Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

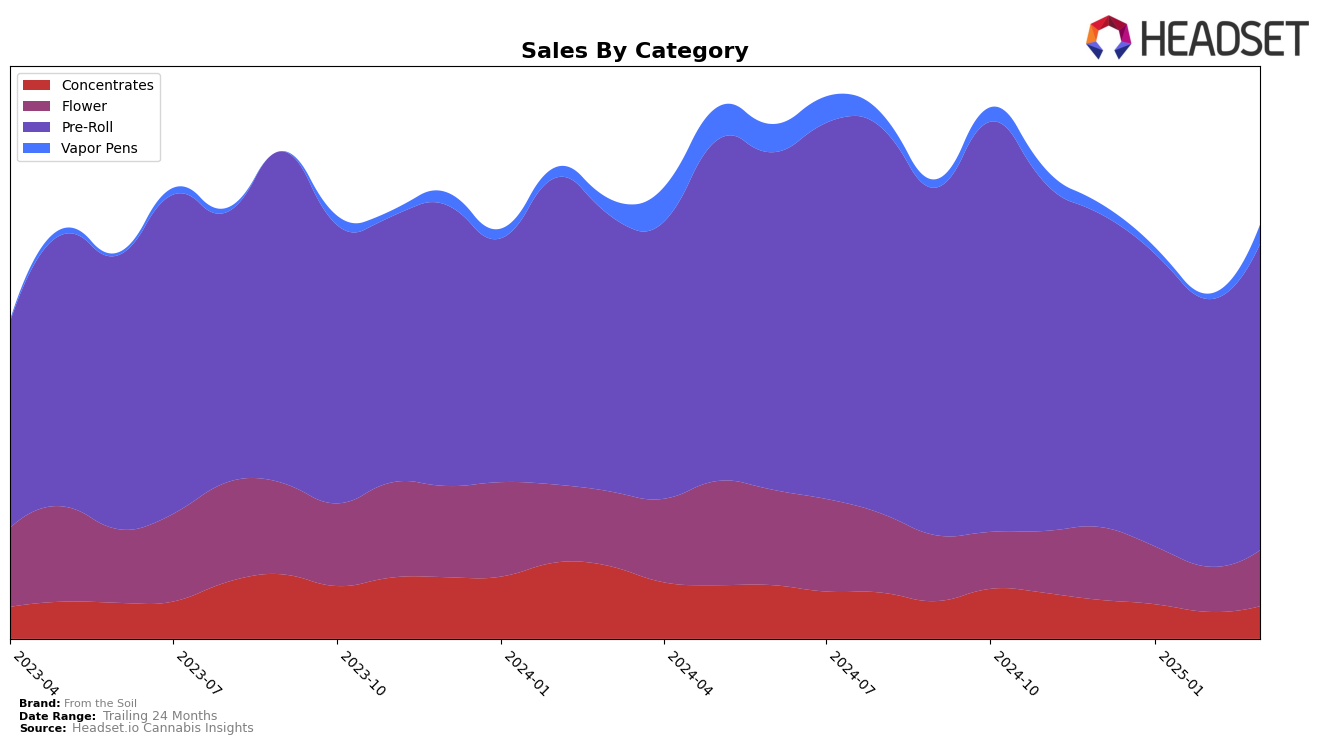

From the Soil has demonstrated varying performance across different product categories in Washington. In the Concentrates category, the brand has faced challenges, slipping out of the top 30 rankings by January 2025 and maintaining a position just outside the top 30 since then. This decline is reflected in their sales figures, which have shown a downward trend from December 2024 to February 2025, before experiencing a slight recovery in March 2025. In contrast, the brand's performance in the Pre-Roll category has been notably strong, consistently ranking in the top 10 and even improving their position slightly from ninth to eighth place by March 2025. This indicates a solid foothold in the Pre-Roll market, despite the fluctuations in other categories.

The Flower category presents another interesting case for From the Soil in Washington. While they have not managed to break into the top 30, their ranking has shown some positive movement, improving from 94th place in February 2025 to 84th in March 2025. This suggests a potential upward trajectory, although the brand still has significant ground to cover to become a major player in this category. The sales figures for Flower also reflect a recovery in March 2025 after a consistent decline in the preceding months. Overall, From the Soil's performance across these categories highlights both challenges and opportunities, with Pre-Rolls standing out as a particularly strong area for the brand.

Competitive Landscape

In the competitive landscape of Washington's Pre-Roll category, From the Soil has demonstrated a consistent presence, maintaining a rank of 9th from December 2024 to February 2025, before improving to 8th in March 2025. This upward trend in rank suggests a positive reception in the market, despite facing strong competition. Notably, Stingers and Hellavated have maintained higher ranks, with Stingers consistently ranking between 5th and 7th, and Hellavated showing a slight decline from 5th to 7th over the same period. Meanwhile, Seattle Bubble Works and The Happy Cannabis have shown fluctuations, with Seattle Bubble Works dropping from 8th to 10th, and The Happy Cannabis experiencing a similar pattern. From the Soil's ability to improve its rank amidst these shifts indicates a robust market strategy, potentially leading to increased sales and brand recognition.

Notable Products

In March 2025, the top-performing product from From the Soil was the Triple OG Pre-Roll 2-Pack (1.5g) in the Pre-Roll category, which climbed to the number one position with sales of 2131 units. The Lemon Amnesia Pre-Roll 2-Pack (1.5g), previously holding the top spot for three consecutive months, slipped to second place. Layer Cake Pre-Roll 2-Pack (1.5g) debuted at third place in March, indicating strong initial sales. The Indica RSO Syringe (1g) maintained its presence in the top four, though it dropped one rank compared to February. Chem Dawg Pre-Roll 2-Pack (1g) remained steady in fifth place, showing a consistent performance since its appearance in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.