Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

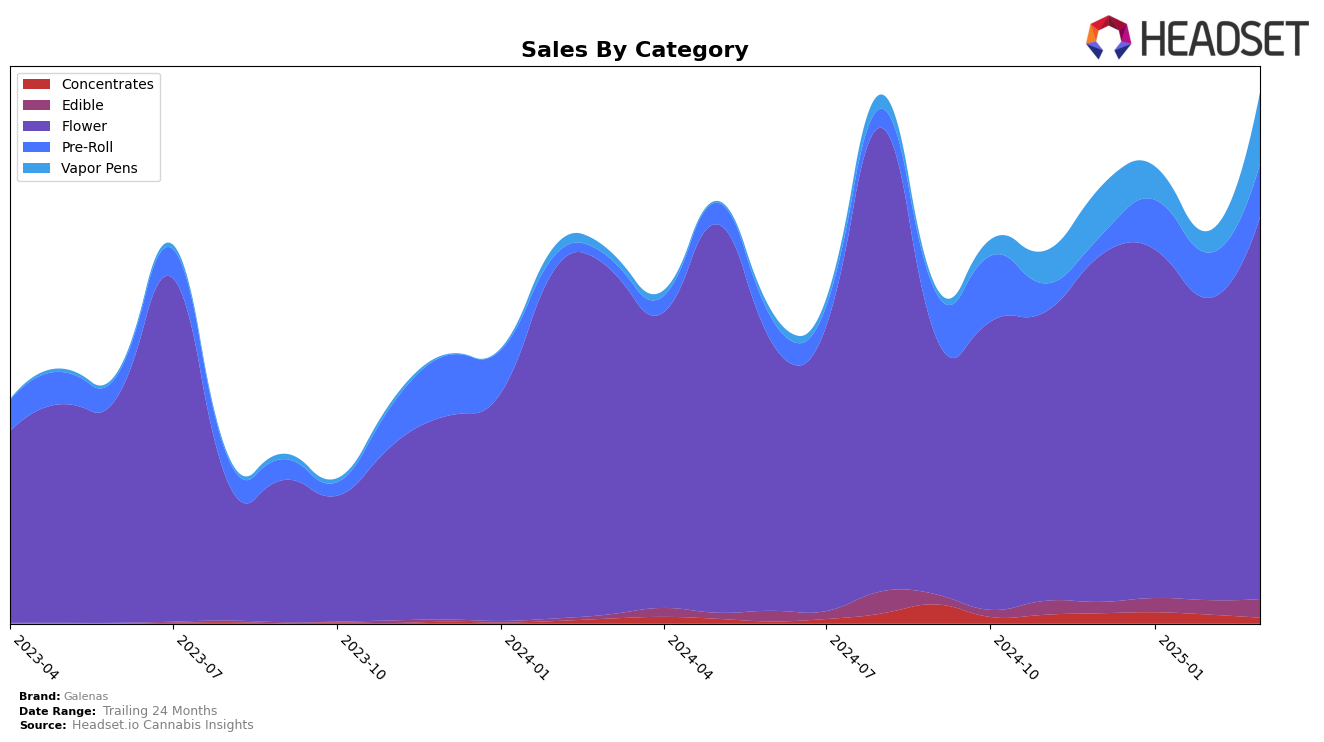

Galenas has demonstrated a varied performance across different categories and states. In Michigan, the brand's presence in the Flower category was absent from the top 30 rankings in December 2024 and February 2025, but it re-emerged in March 2025 at rank 78. This suggests a potential rebound or strategic shift that could have influenced its visibility. Meanwhile, in the Pre-Roll category, Galenas maintained a steady position, starting at rank 62 in January 2025 and improving slightly to rank 59 by March 2025. This consistency indicates a stable consumer base or effective market strategies in this category.

In Ohio, Galenas showed notable progress in the Edible category, climbing from rank 45 in December 2024 to rank 32 by March 2025. This upward movement highlights an increasing demand or improved product offerings within this segment. However, in the Vapor Pens category, the brand experienced fluctuations, with a dip to rank 44 in February 2025 before bouncing back to rank 28 in March 2025. This volatility could point to competitive pressures or shifting consumer preferences. In the Flower category, Galenas maintained a relatively stable presence, with minor rank changes, indicating a strong foothold in this segment despite the competitive landscape.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Galenas has experienced some fluctuations in its market position, reflecting both challenges and opportunities. From December 2024 to March 2025, Galenas' rank shifted from 16th to 17th, with a notable dip to 18th in February. This movement contrasts with Simply Herb, which improved its rank from outside the top 20 to 14th by February, indicating stronger sales momentum. Meanwhile, Find. showed a remarkable rise from 23rd to 16th, surpassing Galenas by March, suggesting a significant increase in consumer preference or distribution reach. The Standard and Black Sheep also demonstrated dynamic shifts, with The Standard dropping to 20th by March and Black Sheep climbing to 19th, reflecting volatility in consumer demand. These competitive movements highlight the need for Galenas to strategize effectively to regain and enhance its market position amidst evolving consumer preferences and competitive pressures in the Ohio market.

Notable Products

In March 2025, the top-performing product for Galenas was Han Solo Burger Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank from January with impressive sales of 7056 units. Eastside Gary (2.83g) in the Flower category emerged as a strong contender, securing the second position. Bickett OG Pre-Roll (1g) saw a slight decline, moving from second place in January and February to third in March. Gorilla Butter Pre-Roll (1g) dropped to fourth place, reflecting a consistent downward trend from its third-place ranking in January. Alien Pebbles (2.83g) in the Flower category debuted in the rankings at fifth place, indicating a potential rise in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.