its sales from February to March 2025, suggesting potential for growth if it can capitalize on market trends and consumer preferences. This competitive analysis highlights the need for Freddy's Fuego (WA) to strategize effectively to improve its market rank and sales in the vapor pen category.

Notable Products

In March 2025, Freddy's Fuego (WA) saw Carrot Cake Pre-Roll (1g) maintain its top position as the best-selling product in the Pre-Roll category, with sales reaching 821 units. Freddy's Finest - Lemon Short Bread Pre-Roll (1g) climbed to the second spot, improving from its third-place ranking in February. Girl Scout Cookies Liquid Gold Distillate Disposable (1g) slid from second to third place in the Vapor Pens category, showing a slight decline in sales. Big Baby Pre-Roll (1g) entered the top five, securing the fourth position, while Lyon King Pre-Roll (1g) made its debut at fifth place. Overall, Pre-Rolls dominated the rankings, with notable shifts in positions from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.