Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

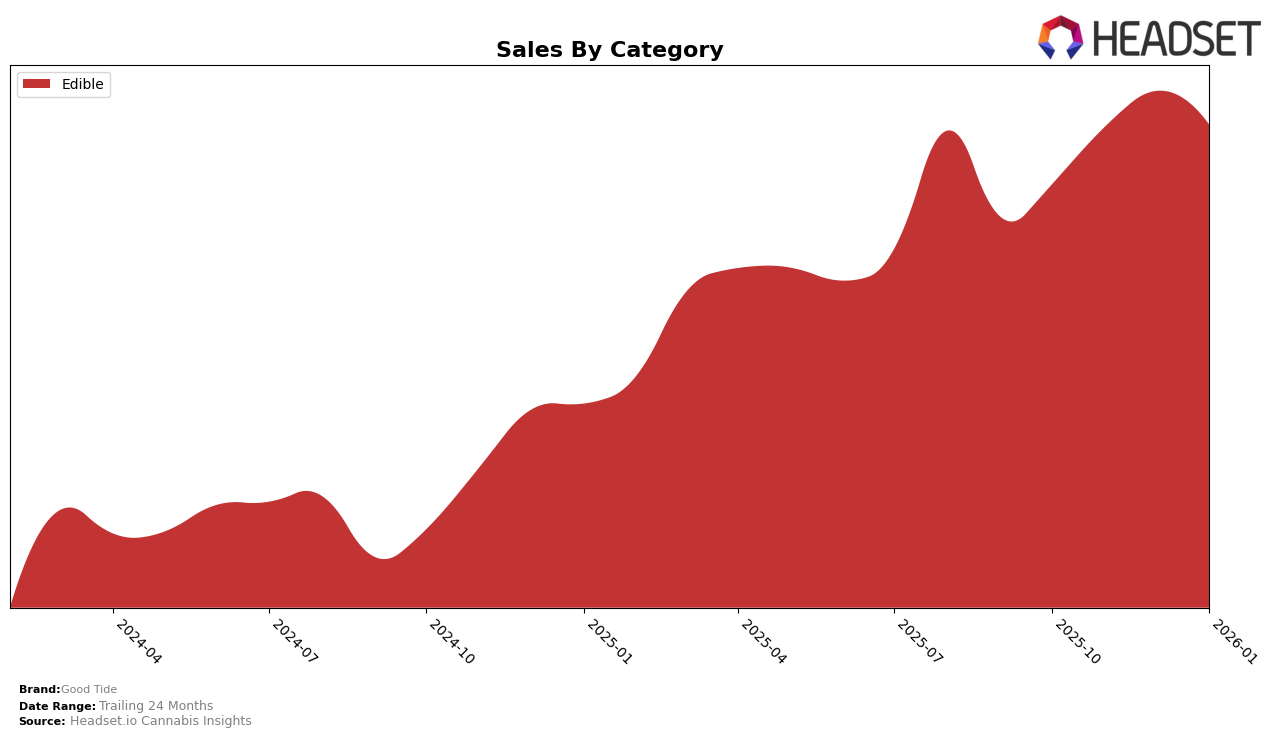

Good Tide has demonstrated consistent performance in the Edible category across various states, with notable stability in markets like California and Colorado, where it maintained a steady 5th place ranking from October 2025 to January 2026. In contrast, the brand has seen some fluctuations in Arizona, where it slipped from 9th to 12th place by January 2026, despite a slight increase in sales from November to December 2025. This might suggest a competitive market environment or a shift in consumer preferences. Meanwhile, Michigan presents a success story for Good Tide, as it improved its position from 5th to 3rd, indicating a strengthening market presence and possibly effective local strategies.

In the eastern markets, Good Tide's performance in New Jersey is commendable, moving up from 9th to 7th place, which suggests a growing acceptance and popularity among consumers. However, in Illinois, the brand has not broken into the top 15, fluctuating between 17th and 19th place. This indicates potential challenges or opportunities for growth in that region. Despite the competitive landscape, Good Tide has maintained a consistent 6th place ranking in Washington, showing a stable market position. The brand's varied performance across states highlights the importance of tailored strategies to address the unique market dynamics in each region.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Good Tide has consistently maintained its position at rank 5 from October 2025 to January 2026. This stability in ranking suggests a solid market presence, although it trails behind competitors like Kanha / Sunderstorm and Lost Farm, which have consistently held ranks 3 and 4, respectively. Despite not breaking into the top 3, Good Tide's sales figures have shown a positive trajectory, peaking in December 2025 before a slight dip in January 2026. This trend indicates a potential for growth if the brand can capitalize on its current momentum. Meanwhile, Heavy Hitters and Froot, ranked 6 and 7, respectively, have not posed a significant threat to Good Tide's position, as their sales figures remain lower. For Good Tide, the challenge lies in closing the gap with the top-tier brands while maintaining its edge over lower-ranked competitors.

Notable Products

In January 2026, Good Tide's Uplifting Sativa Pineapple Solventless Hash Rosin Gummies 10-Pack continued to dominate the sales rankings, maintaining its position as the top-selling product for the fourth consecutive month with sales of 65,589 units. The CBN/CBD/THC 1:1:1 Passionfruit Solventless Hash Rosin Gummies 10-Pack also held steady in second place, showing a consistent increase in sales over the months. The Refreshing CBG/CBD/THC 1:1:1 Kiwi Strawberry Solventless Hash Rosin Gummies 10-Pack remained in third place, having regained its position after briefly dropping to fourth in November 2025. Indica Mango Mellow Hash Rosin Gummies consistently stayed in fourth place, while Hybrid Guava Solventless Hash Rosin Gummies 10-Pack maintained its fifth-place ranking. Overall, the rankings have shown remarkable stability, with no changes in product positions from December 2025 to January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.