Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

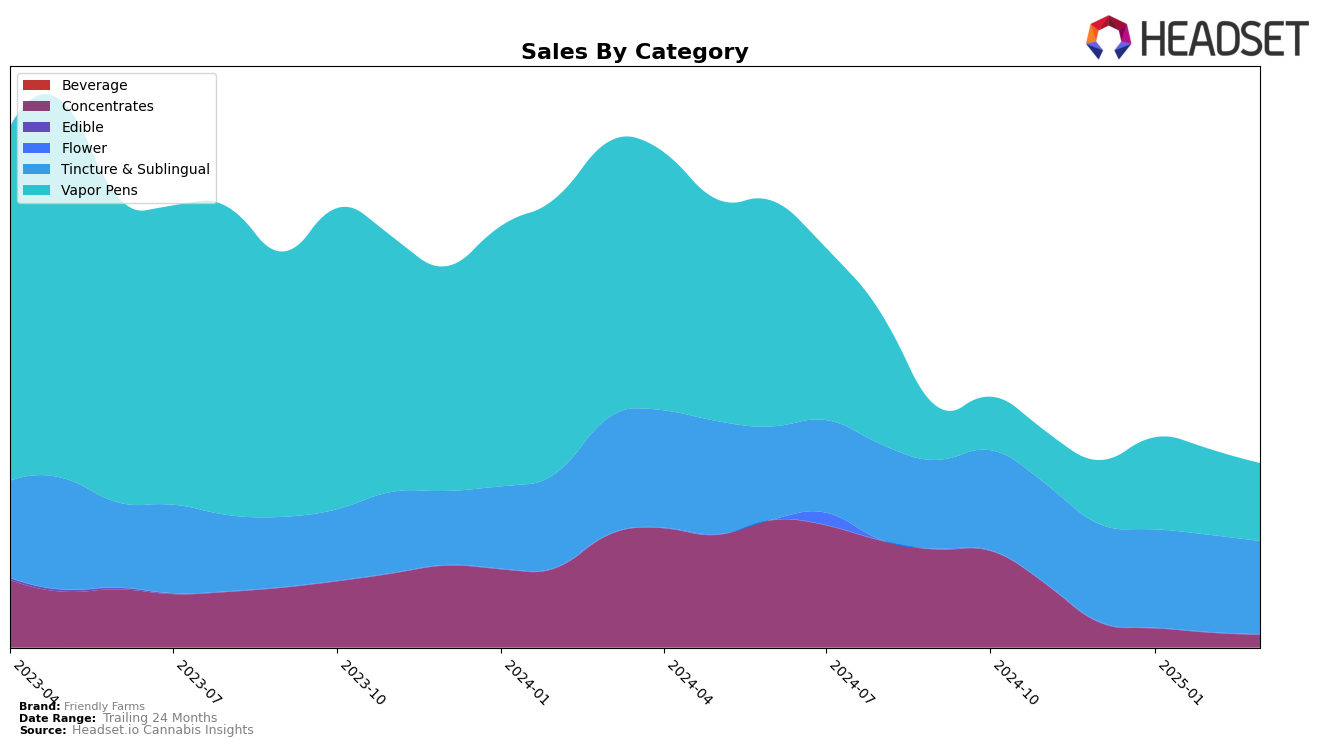

In the highly competitive California cannabis market, Friendly Farms has demonstrated varying performance across different product categories. In the Concentrates category, the brand has not managed to break into the top 30 rankings, experiencing a downward trend from a rank of 61 in December 2024 to 85 by March 2025. This decline might indicate challenges in maintaining a competitive edge or consumer preference shifts. On the other hand, the Tincture & Sublingual category tells a different story, where Friendly Farms has consistently held a strong position, ranking in the top 6 throughout the same period, albeit with a slight dip in sales from December to March. This consistent ranking suggests a stable consumer base and a strong product offering in this category.

Turning to the Vapor Pens category, Friendly Farms has shown some positive movement. Starting at rank 85 in December 2024, the brand improved its position to 64 by January 2025, though it slightly declined to 67 by March 2025. Despite these fluctuations, the brand's sales in this category have seen a notable increase from December to January, indicating potential growth opportunities. The fact that Friendly Farms did not make it into the top 30 in any category other than Tincture & Sublingual could be seen as a challenge that needs addressing, as it suggests limited reach or appeal in those other segments. For more insights into the California market, you can explore the data further by visiting the California market page.

