Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

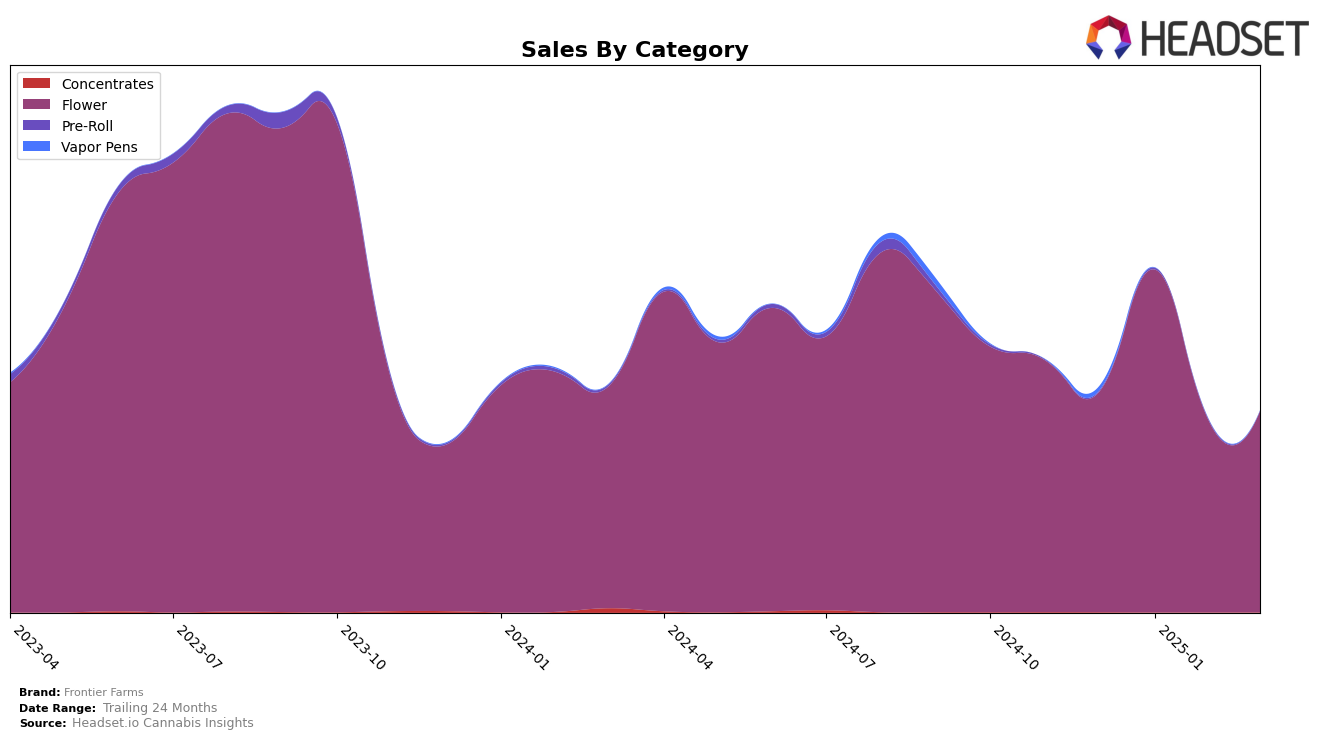

Frontier Farms has shown varying performance across different states and categories, with notable fluctuations in their rankings. In the Flower category in Oregon, the brand has experienced a rollercoaster ride in terms of rank. Starting at the 28th position in December 2024, Frontier Farms improved its standing significantly to 18th in January 2025. However, it slipped back to 28th in February and further down to 30th by March. This decline suggests challenges in maintaining a consistent market share, possibly due to increased competition or shifts in consumer preferences. Despite these ranking fluctuations, the brand's ability to remain within the top 30 indicates a steady yet competitive presence in the Oregon market.

While the rankings provide insight into Frontier Farms' market position, the sales figures reveal underlying trends. The brand saw a sharp increase in sales from December 2024 to January 2025, indicating a successful period, possibly driven by holiday demand or strategic marketing efforts. However, the subsequent drop in February and March sales suggests a need to reassess strategies to regain momentum. The absence of Frontier Farms in the top 30 in other states or categories highlights areas where the brand could potentially expand or improve. Such insights are crucial for stakeholders looking to understand the brand's performance dynamics and strategize accordingly for future growth.

Competitive Landscape

In the competitive landscape of the Oregon Flower market, Frontier Farms experienced a fluctuating ranking from December 2024 to March 2025, with a notable drop from 18th in January 2025 to 30th by March 2025. This decline in rank suggests a competitive pressure from brands like Alter Farms, which surged from 61st to 29th in the same period, and Excolo, which improved its position to 28th by March 2025. Despite these challenges, Frontier Farms maintained relatively stable sales, indicating a loyal customer base even as competitors like Drewby Doobie / Epic Flower and Decibel Farms showed varied sales performance. The data highlights the dynamic nature of the Oregon Flower market, emphasizing the need for Frontier Farms to strategize effectively to regain its competitive edge.

Notable Products

In March 2025, Frontier Farms' top-performing product was Blue Dream (Bulk) in the Flower category, maintaining its first-place rank for three consecutive months with a notable sales figure of 2105 units. Cakelatto (Bulk) secured the second position, consistently holding this rank since February. Purple Punch (2 Grams) emerged as a new contender, entering the rankings at third place. Superboof (Bulk) followed closely behind in fourth place, while Jack Herer (Bulk) retained its fifth-place position from the previous month. Overall, the rankings show stability in the top two positions, with new entries and slight shifts in the lower ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.