Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

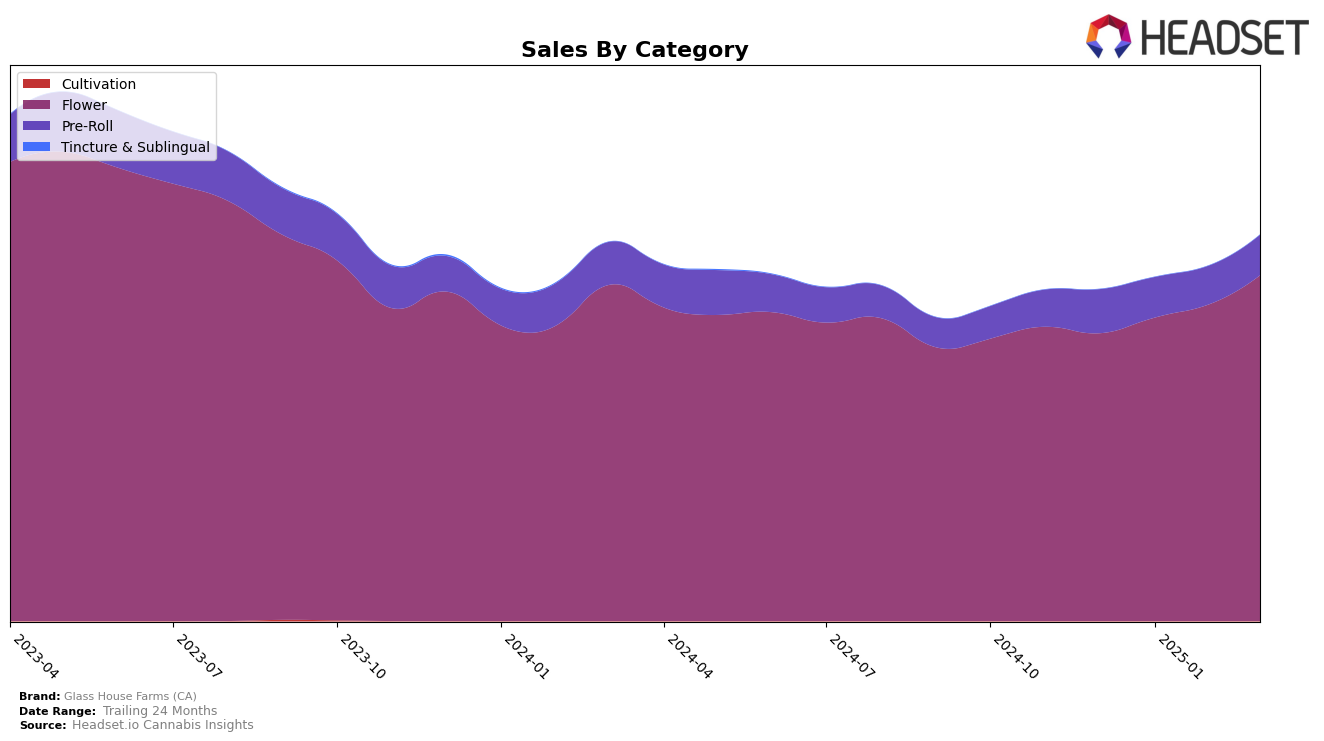

Glass House Farms (CA) has shown a consistent performance in the California market, especially within the Flower category. From December 2024 to March 2025, the brand maintained a steady rank of 12th, reflecting a solid position among competitors. This stability is bolstered by a notable increase in sales over the same period, indicating a strong consumer base and effective market strategies. However, in the Pre-Roll category, Glass House Farms did not make it into the top 30, with ranks hovering around the 40s, suggesting potential areas for growth and improvement in that segment.

While Glass House Farms (CA) has cemented its presence in the Flower category, the Pre-Roll segment presents a different narrative. The brand's ranking fluctuated slightly, ranging from 40th to 44th, which indicates challenges in gaining traction compared to the Flower category. The sales figures in the Pre-Roll category reflect this challenge, showing less robust growth. This discrepancy between categories highlights an opportunity for the brand to reassess its strategy in Pre-Rolls to potentially capture a larger market share. Such insights could be pivotal for stakeholders looking to understand the brand's positioning and future potential in California.

Competitive Landscape

In the competitive landscape of the California flower category, Glass House Farms (CA) has shown a consistent upward trend in its ranking, moving from 14th place in December 2024 to maintaining the 12th position from January to March 2025. This steady climb in rank is indicative of a positive trajectory in sales performance, contrasting with competitors like Fig Farms, which fluctuated from 13th to 9th and then back to 11th, and UpNorth Humboldt, which saw a slight dip before recovering to 10th place. Meanwhile, West Coast Treez improved from 19th to 13th, and Delighted made a significant leap from 27th to 14th by March 2025. Glass House Farms' stable rank amidst these shifts suggests a robust market presence and effective strategies that are resonating well with consumers, positioning it favorably against its competitors in the California market.

Notable Products

In March 2025, Lilac Diesel (7g) emerged as the top-performing product for Glass House Farms (CA), climbing from the second position in February to first place with sales reaching 5111. Lilac Diesel (3.5g) dropped to the second position despite maintaining strong sales figures at 5009. Lilac Diesel Pre-Roll (1g) improved its ranking from fifth in February to third in March, indicating a resurgence in popularity. Dark Nebula (7g) and Garlic Starship (3.5g) entered the rankings for the first time in March, securing fourth and fifth positions, respectively. These shifts highlight a dynamic sales landscape where consumer preferences may be evolving towards new or previously overlooked products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.