Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

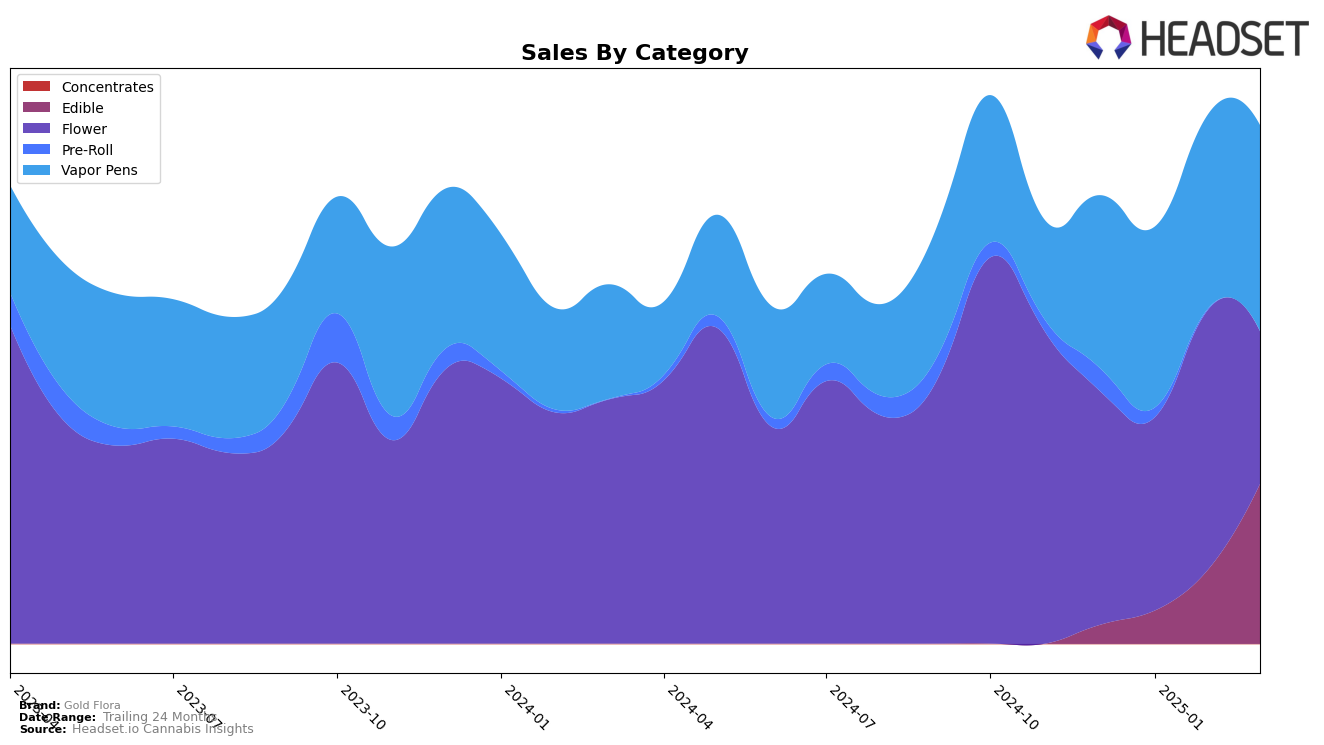

Gold Flora has demonstrated a significant upward trajectory in the Edible category within California, marking a steady rise from a rank of 54 in December 2024 to 18 by March 2025. This improvement indicates a growing consumer preference for their edible products, which aligns with their substantial increase in sales from $37,283 to $321,488 over the same period. Conversely, their performance in the Flower category in California has seen fluctuations, with a notable drop from position 48 in February 2025 to 79 in March 2025, suggesting potential challenges in maintaining a competitive edge in this segment.

In the Vapor Pens category, Gold Flora has maintained a relatively stable presence in the California market, with rankings hovering around the low 40s throughout the analyzed months. This consistency, coupled with a gradual increase in sales figures, suggests a solid customer base and a steady demand for their vapor pen products. However, the absence of Gold Flora in the top 30 rankings in other states or categories could imply either a strategic focus on the California market or a need for expansion and increased competitiveness elsewhere. Further insights into these dynamics could reveal strategic opportunities for the brand to capitalize on its strengths and address areas for growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, Gold Flora has shown a promising upward trend in its rankings over the past few months. Starting from a rank of 51 in December 2024, Gold Flora improved to 44 by January 2025 and maintained a steady climb to 43 in February, before slightly dropping back to 44 in March. This positive trajectory in rankings is mirrored by a consistent increase in sales, indicating a strengthening market presence. In contrast, competitors such as Connected Cannabis Co. and Cruisers have experienced a decline in both rank and sales, with Connected Cannabis Co. dropping from 38 to 45 and Cruisers from 17 to 40 over the same period. Meanwhile, Delighted has shown volatility, with a notable jump to 41 in March after fluctuating ranks. These dynamics suggest that Gold Flora is gaining traction in the market, potentially capturing market share from its competitors, and positioning itself as a formidable player in the California vapor pen category.

Notable Products

In March 2025, the top-performing product for Gold Flora was the CBN/CBD/THC 1:1:1 Nightberry Dream Gummies 10-Pack, maintaining its position as the number one ranked product for four consecutive months with a notable sales figure of 21,465. The Gold Rush - Tropicana Banana CDT Disposable advanced to the second position, climbing from fourth in February. The Gold Rush - GMO Blood Orange CDT Disposable made a strong debut at third place. Black Gold - Super Silver Haze Full Spectrum Cured Resin Disposable entered the rankings at fourth position. The Gold Rush - Blueberry Wedding Pie CDT Disposable re-entered the rankings at fifth, having been unranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.