Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

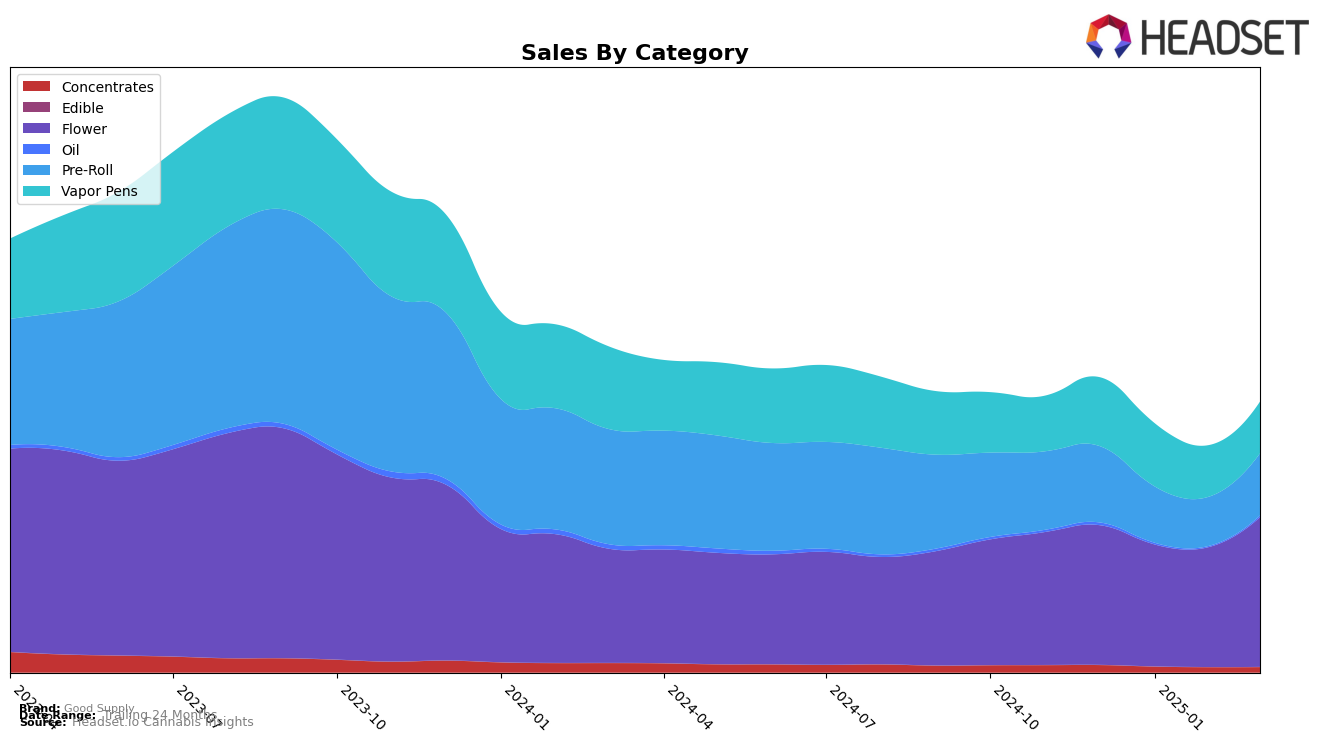

Good Supply has shown notable performance in the Alberta market, particularly in the Flower category, where it ascended from the third position in December 2024 to claim the top spot by March 2025. This upward trajectory is reflective of a significant increase in sales, culminating in March. However, the brand faced challenges in the Pre-Roll category in Alberta, where it slipped from the 10th position to 13th over the same period, indicating potential areas for improvement. In British Columbia, Good Supply maintained a steady performance in the Flower category, consistently holding the 6th position from January to March 2025, while its Vapor Pens category experienced slight fluctuations but remained within the top 15.

In Ontario, Good Supply's Flower category consistently held the 5th position from December 2024 to March 2025, showcasing stability in a competitive market. The brand's performance in the Pre-Roll category saw a slight improvement, moving from 14th to 13th by March. However, its presence in the Vapor Pens category remained varied, with rankings oscillating between 13th and 15th. Notably, Good Supply's Concentrates category in Ontario did not maintain a top 30 position beyond December 2024, suggesting a potential area for strategic focus. In Saskatchewan, the brand achieved a remarkable feat by reaching the top rank in the Flower category by March 2025, although its Vapor Pens category did not sustain a top 30 presence past January 2025, indicating room for growth.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Good Supply has maintained a consistent rank of 5th from December 2024 through March 2025. This stability in ranking highlights its solid market presence, despite a noticeable decline in sales over the same period. In contrast, Spinach holds a stronger position, consistently ranking 2nd or 3rd, with sales figures significantly higher than those of Good Supply. Meanwhile, Pure Sunfarms also maintains a steady 4th rank, slightly outperforming Good Supply in sales. Notably, The Original Fraser Valley Weed Co. and SUPER TOAST have shown more dynamic movements in rankings, with SUPER TOAST climbing from 10th to 6th place, suggesting a potential threat to Good Supply's position if current trends continue. These insights underscore the competitive pressure Good Supply faces and the importance of strategic adjustments to bolster its market share.

Notable Products

In March 2025, the top-performing product from Good Supply was Jean Guy Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank for four consecutive months with sales of 27,662 units. Jean Guy (3.5g) in the Flower category showed significant improvement, rising from fifth in January to second in March. Grand Daddy Purps (3.5g) also in Flower, debuted in the rankings at fourth in February and climbed to third in March. Purple Monkey Distillate Cartridge (1g) in Vapor Pens, which had been consistently second, fell to fourth place in March. Meanwhile, Tropical Chewy Bear Distillate Cartridge (1g) in Vapor Pens held steady at fifth place since February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.