Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

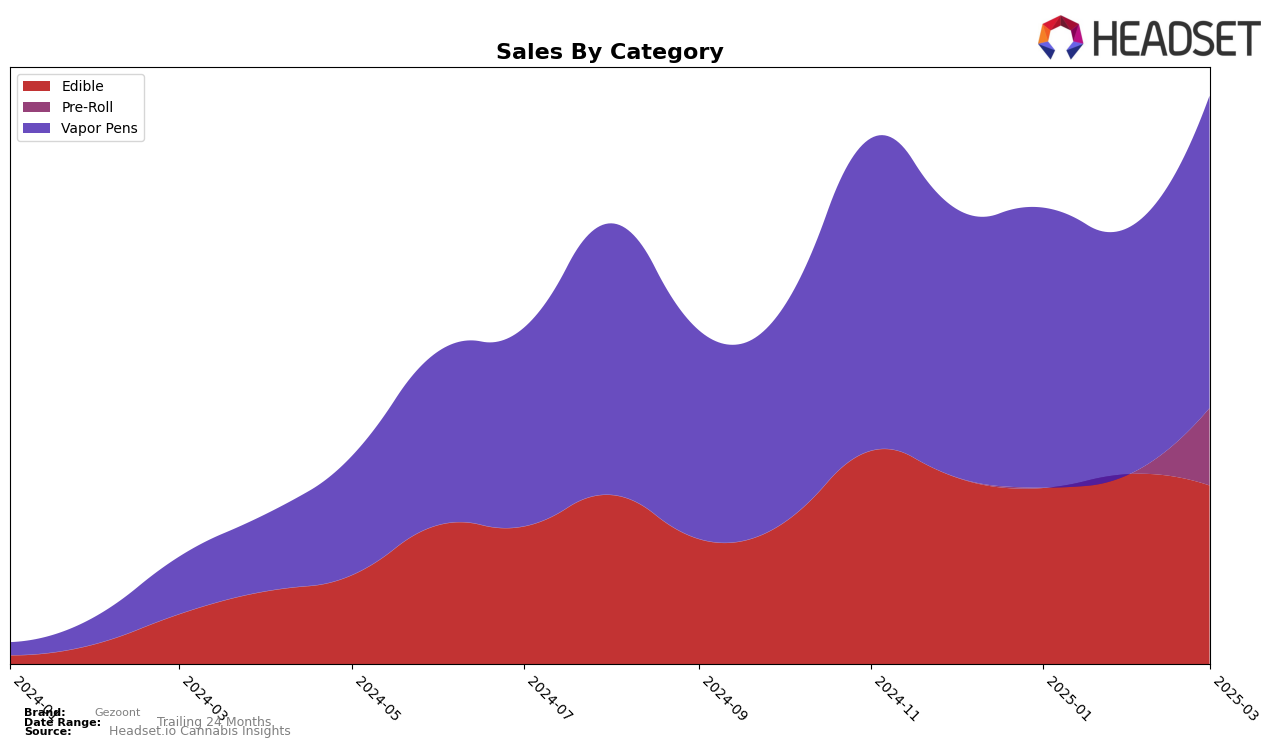

Gezoont's performance in the New York market has shown notable fluctuations across different product categories. In the Edible category, Gezoont has maintained a presence within the top 30 brands, with rankings slightly improving from 29th in December 2024 to 25th in February 2025, before dropping back to 28th in March 2025. This indicates a competitive landscape where Gezoont is managing to hold its ground, albeit with some volatility. In contrast, the Vapor Pens category has seen a more consistent performance, with rankings ranging from 45th to 42nd over the same period, suggesting a stable demand for Gezoont's vapor products. This stability is underscored by a noticeable increase in sales from February to March 2025, indicating a positive trend in consumer preference or market conditions.

On the other hand, Gezoont's absence from the top 30 in the Pre-Roll category throughout the observed months highlights a significant challenge for the brand in this segment. The lack of ranking suggests that Gezoont may need to reassess its strategy or product offering in the Pre-Roll category to enhance its market presence. The sales data for Pre-Rolls, while available, does not provide enough momentum to propel Gezoont into the top tier, highlighting a potential area for growth or innovation. Overall, Gezoont's mixed performance across categories in New York reflects both opportunities and challenges, with some categories showing promise while others require strategic attention.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Gezoont has shown a dynamic shift in its market position over the months from December 2024 to March 2025. Starting at rank 45 in December, Gezoont improved to rank 40 in January, indicating a positive reception and possibly effective marketing strategies. However, it slipped back to rank 45 in February before climbing again to rank 42 in March. This fluctuation suggests a volatile market presence compared to competitors like Flower by Edie Parker, which maintained a relatively stable decline from rank 31 to 39 over the same period. Meanwhile, Nanticoke showed a consistent performance, hovering around ranks 38 to 41, and OMO - Open Minded Organics remained in the lower ranks, from 42 to 45. Despite these fluctuations, Gezoont's sales in March were higher than in February, indicating a potential recovery and a promising outlook if the upward trend continues. This analysis highlights the importance of strategic positioning and adaptability in the competitive vapor pen market in New York.

Notable Products

In March 2025, Blood Orange Diesel Live Resin Disposable maintained its top position as the leading product in the Vapor Pens category for Gezoont, with sales reaching 1066 units. Gorilla Glue Live Resin Disposable consistently held the second spot across four consecutive months, demonstrating stable performance. Kim's Karamels 10-Pack climbed to third place in March, showing a steady increase in popularity since January. Bangin Blueberry Gummies, although dropping to fourth place, remained a strong contender in the Edible category. Strawberry Pom Gummies consistently ranked fifth, maintaining its position from previous months without significant changes in sales rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.