Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

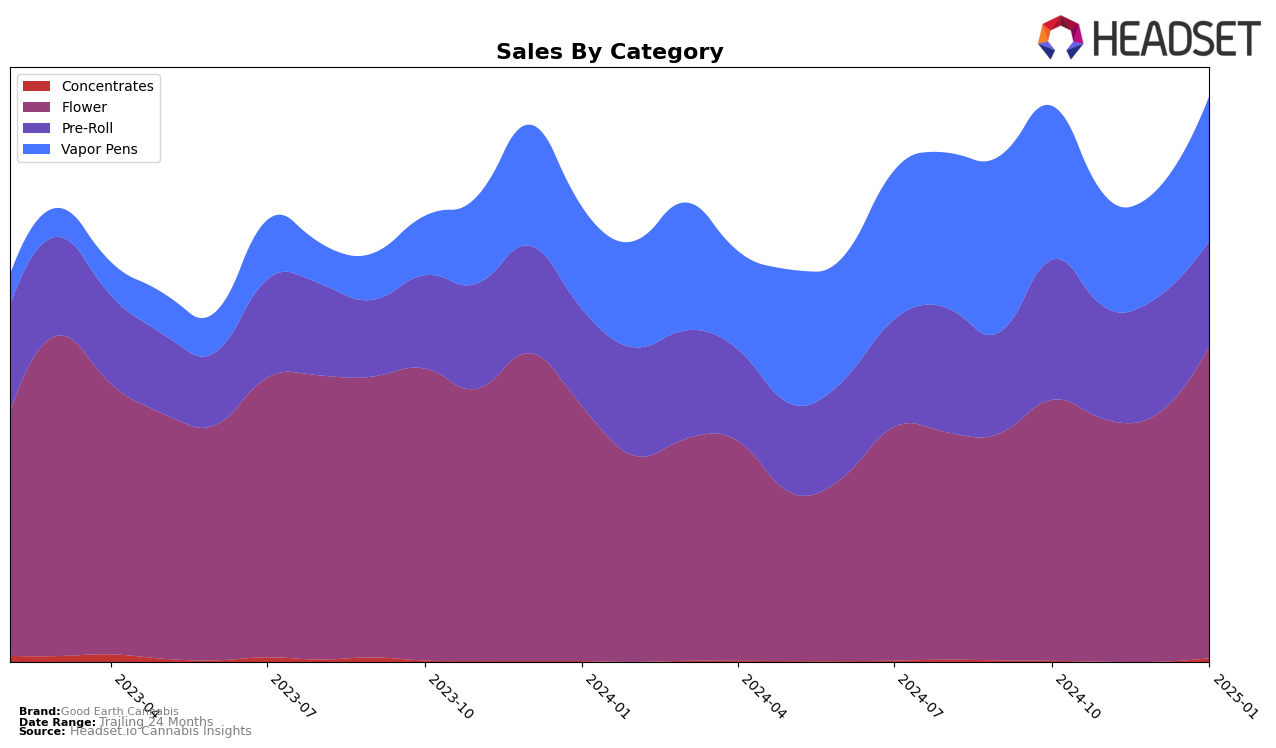

Good Earth Cannabis has shown a notable performance in the Washington market, particularly in the Flower category. Over the span from October 2024 to January 2025, the brand improved its rank from 37th to 18th, marking a significant upward movement. This improvement in ranking is mirrored by an increase in sales, with a notable jump in January 2025. However, in the Pre-Roll category, while they managed to enter the top 40 by December 2024, their position remained stagnant at 36th in January 2025, indicating a need for strategic efforts to climb higher in this category. The lack of a top 30 presence in Vapor Pens suggests a challenge in that segment, as they were unable to break into the top tier rankings during the observed period.

In terms of category dynamics, the Flower category appears to be the strongest for Good Earth Cannabis in Washington, with a marked improvement in both ranking and sales figures over the months. This suggests a growing consumer preference or successful marketing strategies in that category. Conversely, the Vapor Pens category shows a less favorable trajectory, with rankings fluctuating between 48th and 59th, indicating potential issues with product positioning or competition. The consistent ranking in the Pre-Roll category might reflect a stable but not particularly strong market presence. Overall, while there are areas of success, particularly in Flower, the brand faces challenges in other categories that could benefit from targeted strategies to enhance their market position.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Good Earth Cannabis has shown a notable upward trajectory in rankings from October 2024 to January 2025. Initially ranked 37th in October, Good Earth Cannabis climbed to 18th by January, indicating a significant improvement in market position. This upward movement is mirrored by a steady increase in sales, culminating in a strong performance in January. Competitors such as Bondi Farms and Mini Budz also improved their rankings, with Bondi Farms moving from 33rd to 19th and Mini Budz from 42nd to 20th, suggesting a competitive push in the market. However, Passion Flower Cannabis and EZ Puff maintained stronger positions throughout, with Passion Flower Cannabis consistently ranking in the top 20 and EZ Puff achieving a similar upward trend to Good Earth Cannabis. These dynamics highlight a competitive but growing market where Good Earth Cannabis is gaining ground, potentially driven by strategic initiatives or product offerings that resonate with consumers.

Notable Products

In January 2025, the top-performing product for Good Earth Cannabis was Pineapples In Space (3.5g) in the Flower category, maintaining its first-place rank from the previous two months with impressive sales figures of 1643 units. The Pineapples in Space Pre-Roll 2-Pack (1g) held steady at the second position, showing consistent popularity in the Pre-Roll category. Wedding Cake (3.5g) emerged as a strong contender, debuting at third place in the Flower category. Grape Gasoline (3.5g) improved its standing from fifth to fourth place, indicating a growing preference among consumers. Blue Dream Pre-Roll 2-Pack (1g) entered the rankings at fifth place, suggesting a positive reception in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.