Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

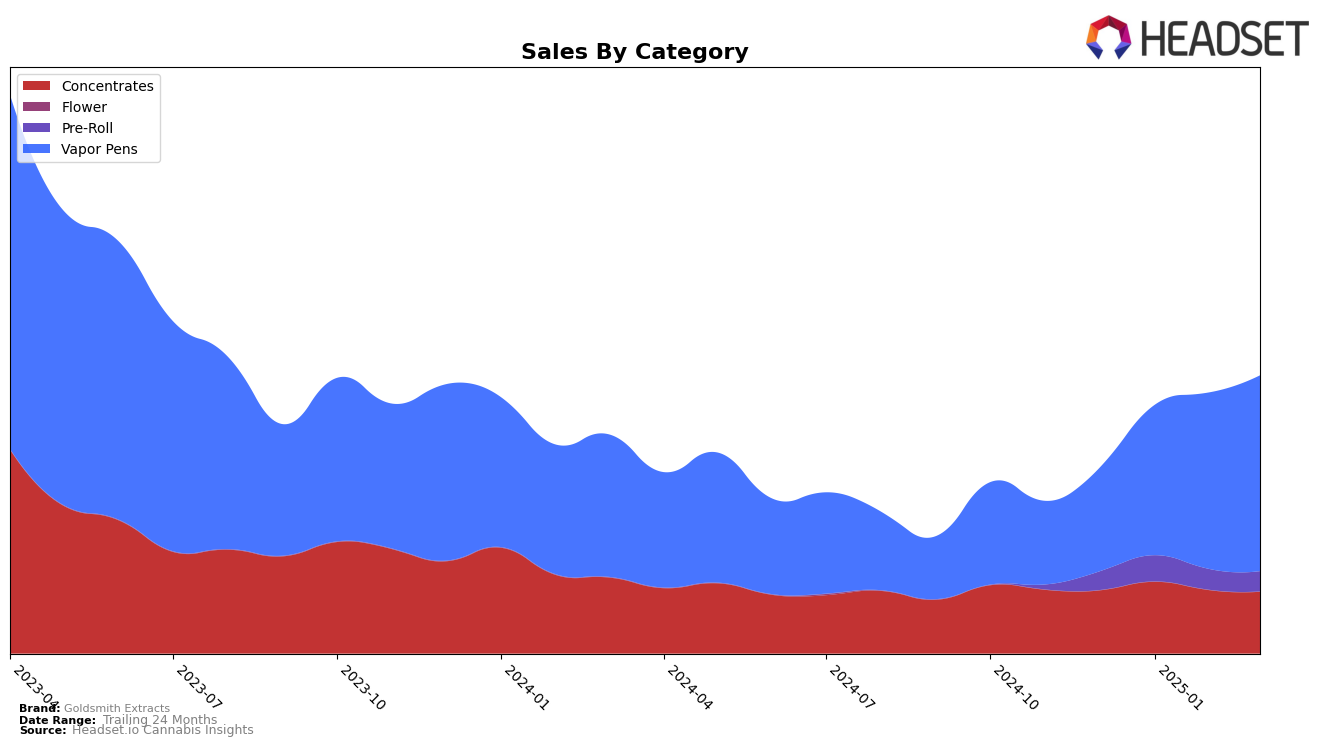

Goldsmith Extracts has demonstrated varied performance across different product categories in Arizona. In the Concentrates category, the brand showed a promising upward movement from December 2024 to February 2025, reaching a rank of 15th, before slipping back to 18th in March 2025. This fluctuation suggests a competitive market environment where maintaining a top position is challenging. In contrast, the Vapor Pens category saw a consistent improvement, moving from 32nd in December 2024 to a strong 21st by March 2025, indicating a growing consumer preference for their products in this segment. Meanwhile, the Pre-Roll category did not make it into the top 30, which highlights a potential area for growth or reconsideration of strategy.

Despite some challenges, Goldsmith Extracts has shown resilience, particularly in the Vapor Pens category. The sales figures support this trend, with a notable increase from December 2024 to March 2025, reflecting a successful penetration in the market. However, the brand's presence in the Pre-Roll category remains outside the top 30, suggesting that there may be room for improvement or a need to innovate to capture more market share. The fluctuating ranks in the Concentrates category also highlight the competitive pressures and the necessity for strategic adjustments to sustain or improve their position. Overall, Goldsmith Extracts' performance in Arizona presents a mixed picture, with strengths in certain areas and opportunities for growth in others.

Competitive Landscape

In the Arizona Vapor Pens category, Goldsmith Extracts has shown a notable upward trajectory in its market position from December 2024 to March 2025. Starting at rank 32 in December, Goldsmith Extracts improved to rank 20 by February, before slightly dropping to 21 in March. This positive trend indicates a strengthening presence in the market, likely driven by increasing consumer demand for their products. In comparison, Grow Sciences maintained a relatively stable position, hovering around the 18th to 19th rank, while Micro Bar experienced a slight decline from 19th to 22nd. Notably, Big Bud Farms made a significant leap from 47th in December to 20th in March, suggesting a competitive surge that Goldsmith Extracts should monitor closely. Meanwhile, Tru Infusion showed fluctuations but remained outside the top 20 for most months. These dynamics highlight the competitive landscape in Arizona's Vapor Pens market, where Goldsmith Extracts' upward movement suggests potential for increased sales and market share, amidst a backdrop of shifting ranks among competitors.

Notable Products

In March 2025, the top-performing product for Goldsmith Extracts was the Pineapple Express Distillate Cartridge (1g) in the Vapor Pens category, regaining its position at rank 1 with sales of $573. The Ice Cream Cake Distillate Cartridge (1g) made an impressive debut, securing the 2nd rank. The Forbidden Fruit Distillate Cartridge (1g) maintained a steady presence, ranking 3rd, although it had dropped out of the rankings in February. Purple Punch Badder (1g) in the Concentrates category slipped to 4th place, continuing its decline from the top position it held in December. The Sherblato Diamond Infused Pre-Roll 3-Pack (3.5g) entered the rankings at 5th, marking its first appearance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.