Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

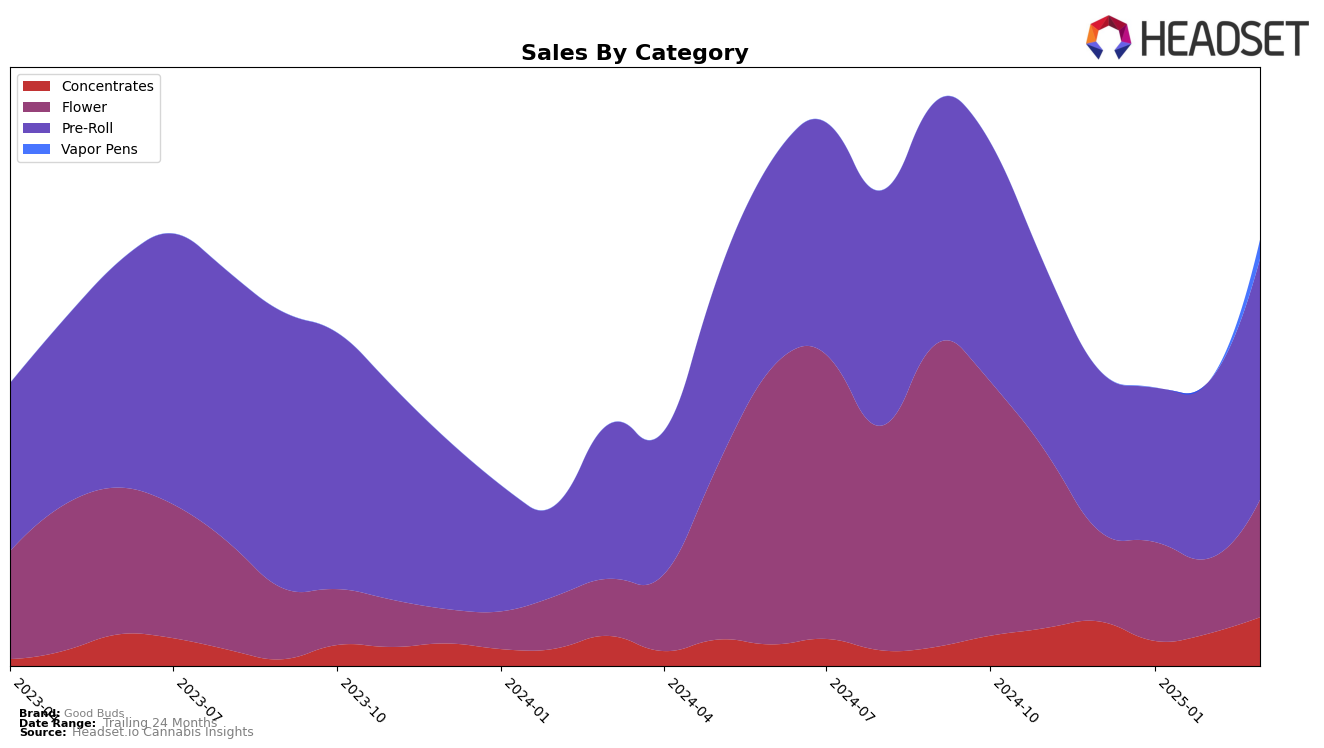

Good Buds has demonstrated notable performance shifts across various categories and provinces, especially in Alberta. In the Concentrates category, Good Buds made a significant leap from not being in the top 30 in January 2025 to ranking 22nd by March 2025, indicating a strong upward trajectory. This improvement is mirrored by a substantial increase in sales. Their Flower category, however, showed more volatility, with rankings fluctuating from 86th in December 2024 to 59th by March 2025. While this still represents a positive trend, it highlights the competitive nature of the Flower market in Alberta. Pre-Rolls also saw a steady climb, moving from 55th in December 2024 to 48th in March 2025, showcasing consistent growth in this segment.

In British Columbia, Good Buds exhibited varied performance across categories. They maintained a relatively stable yet modest presence in the Concentrates category, with rankings fluctuating between 21st and 32nd over the months. The Flower category showed a slight improvement, moving from 56th in December 2024 to 48th in March 2025, suggesting a gradual strengthening of their market position. Notably, the Pre-Roll category experienced a significant rise, advancing from 51st to 33rd place, which could indicate a growing consumer preference for their offerings in this segment. Interestingly, Good Buds entered the Vapor Pens category in March 2025, debuting at 48th, which could signal the brand's strategic expansion into new product lines.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Good Buds has shown a steady improvement in its rank from December 2024 to March 2025, moving from 51st to 33rd place. This upward trajectory is indicative of a positive trend in sales performance, although it still trails behind competitors like Jonny Chronic and Sheeesh!, which have maintained higher ranks throughout the same period. Notably, BLKMKT has experienced the most significant climb, advancing from 60th to 31st, surpassing Good Buds in March 2025. Meanwhile, Woody Nelson has fluctuated but generally maintained a stronger position, despite a slight dip in March. This competitive environment suggests that while Good Buds is gaining ground, there remains a need for strategic initiatives to further enhance its market position against these formidable competitors.

Notable Products

In March 2025, Mango Cake Pre-Roll 2-Pack (1g) retained its position as the top-selling product for Good Buds, with sales reaching 8207 units. Gluerangutan Pre-Roll 7-Pack (3.5g) held steady at the second spot, showing a notable increase in sales from the previous month. Mango Cake Pre-Roll 7-Pack (3.5g) maintained its third-place ranking, demonstrating consistent performance since February. New to the rankings in March, Mango Cake (3.5g) debuted in fourth place, indicating a strong market entry. BC Organic - Gluerangutan Pre-Roll (1g) remained in fifth place, with a gradual increase in sales over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.