Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

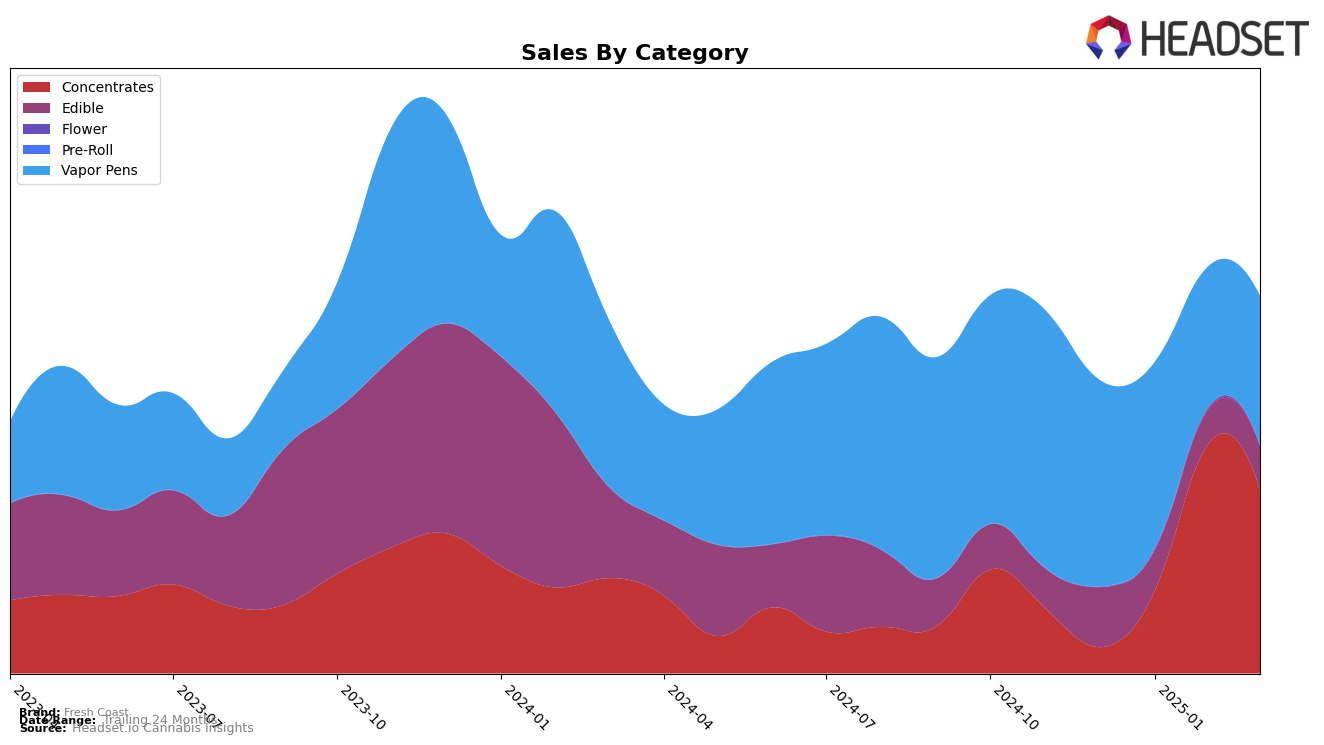

Fresh Coast has shown a notable performance in the Michigan cannabis market, particularly in the Concentrates category. The brand made a significant leap from being ranked 65th in December 2024 to breaking into the top 10 by February 2025, before settling at 14th by March 2025. This upward trajectory indicates a strong consumer reception and possibly effective market strategies. In contrast, the Edible category presents a more stable yet less dynamic picture, with Fresh Coast hovering around the 58th to 59th rank from January to March 2025, suggesting limited penetration in this segment. The Vapor Pens category also shows some fluctuations, with a slight decline in rank from 27th in December 2024 to 36th by February and March 2025, which could reflect shifting consumer preferences or competitive pressures.

In terms of sales, Fresh Coast's performance in Concentrates is particularly impressive, with sales surging from $45,646 in December 2024 to over $400,000 by February 2025, before slightly declining in March. This sales trend underscores the brand's growing prominence and possibly expanding consumer base in this category. Meanwhile, the Edible category saw a decrease in sales from December 2024 to February 2025, with a slight recovery in March, which may indicate challenges in maintaining consumer interest or market share. Vapor Pens experienced a sales decline from December 2024 through February 2025, with a modest increase in March, aligning with the brand's rank stability in this category. This mixed performance across categories highlights the brand's strengths and areas for potential growth in the competitive Michigan market.

Competitive Landscape

In the Michigan concentrates market, Fresh Coast has shown a remarkable upward trajectory in rankings and sales from December 2024 to March 2025. Starting from a rank of 65 in December, Fresh Coast made a significant leap to 31 in January, reaching the top 10 by February, and maintaining a strong position at 14 in March. This surge reflects a strategic gain over competitors such as Rkive Cannabis, which fluctuated slightly but remained consistently in the top 15, and Society C, which experienced a rank drop in February before recovering in March. Meanwhile, Anarchy Extracts maintained a steady presence in the top 15, and Bamn showed a similar upward trend but did not surpass Fresh Coast's peak rank. Fresh Coast's impressive climb in rank and sales suggests a growing consumer preference and effective market strategies, positioning it as a formidable player in the Michigan concentrates sector.

Notable Products

In March 2025, Fresh Coast's top-performing product was Trop Runtz Cured Resin Badder (1g) in the Concentrates category, maintaining its first-place rank from February with notable sales of 3,860 units. Peach Bubblegum Cured Resin Badder (1g) and Trop Cherry Cured Resin Badder (1g) held the second and third ranks respectively, marking their debut appearances in the ranking. Zoap Cured Resin Badder (1g) secured the fourth position, while Fruit Salad Cured Resin Badder (1g) dropped from fourth in February to fifth in March. The consistency of Trop Runtz Cured Resin Badder's top rank highlights its strong market presence, while the entry of new products in the top ranks indicates a dynamic shift in consumer preferences. Overall, the Concentrates category dominated the top product rankings for Fresh Coast in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.