Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

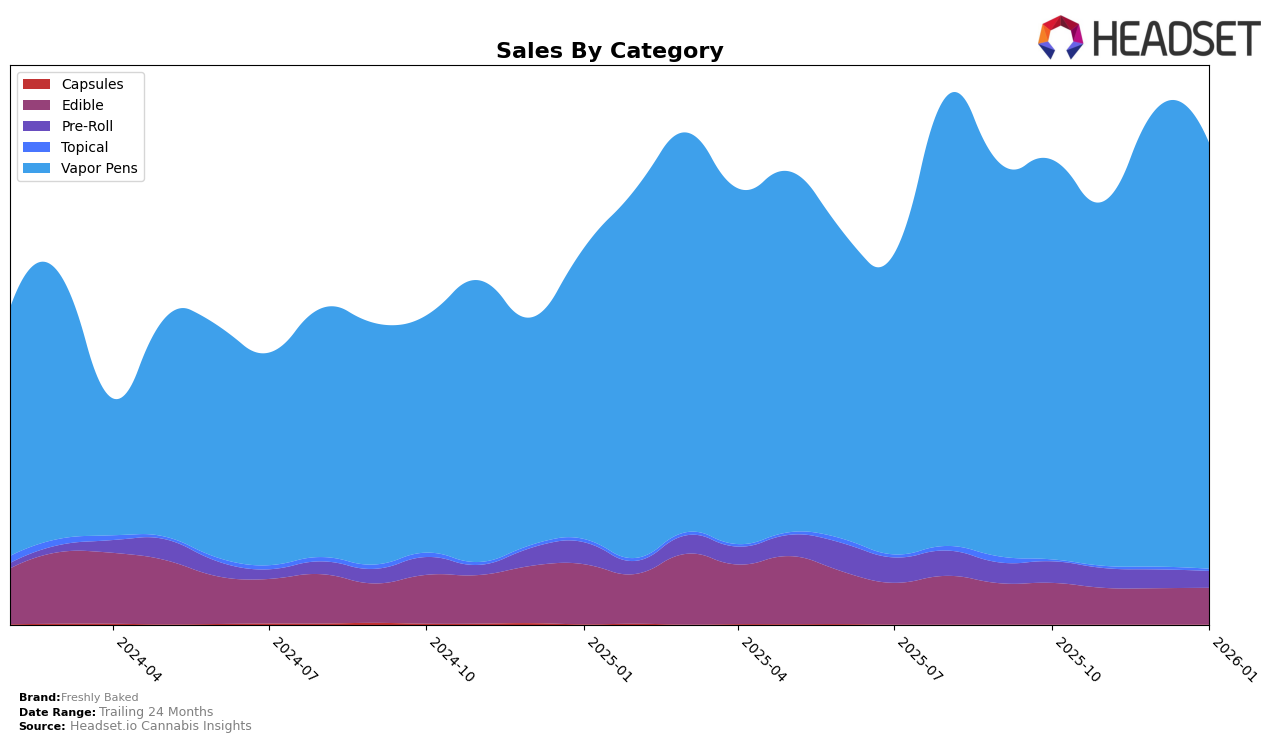

Freshly Baked has shown varied performance across different categories and states. In the Massachusetts market, the brand's presence in the Edible category has been outside the top 30, with rankings fluctuating between 34 and 38 from October 2025 to January 2026. This indicates a challenging competitive landscape in this category, as Freshly Baked struggles to break into the top tier. Despite this, the Vapor Pens category tells a different story, with Freshly Baked maintaining a strong position. The brand consistently ranked within the top 12, even climbing to a commendable 9th place in December 2025 and January 2026. This suggests a solid consumer base and effective product offerings in the vapor pen segment.

The sales trends for Freshly Baked in Massachusetts further highlight these dynamics. While Edible sales have seen a slight decline over the months, the Vapor Pens category has experienced a notable uptick, with December 2025 sales peaking at 749,000. This growth in vapor pen sales suggests an increasing consumer preference or successful marketing strategies in this segment. The brand's ability to maintain and improve its ranking in Vapor Pens, despite fluctuations in the Edible category, points to a strategic focus on more successful product lines. This dual performance across categories underscores the importance of targeted strategies in diverse markets.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Freshly Baked has shown a notable improvement in its market position, climbing from 12th place in November 2025 to 9th place by December 2025 and maintaining that rank into January 2026. This upward trend suggests a positive reception and growing consumer preference for Freshly Baked's offerings. In comparison, Hellavated experienced a slight fluctuation, starting at 12th place in October 2025, dropping to 13th in November and December, but recovering to 10th in January 2026. Meanwhile, Jeeter and Simply Herb consistently outperformed Freshly Baked, maintaining higher ranks throughout the period, with Jeeter peaking at 6th place in November 2025. Despite this, Freshly Baked's sales trajectory indicates a robust growth pattern, particularly from November to December 2025, where it saw a significant boost, reflecting its strategic positioning and potential to challenge higher-ranked competitors in the future.

Notable Products

In January 2026, the top-performing product for Freshly Baked was the Blue Dream Distillate Cartridge (1g) from the Vapor Pens category, climbing to the number one spot with sales reaching 2515 units. Following closely, the Northern Lights Distillate Cartridge (1g) secured second place, maintaining its high performance from the previous months despite a slight drop from its top position in December. The Jack Herer Distillate Cartridge (1g) ranked third, consistently improving its rank over the past months. The Grand Daddy Purple Distillate Cartridge (1g) witnessed a decline to fourth place, having peaked at first in November. Notably, the Strawberry Lemonade Gummies 20-Pack (100mg) entered the rankings in January, securing the fifth position in the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.