Competitive Landscape

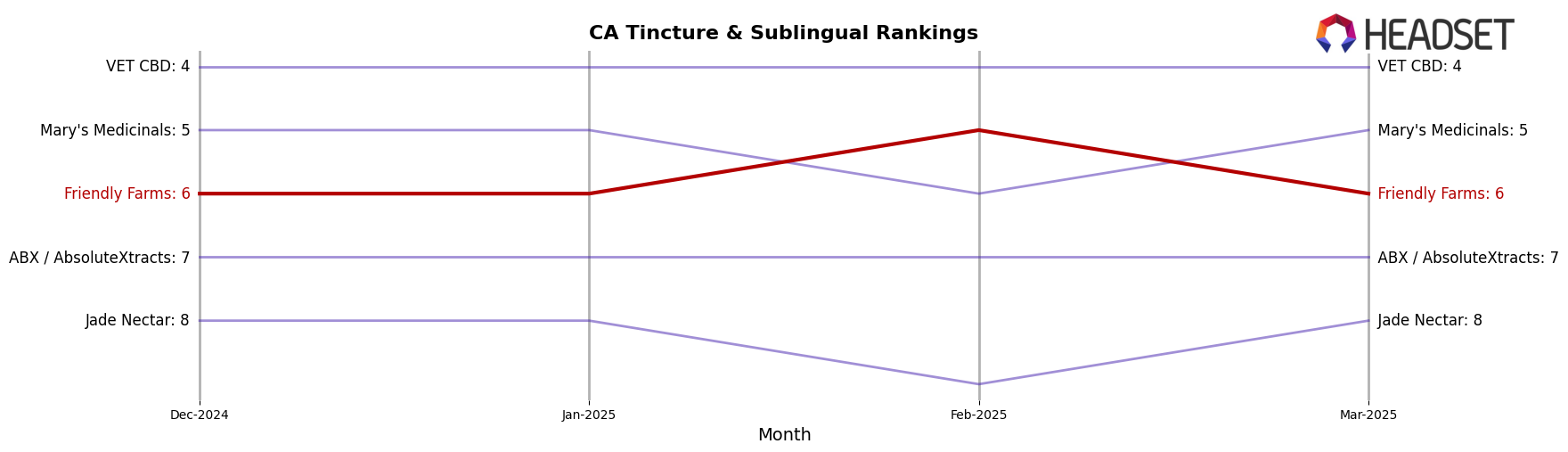

In the competitive landscape of the Tincture & Sublingual category in California, Friendly Farms has shown a consistent presence, maintaining a rank within the top 10 brands from December 2024 to March 2025. Notably, Friendly Farms experienced a slight fluctuation in rank, moving from 6th in December 2024 to 5th in February 2025, before returning to 6th in March 2025. This indicates a stable performance amidst competitive pressures. In comparison, VET CBD consistently held the 4th position throughout the same period, suggesting a stronger market hold. Meanwhile, Mary's Medicinals maintained a steady rank, closely trailing VET CBD, except for a slight dip in February 2025. The sales trajectory of Friendly Farms shows a slight decline in March 2025, which could be a point of concern, especially when juxtaposed with the stable sales of VET CBD. This competitive analysis highlights the need for Friendly Farms to strategize on maintaining its rank and potentially increasing its market share in the face of strong competitors like VET CBD and Mary's Medicinals.

Notable Products

In March 2025, the top-performing product for Friendly Farms was the Zues Cured Resin Cartridge 1g in the Vapor Pens category, achieving the number one rank with sales of 1405 units. This product demonstrated a strong performance, maintaining its leading position as it was not ranked in previous months. Following closely, the Strawberry Banana Fumez Nucleus Cured Resin Cartridge 1g also in the Vapor Pens category secured the second position with notable sales, showing a significant leap from unranked status in prior months. The Guava Daiquiri Cured Resin Cartridge 1g and the Grape Cake Souffle Live Resin Cartridge 1g held the third and fourth positions, respectively, both making impressive entries into the rankings. God's Gift Full Spectrum Tincture 1000mg in the Tincture & Sublingual category rounded out the top five, marking its debut in the rankings with a strong performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.