Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

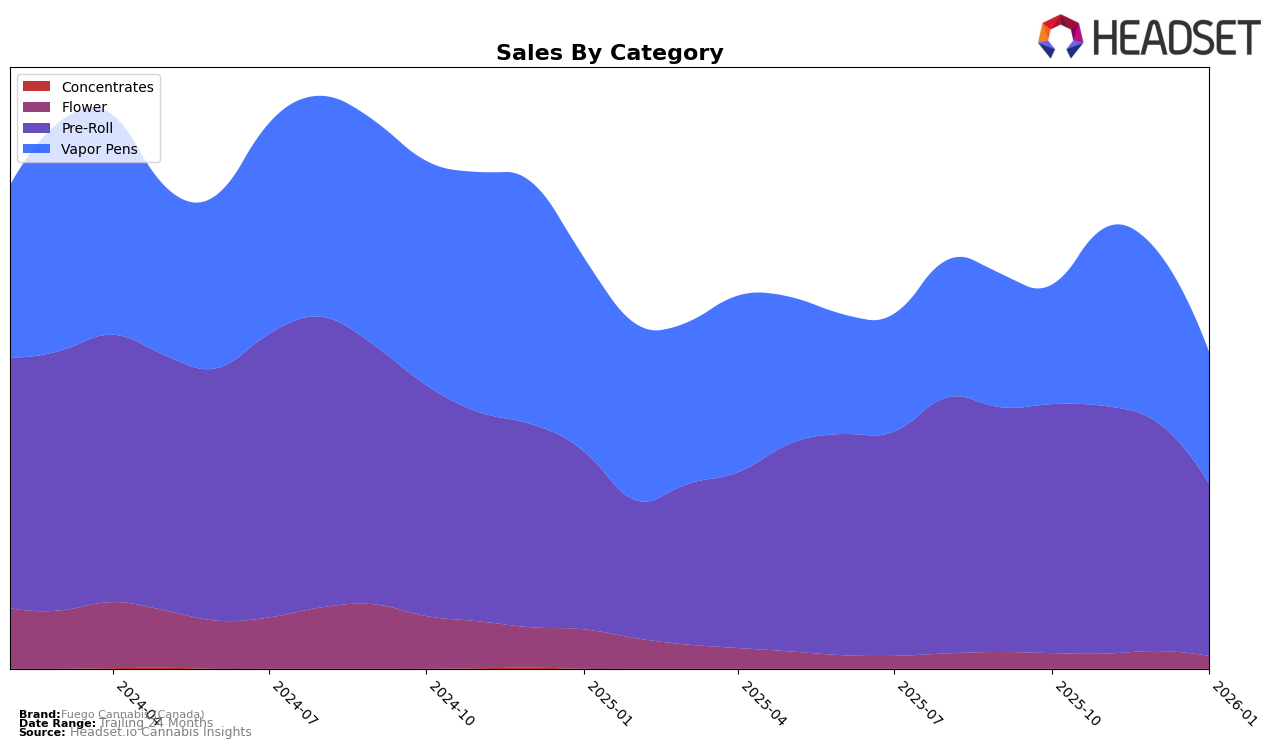

Fuego Cannabis (Canada) has shown a varied performance across different categories and provinces. In Alberta, the brand's presence in the Pre-Roll category has been relatively weak, consistently ranking outside the top 30 brands, with a notable decline in sales from October 2025 to January 2026. Meanwhile, in British Columbia, Fuego Cannabis has maintained a stronger position in the Vapor Pens category, although there was a slight dip in their ranking from 15th in October 2025 to 17th by December 2025, which stabilized in January 2026. This suggests a challenge in maintaining momentum in a competitive market.

In Ontario, Fuego Cannabis has shown a strong performance in the Pre-Roll category, maintaining a top 10 position throughout the period, though there was a gradual decline from 7th to 9th place by January 2026. Their Vapor Pen category also saw fluctuations, moving from 19th to 14th place before settling at 15th. Interestingly, their presence in the Flower category in Ontario was short-lived, with a ranking only in October 2025. In Saskatchewan, Fuego Cannabis had a notable presence in the Pre-Roll category, consistently ranking in the top 10 and achieving a peak position of 3rd in November 2025. However, their Vapor Pens saw a significant drop from 5th to 13th by January 2026, indicating potential volatility in consumer preferences or increased competition.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Fuego Cannabis (Canada) has experienced notable shifts in its market positioning from October 2025 to January 2026. Starting at rank 7 in October, Fuego Cannabis (Canada) saw a slight decline to rank 9 by January 2026. This downward trend contrasts with the performance of competitors such as Redecan, which maintained a stronger position, starting at rank 5 and ending at rank 7, despite a decrease in sales. Meanwhile, FIGR showed consistent improvement, moving from rank 12 to 10, indicating a positive sales trajectory. Similarly, PIFF managed to surpass Fuego Cannabis (Canada) by January, climbing from rank 8 to 8, showing resilience in sales. These dynamics suggest that while Fuego Cannabis (Canada) remains a competitive player, it faces increasing pressure from both established and emerging brands in the Ontario Pre-Roll market, highlighting the need for strategic adjustments to regain and enhance its market standing.

Notable Products

In January 2026, the top-performing product from Fuego Cannabis (Canada) was the Sunny Daze Pre-Roll 2-Pack (2g), maintaining its position as the leading product for four consecutive months with sales of 30,928 units. The Night Rider Pre-Roll 2-Pack (2g) secured the second spot, consistently ranking in the top three since October 2025. The Night Rider Pre-Roll (1g) held steady at third place, showing a slight decline from November 2025 when it briefly reached second place. The Sunny Daze Pre-Roll (1g) remained in fourth position, demonstrating consistent performance over the months. Lastly, the Galactic Fire Pre-Roll 2-Pack (2g) continued to rank fifth, experiencing a steady decrease in sales figures from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.