Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

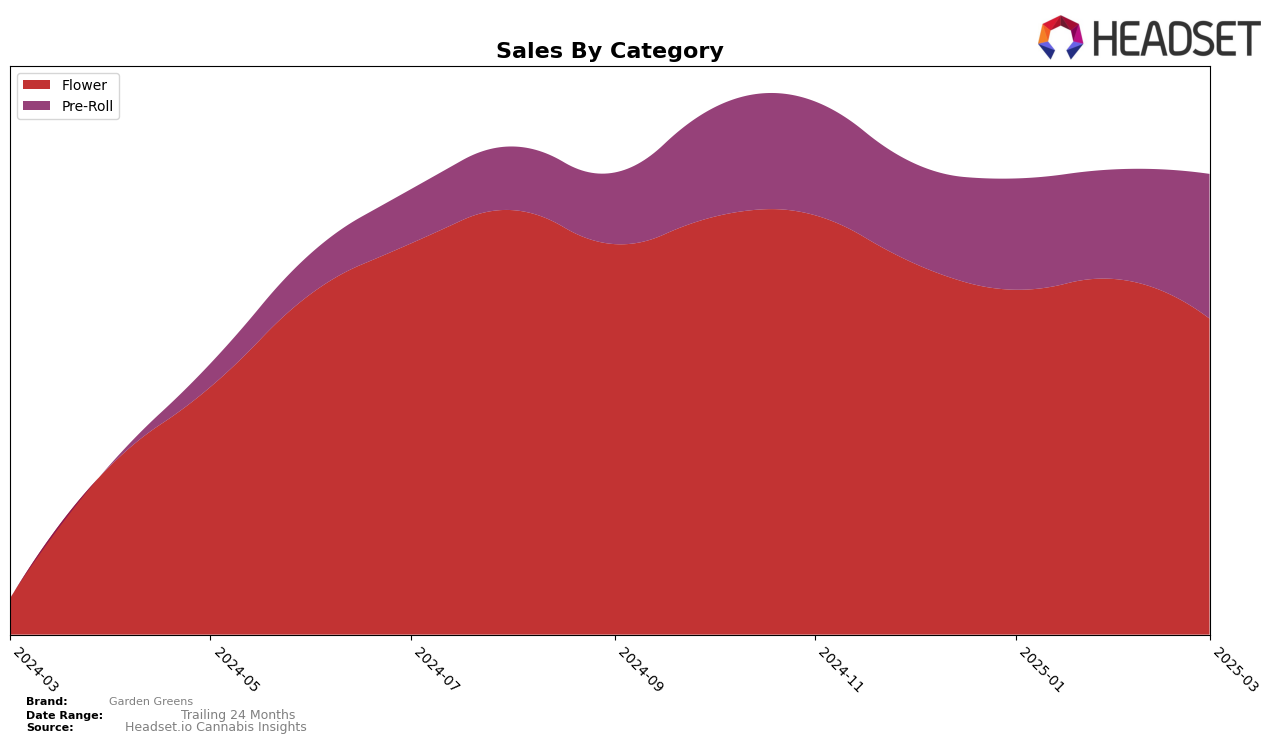

Garden Greens has shown a consistent presence in the New Jersey market, particularly in the Flower category. The brand held the top spot in December 2024 but slipped to the second position from January to March 2025. Despite this slight decline in ranking, their sales figures indicate a healthy performance, with December 2024 sales at approximately $4.09 million. In the Pre-Roll category, Garden Greens maintained strong rankings, initially holding the fourth position in December 2024 and January 2025 before climbing to second place in February and then settling at third in March. This upward trend in the Pre-Roll category suggests an increasing consumer preference for their products in this segment.

While Garden Greens has maintained a notable presence in the New Jersey market, their absence from the top 30 in other states or provinces indicates areas for potential growth or challenges in market penetration. The brand's consistent performance in New Jersey, particularly in the Flower and Pre-Roll categories, highlights their strength in these segments. However, the lack of ranking in other regions could point to either a strategic focus on New Jersey or competitive pressures elsewhere. Understanding the dynamics in these other markets could be key for Garden Greens' future expansion and success.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Garden Greens has experienced a notable shift in its market position from December 2024 to March 2025. Initially holding the top rank in December 2024, Garden Greens was overtaken by Ozone in January 2025, which maintained its lead through March 2025. Despite this, Garden Greens consistently held the second position, indicating strong brand resilience. Meanwhile, Rythm and Savvy remained stable in their ranks, with Rythm consistently at third and Savvy at fourth. The sales trends reveal that while Garden Greens experienced a decline in sales over the months, Ozone's sales surged significantly, which likely contributed to its sustained top ranking. This dynamic suggests that while Garden Greens remains a strong contender, it faces stiff competition from Ozone, which has been aggressively increasing its market share.

Notable Products

In March 2025, the top-performing product for Garden Greens was GG Rainbow Mochi (3.5g) in the Flower category, achieving the number one rank with sales of $5050. Ice Wookie Pre-Roll 2-Pack (1g) rose to second place, improving from its consistent third-place position in January and February. Z Pie (3.5g) secured the third spot, making a notable comeback after being unranked in the previous two months. Peanut Butter Trix (3.5g) entered the rankings at fourth place, while Deez Runtz Pre-Roll 2-Pack (1g) rounded out the top five. This month saw a reshuffling of ranks, highlighting the dynamic nature of consumer preferences within the Garden Greens lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.