Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

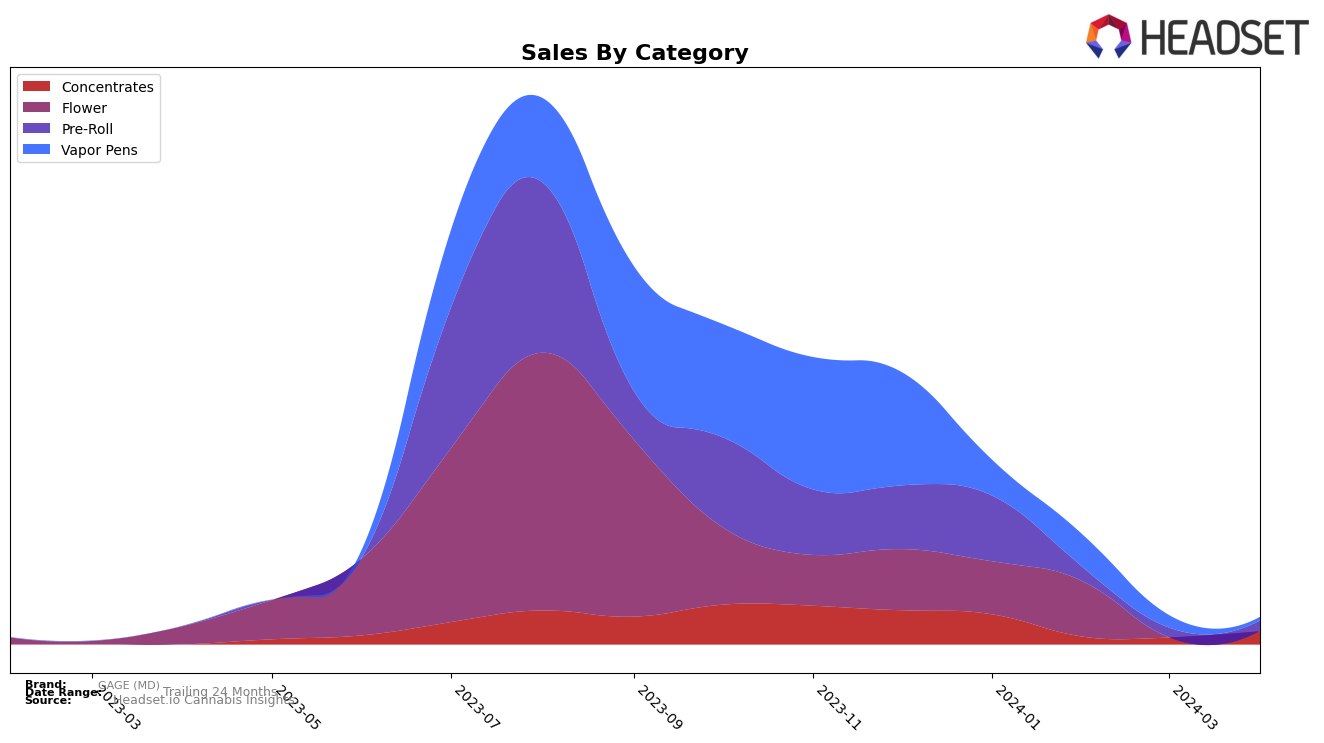

In the competitive cannabis market of Maryland, GAGE (MD) has shown a notable presence, particularly in the Flower and Pre-Roll categories. For the Flower category, their rankings in January and February 2024 were 43rd and 45th, respectively. This slight dip in ranking, while maintaining a presence in the top 50, indicates a stable but challenging position within the market. The sales figures for January and February 2024 were $10,058 and $10,405, respectively, showing a slight increase in sales despite the drop in rank. This could suggest a general increase in competition or fluctuations in consumer preferences within the state's Flower category. However, the absence of ranking data for March and April 2024 leaves room for speculation on their market performance in the subsequent months.

On the other hand, the Pre-Roll category tells a different story for GAGE (MD), with a ranking in January 2024 but no further ranking data available for February through April 2024. The initial ranking of 35th in January, coupled with sales of $12,416, positions GAGE (MD) as a competitive player within the Pre-Roll market segment at the start of the year. The lack of ranking information for the following months could indicate a potential drop out of the top 30 brands in Maryland for this category, which may be viewed as a significant setback or an opportunity for reassessment and strategic planning. The absence of data might hint at shifting market dynamics or operational challenges that could have impacted their market standing. Nonetheless, the early 2024 performance in the Pre-Roll category underscores the brand's initial traction and highlights the volatile nature of consumer preference and market competition in Maryland's cannabis industry.

Competitive Landscape

In the competitive landscape of the Maryland flower cannabis market, GAGE (MD) has faced significant challenges in maintaining its rank and sales amidst stiff competition. Notably, GAGE (MD) was ranked 43rd in January 2024 and slightly improved to 45th by February, indicating a struggle to break into the top 40 brands in this category. In comparison, Find., another competitor, consistently ranked higher, securing the 29th position in January and slightly fluctuating but maintaining a position within the top 35 through February and March. This indicates a more stable market presence compared to GAGE (MD), with Find. showing a stronger performance in terms of rank and sales. Another competitor, In House, made a notable entry in February, ranking 35th, which suggests a dynamic and competitive market environment. The absence of GAGE (MD) from the top 20 rankings in subsequent months underscores the challenges it faces in a market where competitors like Find. and In House are not only entering the fray but also securing better rankings and presumably capturing a larger market share. This competitive analysis highlights the need for GAGE (MD) to strategize effectively to improve its market position and sales in the Maryland flower cannabis category.

Notable Products

In April 2024, GAGE (MD) saw its top product as Banana Bread Pre-Roll (1g) within the Pre-Roll category, maintaining its number one rank from March with sales figures reaching 64 units. Following closely, Grape Gummiez Pre-Roll (1g) also from the Pre-Roll category, secured the second spot, showing consistent improvement in its ranking since January. Dream Candy Pre-Roll (1g) experienced a significant drop, moving from the top position in January to third in April, indicating a fluctuation in consumer preferences. Newcomer to the top products list, Popscotti Live Resin Dablicator (1g) from the Concentrates category, made an impressive entry at fourth place. Meanwhile, Sundae Driver Live Badder (1g), another Concentrate, slightly fell to the fifth position, reflecting a competitive and dynamic market within GAGE (MD)'s product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.