Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

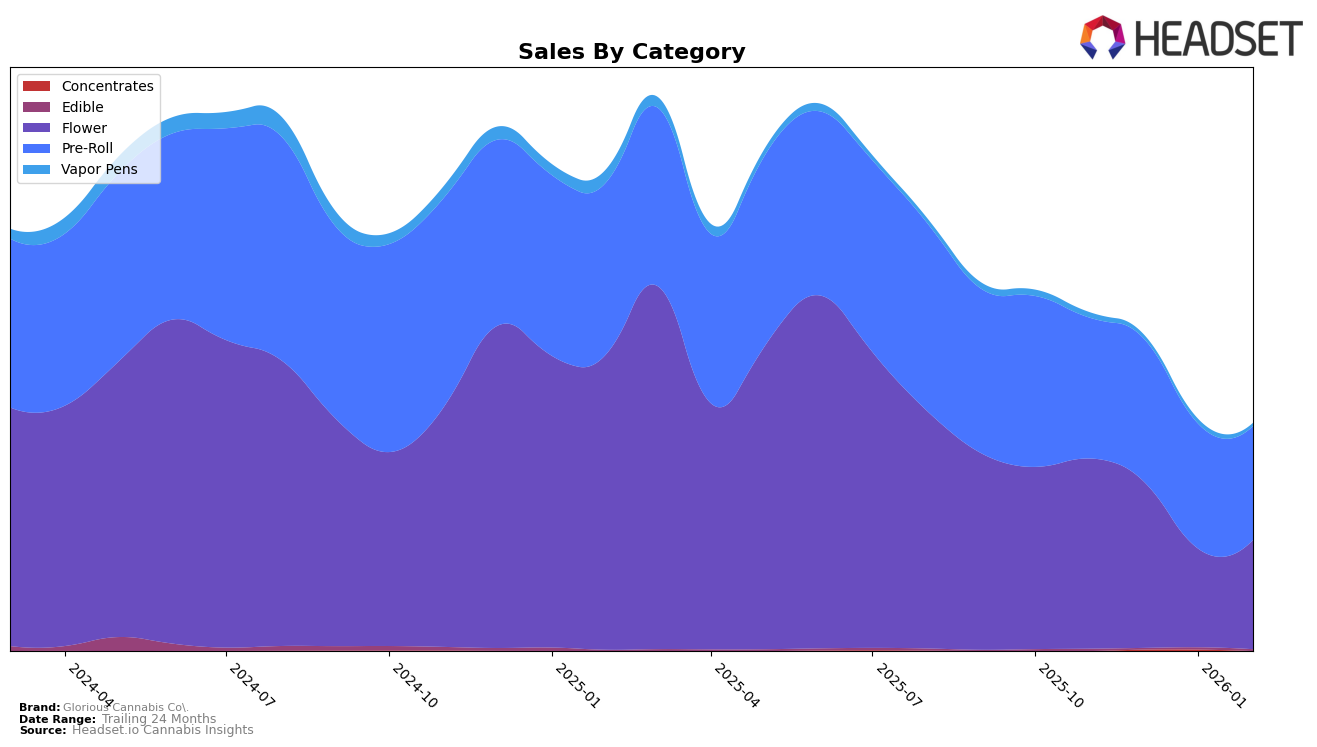

Glorious Cannabis Co. has shown varied performance across different states and product categories. In Massachusetts, the brand has struggled to break into the top 30 for the Flower category, consistently ranking outside of this range from November 2025 to February 2026. This indicates a challenging market position in Massachusetts for Flower products, despite a slight improvement from January to February 2026. Conversely, their Pre-Roll category has maintained a stronger presence, consistently ranking within the top 30, peaking at 17th place in both November 2025 and February 2026. This suggests a more stable and competitive standing in the Pre-Roll category within Massachusetts.

In contrast, Michigan presents a different narrative for Glorious Cannabis Co. The brand has achieved notable success in the Flower category, securing a top 10 position in November 2025. Although there was a dip in rankings to 24th in January 2026, the brand rebounded to 18th by February. This indicates a fluctuating but generally strong presence in Michigan's Flower market. Similarly, in the Pre-Roll category, Glorious Cannabis Co. maintained a top 10 ranking throughout the observed period, though a slight decline was seen by February 2026. The brand's consistent performance in Michigan underscores its competitive edge and potential for growth in this state.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Glorious Cannabis Co. has experienced notable fluctuations in its market position from November 2025 to February 2026. Initially ranked 10th in November 2025, Glorious Cannabis Co. saw a decline to 13th in December and further to 24th in January 2026, before rebounding to 18th in February. This volatility contrasts with the performance of competitors like OG Farms, which maintained a more stable presence, albeit with a downward trend from 15th to 19th over the same period. Meanwhile, Skymint demonstrated a positive trajectory, climbing from 33rd in November to 16th by February, suggesting a strengthening market position. Similarly, Glacier Cannabis made significant gains, moving from 37th in November to 17th in February. These shifts indicate a dynamic market where Glorious Cannabis Co. faces both challenges and opportunities, particularly as competitors like Dubs & Dimes also navigate fluctuations, dropping to 20th in February after peaking at 14th in January. Understanding these trends can provide Glorious Cannabis Co. with strategic insights to enhance its competitive positioning in Michigan's flower market.

Notable Products

In February 2026, the top-performing product from Glorious Cannabis Co. was Fire Styxx - Tigers Breath Infused Pre-Roll (1g), which climbed to the number one rank from the third position in January. The Fire Styxx - Grape Escape Infused Pre-Roll (1g) maintained its steady performance, holding the second rank consistently from the previous month. Fire Styxx - Midnight Berry Infused Pre-Roll (1g) made a notable re-entry by securing the third position, despite not being ranked in January. Meanwhile, Fire Styxx - Blazing Star THCA Infused Pre-Roll (1g) remained stable in the fourth position, experiencing a slight drop from its peak in December. Fire Styxx - Royal Punch Infused Pre-Roll (1g) rounded out the top five, showing a gradual decline in rank since November 2025, with its sales reaching 16,213 in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.