Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

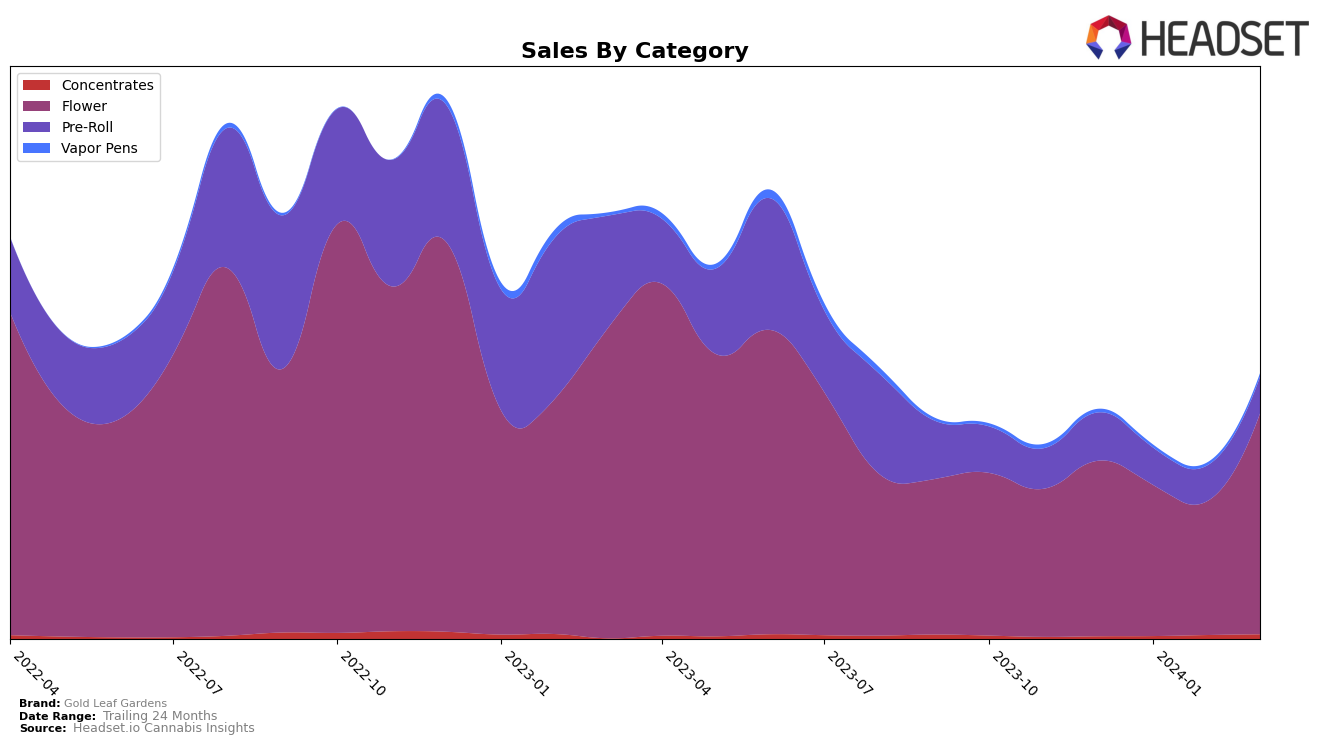

In the competitive cannabis market, Gold Leaf Gardens has shown a varied performance across categories and states. In Nevada, the brand's presence in the Flower category experienced a notable drop, as it fell out of the top 30 rankings after December 2023, where it was ranked 94th with sales amounting to $22,371. This indicates a significant challenge in maintaining or growing its market share within the state's Flower category. Conversely, in Washington, Gold Leaf Gardens demonstrated a stronger performance in the Flower category, improving its ranking from 33rd in December 2023 to 16th by March 2024, alongside a remarkable increase in sales from $279,221 to $374,405 over the same period. This upward trend in Washington suggests a growing consumer preference and a successful market penetration strategy for Gold Leaf Gardens in the Flower category.

However, the brand's performance in the Pre-Roll category in Washington tells a different story. Despite maintaining a presence in the top 60 from December 2023 through March 2024, Gold Leaf Gardens saw only a slight increase in sales, moving from $82,606 to $62,315 over the four months. This relatively flat sales trajectory, combined with rankings fluctuating between 47th and 59th, indicates a steady but slow growth in this category. Such performance contrasts sharply with the brand's success in the Flower category within the same state, highlighting the diverse challenges and opportunities Gold Leaf Gardens faces across different cannabis product categories. The brand's ability to leverage its strengths and address areas of weak performance will be crucial in its ongoing efforts to expand its market presence and consumer base.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Washington, Gold Leaf Gardens has shown a notable improvement in its market position, moving from not being in the top 20 in December 2023, to a significant rise to 16th place by March 2024. This upward trajectory in rank is mirrored by a substantial increase in sales over the same period, indicating a growing consumer preference for their products. Competitors such as SKÖRD have maintained a strong presence in the market, consistently ranking within the top 20 and showing a slight improvement from 14th to 10th place, then stabilizing at 14th by March 2024. Meanwhile, Smokey Point Productions (SPP), after not being in the top 20 in December, improved its rank significantly, reaching 17th by January and maintaining a position around 18th in the following months. Snickle Fritz and Ooowee also displayed competitive dynamics, with Snickle Fritz moving up to 15th by January and slightly adjusting to 17th by March, and Ooowee showcasing a similar pattern of rank improvement. Gold Leaf Gardens' recent performance, particularly its leap in rank and sales, highlights its growing prominence and competitive edge in the Washington cannabis flower market.

Notable Products

In March 2024, Gold Leaf Gardens saw Ric James (3.5g) as its top-selling product, with sales reaching 2324 units, maintaining its leading position from previous months with a brief dip to second place in February. The second place was claimed by Ric James Pre-Roll (0.7g), which saw a significant increase in popularity, moving up from the third and first positions in January and February, respectively, to secure its rank in March. Animal Sherbert (3.5g) followed closely behind in third place, showing a steady climb in the rankings from fifth place in December and January to fourth in February, before finally reaching third in March. A newcomer to the rankings, 808 Runtz (3.5g), made a notable entry directly into the fourth position in March, indicating a strong market debut. Lastly, Animal Sherbert Pre-Roll (0.7g) rounded out the top five, demonstrating a significant interest in pre-rolled options among consumers, despite not being ranked in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.