Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

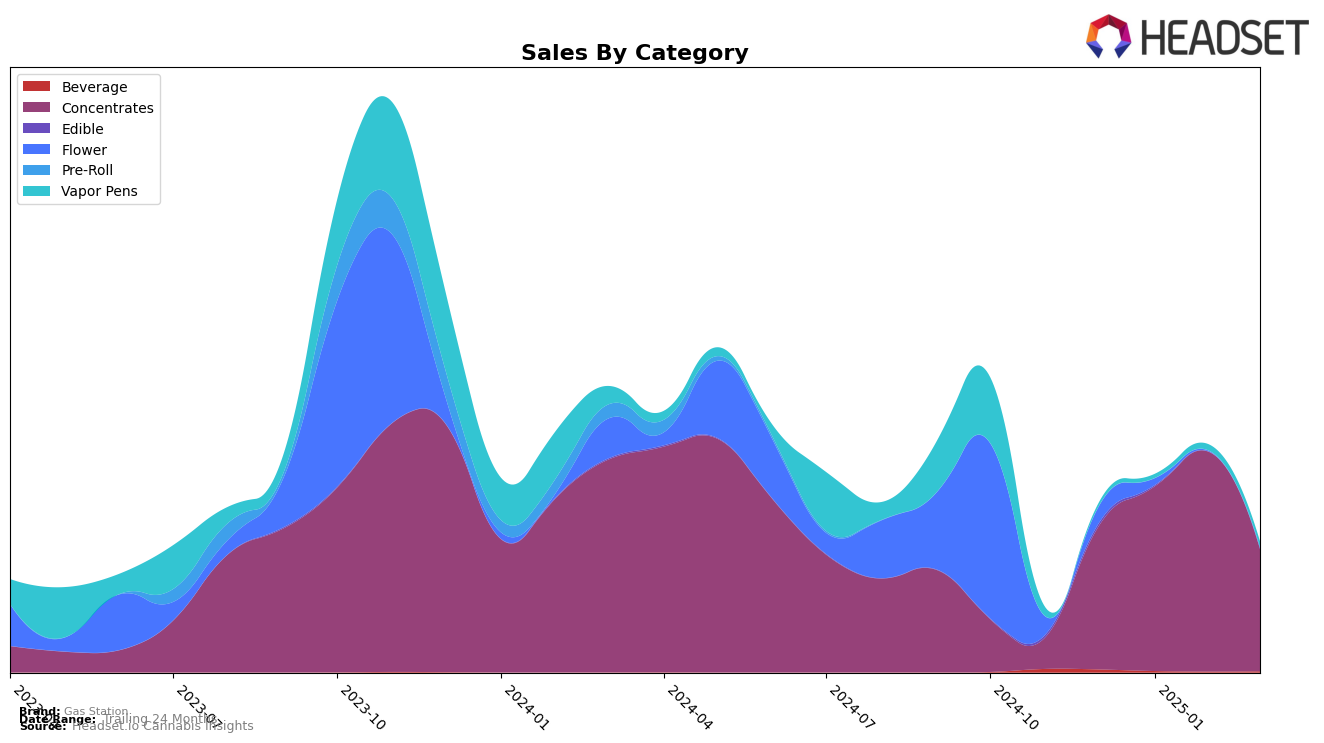

Gas Station has demonstrated varied performance across different states and categories, with notable movements in rankings over the months. In the Michigan market, the brand has shown fluctuating success in the Concentrates category. Starting from a position outside the top 30 in December 2024, Gas Station made a significant leap to rank 27th in January 2025 and further improved to 22nd in February 2025. However, March 2025 saw a decline, with the brand falling back to a 40th position. This indicates a volatile presence in the Michigan market, suggesting potential challenges in maintaining a consistent upward trajectory in this category.

While Michigan's Concentrates category presents a mixed picture, it's essential to note that Gas Station's upward movement in early 2025 was accompanied by an increase in sales from December 2024 to February 2025. This growth suggests that despite the March dip, there is consumer interest and potential for recovery. The absence of a top 30 ranking in December 2024 highlights a previous struggle to capture significant market share, yet the subsequent rise indicates strategic adjustments or increased brand recognition. Observing these shifts can provide insights into how Gas Station might strategize to stabilize and further enhance its market position in the upcoming months across various states and categories.

Competitive Landscape

In the Michigan concentrates market, Gas Station experienced notable fluctuations in its rank and sales from December 2024 to March 2025. Initially, Gas Station held a strong position, improving from 34th in December to 22nd by February, indicating a positive trend in consumer preference and sales performance. However, March saw a significant drop to 40th place, suggesting increased competition or potential market challenges. In contrast, competitors like Peninsula Cannabis and Belushi's Farm showed a more consistent upward trajectory, with Peninsula Cannabis climbing from 43rd to 32nd and Belushi's Farm improving from 52nd to 36th over the same period. Monster Xtracts and True North Collective also demonstrated resilience, with Monster Xtracts peaking at 37th in February before a slight dip, and True North Collective maintaining a stable presence around the mid-40s. The competitive landscape suggests that while Gas Station had a strong start, the brand needs to address the factors contributing to its March decline to regain its competitive edge against these rising brands.

Notable Products

In March 2025, Gas Station's top-performing product was the Apple Mint Distillate Cartridge (1g) from the Vapor Pens category, which climbed to the number one spot from fourth place in February. The Gummy Buns Cured Badder (1g) secured the second position in the Concentrates category, showcasing significant sales momentum. Candy Fumez Live Resin Sugar (1g) followed closely in third place, also within the Concentrates category. Cherry Sunset Cured Badder (1g) maintained its fourth-place ranking from January, indicating consistent performance. Meanwhile, Blackberry Punch Cured Sugar (1g) experienced a slight decline, dropping from third to fifth place despite notable sales of $901 in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.