Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

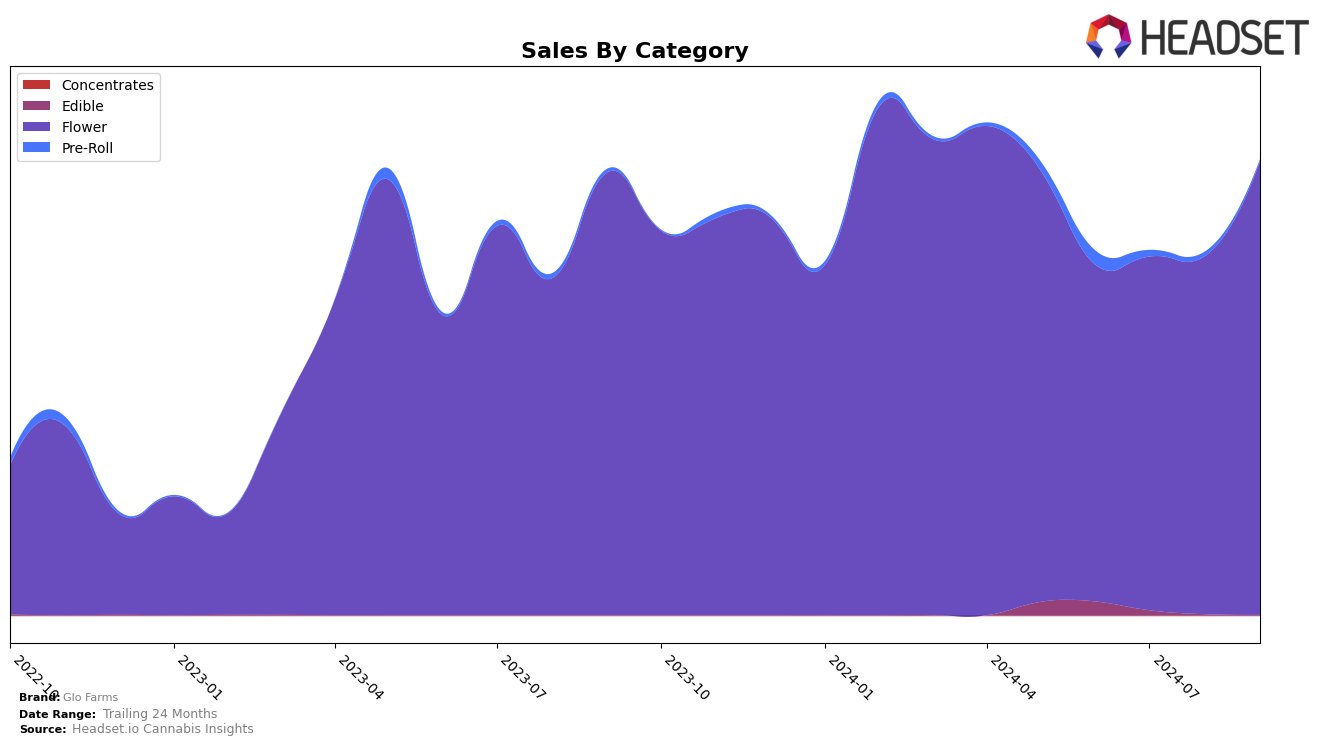

Glo Farms has demonstrated notable performance in the Michigan cannabis market, particularly in the Flower category. Over the past few months, their ranking has improved significantly, moving from 38th place in June and July to 27th place by September. This upward trajectory is accompanied by a consistent increase in sales, indicating a growing consumer preference for their Flower products. However, the Edible category tells a different story, as Glo Farms did not make it into the top 30 rankings during this period, suggesting a potential area for growth or reevaluation of their product offerings in this segment.

While Glo Farms has made strides in the Flower category in Michigan, the absence of top 30 rankings in other categories and states could be seen as a gap in their market presence. The lack of ranking in the Edible category highlights a potential challenge in diversifying their product portfolio or expanding their reach beyond Flower products. This disparity in performance across categories and regions suggests that while Glo Farms has found a niche in the Flower market, there are opportunities to explore and expand their influence in other areas of the cannabis industry. Observing how they navigate these challenges in the coming months will be crucial for understanding their strategic direction and overall market impact.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Glo Farms has shown a notable upward trend in its ranking from June to September 2024. Starting at 38th place in June, Glo Farms climbed to 27th by September, indicating a positive shift in market presence. This improvement is particularly significant given the performance of competitors like LivWell, which saw a decline from 9th to 29th place over the same period. Meanwhile, North Cannabis and Glacier Cannabis also improved their standings, with North Cannabis moving from 42nd to 28th and Glacier Cannabis from 37th to 25th. Common Citizen experienced a dip, falling from 17th to 26th place. These shifts suggest that Glo Farms is gaining traction against some established players, potentially due to strategic marketing or product differentiation, which could be crucial for sustaining its upward trajectory in sales and market rank.

Notable Products

In September 2024, 2 Unicorns 1 Poop emerged as the top-performing product for Glo Farms, maintaining its upward trajectory from the second position in previous months, with a notable sales figure of 7448 units. Unicorn Poop climbed to the second spot, showing consistent improvement from its third rank in the preceding two months. Porn Nug, which had been leading in July and August, fell to third place, indicating a shift in consumer preference. Superman Ice Cream held steady in fourth place throughout the summer, demonstrating stable demand. America Fuck Yeah remained consistent in the fifth position since July, reflecting a steady yet modest performance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.