Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

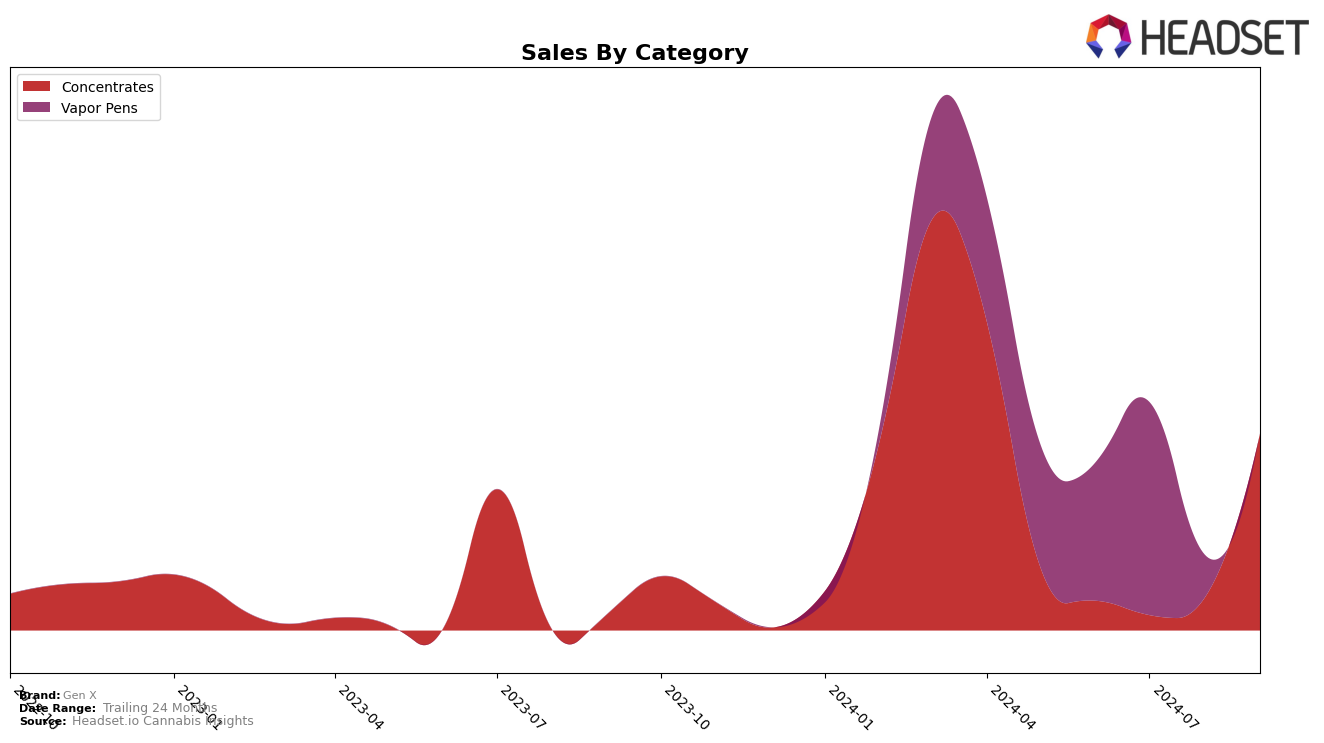

Gen X has demonstrated a notable performance shift in the Arizona market, particularly within the Concentrates category. In June 2024, the brand was ranked 47th, but by September 2024, it had surged to the 16th position. This upward trajectory indicates a significant increase in market presence, likely driven by strategic product launches or marketing efforts. The absence of a ranking in July suggests a temporary dip or strategic withdrawal from the top 30, which was effectively countered by August and September. Such a rebound showcases the brand's resilience and adaptability within the competitive landscape of concentrates.

Conversely, Gen X's performance in the Vapor Pens category in Arizona reflects a more volatile trajectory. The brand improved from 42nd in June to 34th in July, indicating positive momentum, but then experienced a drop to 62nd in August, followed by an absence from the top 30 in September. This fluctuation may suggest challenges in maintaining consistent consumer interest or market competition pressures. The variability in rankings highlights the dynamic nature of the Vapor Pens market and suggests areas for potential improvement or strategic reevaluation for Gen X to regain its footing in this category.

Competitive Landscape

In the Arizona concentrates market, Gen X has shown a significant upward trajectory in its ranking and sales performance over recent months. After not ranking in the top 20 in July 2024, Gen X made a remarkable leap to the 16th position by September 2024, indicating a strong recovery and growth in market presence. This improvement contrasts with competitors such as Shango, which maintained a relatively stable position around the 14th to 19th rank, and Tru Infusion, which consistently ranked between 15th and 17th. Although Achieve and Earth Extracts also experienced fluctuations, their sales volumes did not match the significant growth seen by Gen X, especially in September. This suggests that Gen X's strategic initiatives or product offerings have resonated well with consumers, positioning them as a formidable contender in the concentrates category in Arizona.

Notable Products

In September 2024, the top-performing product for Gen X was Petro Chem #3 Live Diamonds (1g), leading the ranks in the Concentrates category with sales of 3836 units. Following closely was Hell's Banana Live Diamonds (1g), securing the second position. Apple Fritter Live Diamonds (1g) maintained its third-place ranking from August to September, with a notable increase in sales to 2514 units. Cotton Candy Live Sugar (1g) held steady in fourth place, while Rainbow Belts Live Diamonds (1g) entered the top five. The consistency of Petro Chem #3 Live Diamonds (1g) and the rise of Rainbow Belts Live Diamonds (1g) highlight a strong performance in the Concentrates category for September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.