May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

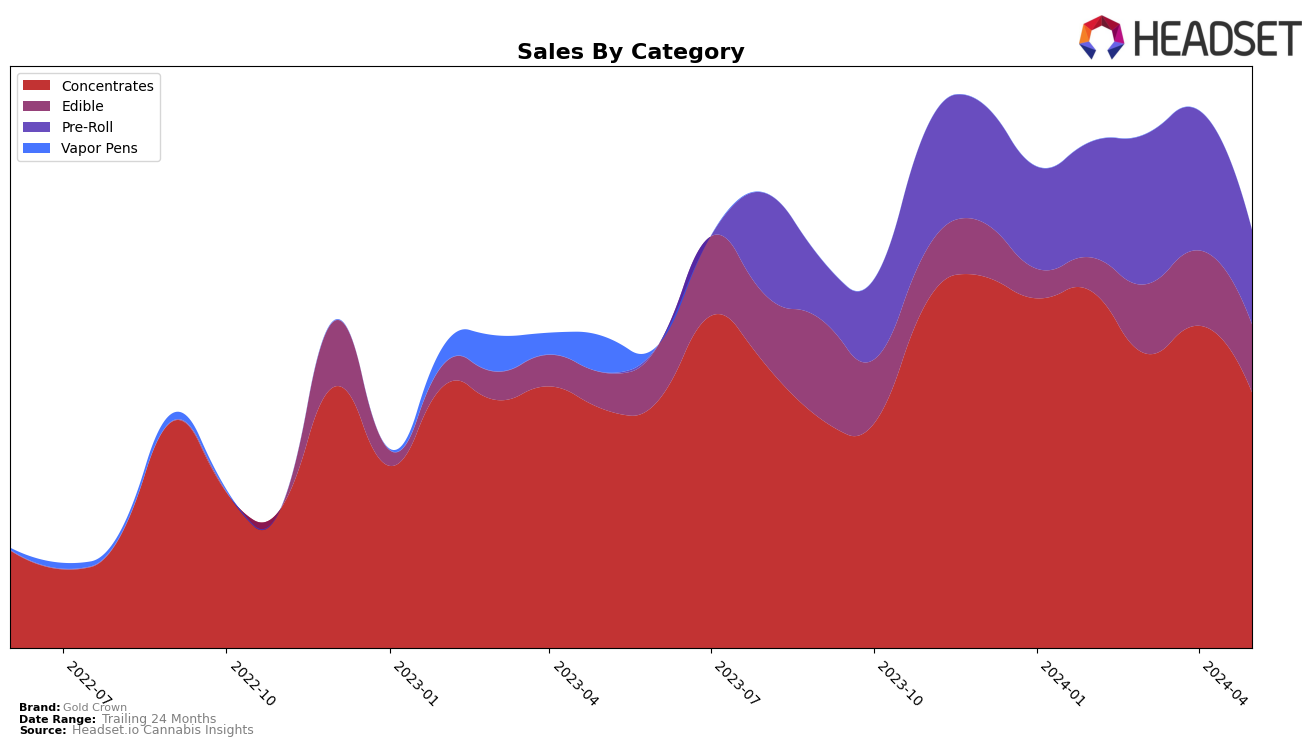

Gold Crown's performance in Michigan has shown notable fluctuations across different categories. In the Concentrates category, the brand has seen a decline in its ranking, moving from 19th in February 2024 to 30th in May 2024. This downward trend is accompanied by a decrease in sales, from $233,319 in February to $167,450 in May. Such a movement suggests that while Gold Crown remains within the top 30, its position is becoming increasingly precarious. Conversely, in the Edible category, Gold Crown has shown a more positive trajectory, improving its ranking from 87th in February to 64th in May. This upward movement aligns with the increase in sales, which peaked in April at $49,110 before slightly dipping to $44,375 in May. This indicates a growing acceptance and demand for their edibles in the market.

In the Pre-Roll category, Gold Crown's performance has been more volatile. Starting at 91st in February, the brand improved its position to 74th in April, only to fall back to 100th in May. This fluctuation is mirrored in their sales figures, which saw a peak in March at $97,748 but dropped significantly to $61,535 by May. Not being in the top 30 for pre-rolls is a clear indicator that Gold Crown is struggling to gain a stronger foothold in this category. Overall, while there are areas of growth, particularly in edibles, Gold Crown faces challenges in maintaining consistent performance across all categories in Michigan.

Competitive Landscape

In the Michigan concentrates market, Gold Crown has experienced notable fluctuations in rank and sales over the past few months. Starting at rank 19 in February 2024, Gold Crown saw a decline to rank 27 in March, a slight recovery to rank 25 in April, and then dropped to rank 30 by May. This downward trend in rank correlates with a decrease in sales from February to May, despite a brief sales uptick in April. In contrast, Cloud Cover (C3) showed a more stable performance, with a significant jump to rank 29 in May from being outside the top 40 in previous months. Similarly, Lit Labs improved its position from rank 58 in March to rank 35 in May, indicating a positive sales trajectory. Meanwhile, GreenCo Ventures made a remarkable leap from rank 63 in March to rank 28 in May, suggesting a strong upward trend in sales. Goodlyfe Farms entered the top 20 in May at rank 31, highlighting its growing market presence. These competitive dynamics suggest that while Gold Crown remains a significant player, it faces increasing pressure from rising brands, necessitating strategic adjustments to maintain and improve its market position.

Notable Products

In May-2024, the top-performing product for Gold Crown was Nerds - Tropical Passion Gummies 10-Pack (200mg) in the Edible category, securing the first rank with sales of $1698. Jesters - Strawberry Shortcake Infused Pre-Roll (1.5g) in the Pre-Roll category held the second position, down from its peak in March-2024. Jesters - Blueberry Diesel Infused Pre-Roll (1.5g) climbed to the third rank, showing a notable improvement from its absence in April-2024. Super Zmash Sugar (1g) in the Concentrates category made its debut at fourth place. Jesters - Watermelon Zkittles Infused Pre-Roll (1.5g) dropped to fifth position from third in April-2024, reflecting a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.