Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

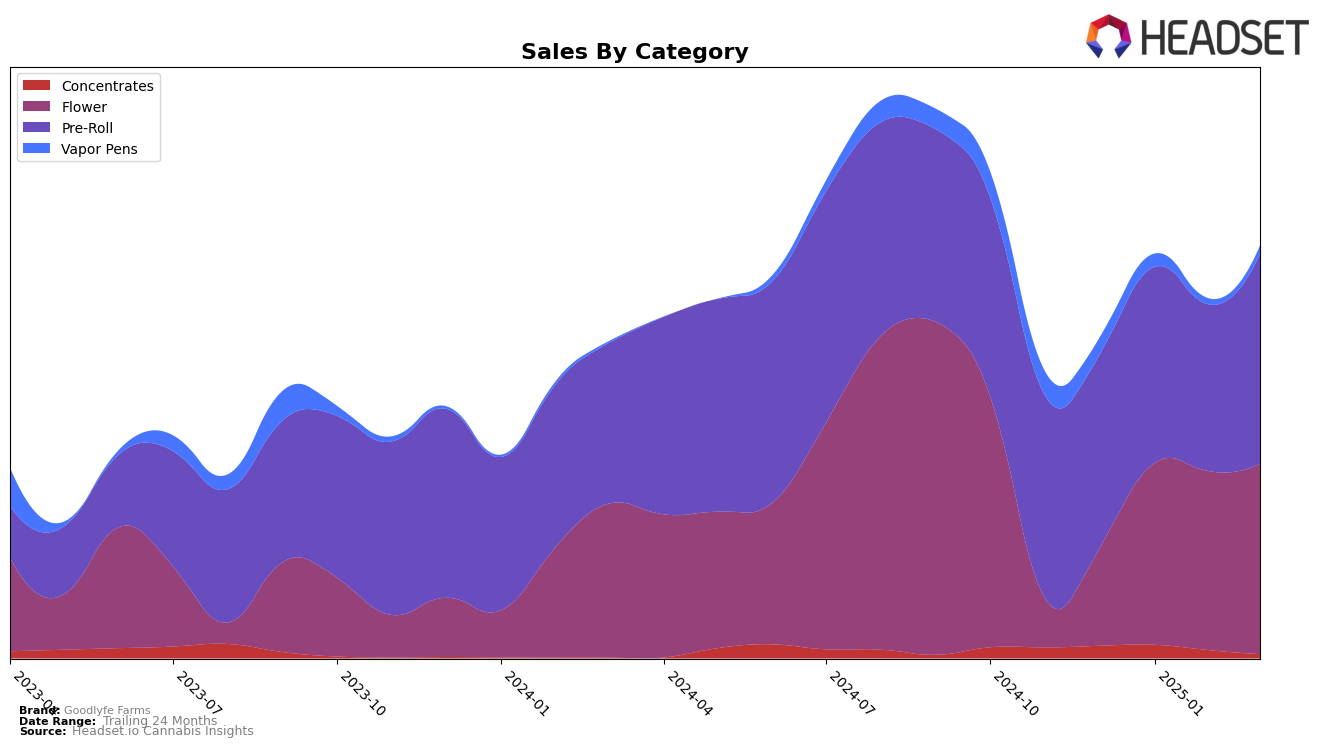

In the state of Michigan, Goodlyfe Farms has shown varied performance across different product categories. Their Flower category has been particularly strong, maintaining a consistent top 10 position from January to March 2025, with a notable jump from 22nd in December 2024 to 6th in January 2025. This indicates a significant increase in consumer preference or market penetration. On the other hand, the Concentrates category saw a decline, falling out of the top 30 by March 2025, which might suggest a need for strategic reassessment or increased competition in that segment. The Pre-Roll category has been a standout, consistently holding the 3rd position throughout the observed months, highlighting Goodlyfe Farms' strong presence and consumer loyalty in that product line.

Conversely, the Vapor Pens category has experienced fluctuations, with rankings dropping out of the top 30 in February 2025, only to reappear at a lower position in March. This inconsistency could be attributed to market volatility or shifts in consumer preferences. Despite these challenges, the brand's performance in the Flower and Pre-Roll categories suggests a robust market strategy and strong brand recognition in Michigan. Understanding these dynamics and focusing on the weaker categories could be key for Goodlyfe Farms to enhance their market standing across all product lines.

Competitive Landscape

In the competitive landscape of pre-rolls in Michigan, Goodlyfe Farms consistently holds the third position from December 2024 through March 2025. Despite maintaining its rank, the brand faces stiff competition from Cali-Blaze, which consistently ranks second, and Jeeter, the market leader. Notably, Goodlyfe Farms shows resilience with a sales increase from February to March 2025, indicating a positive trend despite the competitive pressure. Meanwhile, Dragonfly Cannabis remains a constant competitor at the fourth position, while Simpler Daze shows a promising rise in rank from seventh to fifth place by March 2025. This competitive environment suggests that while Goodlyfe Farms is stable in its ranking, strategic efforts are necessary to close the gap with higher-ranking brands and capitalize on its upward sales trajectory.

Notable Products

In March 2025, Goodlyfe Farms' top-performing product was Unicorn Piss Infused Pre-Roll (1g), maintaining its top rank from January and regaining its position from February with sales of $99,134. Ice Cream Sandwich Distillate Infused Pre-Roll (1g) climbed to second place, showing significant improvement from its fifth position in February. Blueberry Banana Pancakes Infused Pre-Roll (1g) ranked third, experiencing a consistent rise from fourth place in February. Blue Raspberry Infused Pre-Roll (1g) debuted in fourth place, indicating a strong entry into the rankings. Sour Diesel Infused Pre-Roll (1g) returned to the rankings at fifth place, showing a resurgence after being unranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.