Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

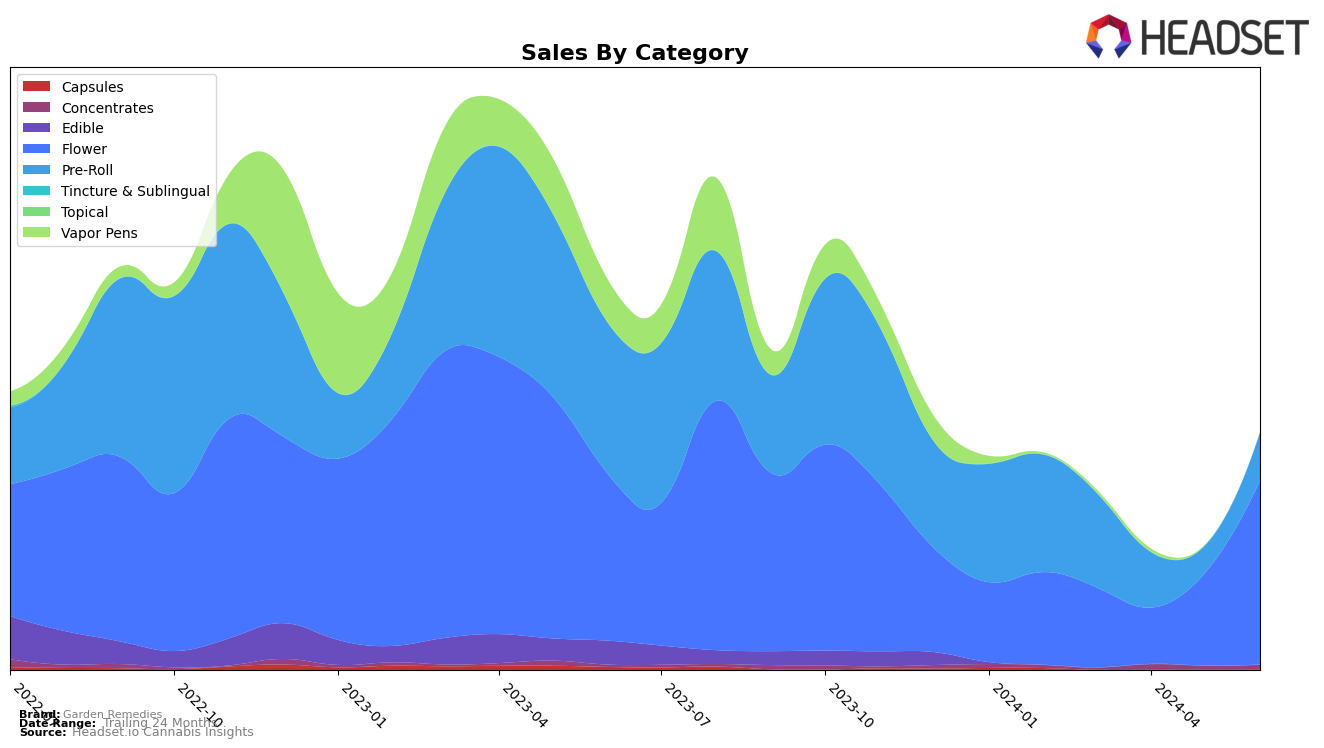

Garden Remedies has shown notable performance fluctuations across different categories and states, particularly in Massachusetts. In the Flower category, the brand made a significant leap from a ranking of 80 in April 2024 to 43 in June 2024, reflecting a substantial increase in sales. This upward trend indicates a growing consumer preference for their Flower products, which could be attributed to improved quality or effective marketing strategies. However, it's important to note that the brand was not in the top 30 for this category earlier in the year, suggesting that while they are making progress, there is still room for further growth and consistency.

In the Pre-Roll category, Garden Remedies experienced a more volatile performance. The brand's ranking dropped from 40 in March 2024 to 83 in May 2024, before recovering slightly to 65 in June 2024. This inconsistency might be a cause for concern, as it indicates potential challenges in maintaining a steady market presence in this category. The absence of top 30 rankings during these months suggests that the brand needs to address specific issues to enhance its competitiveness. Overall, while there are positive signs of growth in certain areas, Garden Remedies still faces hurdles that need to be overcome to achieve sustained success across all categories and states.

Competitive Landscape

In the Massachusetts Flower category, Garden Remedies has shown a notable shift in its market position over the past few months. Starting from a rank of 76 in March 2024, Garden Remedies experienced a dip to 80 in April, before rebounding to 73 in May and making a significant leap to 43 in June. This upward trajectory in rank coincides with a substantial increase in sales, particularly from May to June, where sales more than doubled. In comparison, Khalifa Kush and Springtime have seen fluctuating ranks, with Khalifa Kush improving from 62 in May to 47 in June, while Springtime dropped from 45 in May to 48 in June. Meanwhile, Grassroots and Simpler Daze have maintained relatively stable positions, with Grassroots improving its rank from 58 in April to 42 in June, and Simpler Daze holding a steady rank around the mid-30s before slightly dropping to 41 in June. These dynamics suggest that Garden Remedies is gaining competitive ground, potentially due to strategic marketing efforts or product innovations, making it a brand to watch in the Massachusetts Flower market.

Notable Products

In June 2024, the top-performing product for Garden Remedies was Governmint Oasis Pre-Roll (1g), maintaining its first-place ranking from previous months with impressive sales of 3107 units. Governmint Oasis (1g) emerged as the second top product, making its debut in the rankings. Vermont Logs (1g) followed closely in third place, also appearing for the first time. Limosa Pre-Roll (1g) secured the fourth position, consistent with its earlier performance in March 2024. Pie Scream #6 Pre-Roll (1g) rounded out the top five, demonstrating a strong entry into the market. These rankings highlight a mix of stability and new entries in Garden Remedies' top product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.