Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

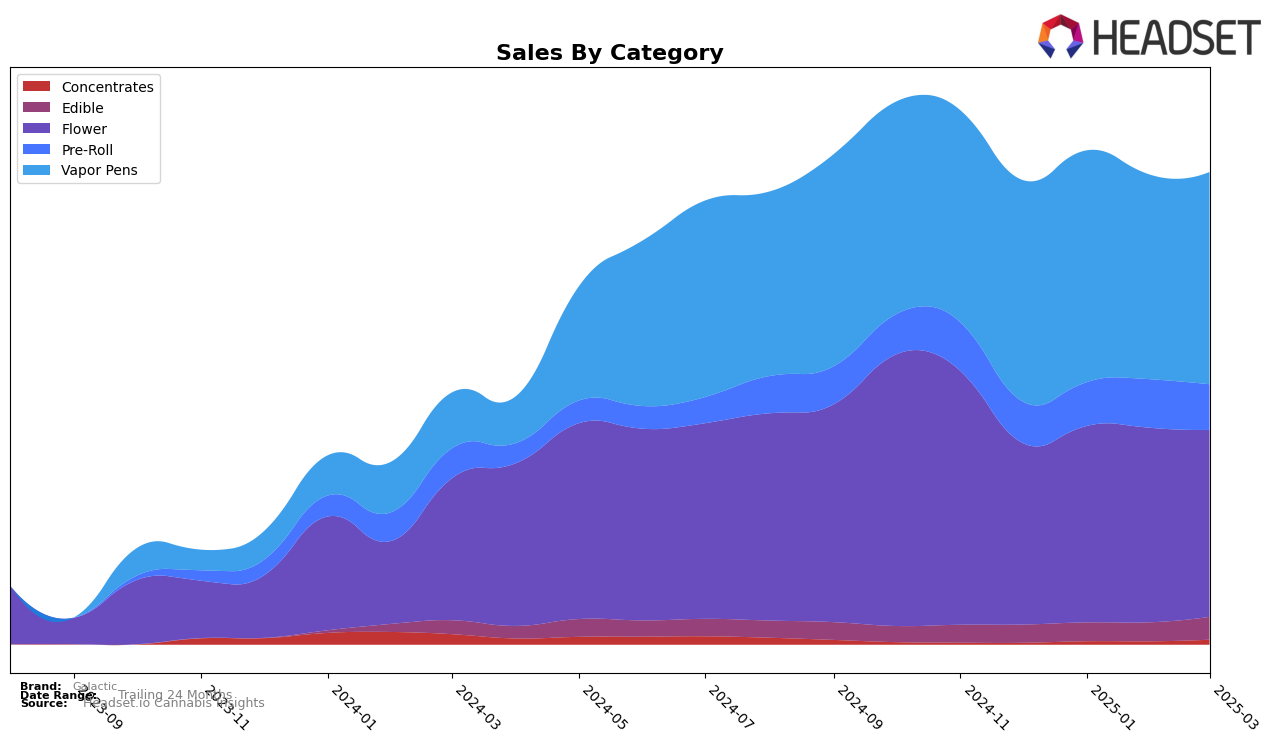

Galactic has demonstrated varied performance across different states and categories, with noteworthy movements in rankings. In Massachusetts, Galactic's Flower category has seen a positive trajectory, climbing from rank 21 in December 2024 to 14 by March 2025, indicating a strengthening presence. Conversely, in the Vapor Pens category within the same state, Galactic's performance has slightly declined, moving from rank 22 in December 2024 to 26 in March 2025, suggesting challenges in maintaining market share. In Michigan, Galactic's Flower category experienced a decline from rank 10 to 21 over the same period, which could be attributed to increased competition or market saturation.

In Missouri, Galactic entered the Flower category rankings in February 2025 at position 30 and improved to 26 by March, showcasing potential growth in a new market. The Vapor Pens category in Missouri has been a stronghold for Galactic, maintaining a top 10 position throughout the observed months, although there was a slight drop from rank 4 in January 2025 to rank 7 in March. Meanwhile, in the Edible category in Michigan, Galactic has consistently hovered around the mid-30s in rank, indicating stable but modest performance. These movements reflect Galactic's strategic positioning and adaptability within different markets, highlighting areas of both opportunity and challenge.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Michigan, Galactic has shown a steady performance, maintaining its rank at 8th place from January to March 2025, after rising from 9th in December 2024. This consistency in rank suggests a stable market presence, although it faces stiff competition from brands like Platinum Vape, which consistently ranks higher, peaking at 4th place in January and February 2025. Meanwhile, Crude Boys has maintained a consistent 7th place, just ahead of Galactic, indicating a close rivalry. Despite this, Galactic's sales have shown a positive trend, with a noticeable increase from December 2024 to March 2025, suggesting effective strategies in customer retention or acquisition. The competitive dynamics highlight the importance for Galactic to innovate and differentiate to climb higher in rankings and capture a larger market share.

Notable Products

In March 2025, the top-performing product from Galactic was the Strawberry Stardust Terp Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place rank from previous months with sales of 21,211 units. The Florida Sunshine Terpene Distillate Cartridge (1g) also held steady in second place, showing a notable increase in sales compared to prior months. The Blueberry Moon Terp Distillate Cartridge (1g) ranked third, experiencing a slight decline in sales figures over time. Celestial Sherbert Terp Cartridge (1g) remained in fourth position, with sales gradually decreasing each month. A new entry, Orange Pop Pre-Roll (1g), debuted at fifth place, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.