Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

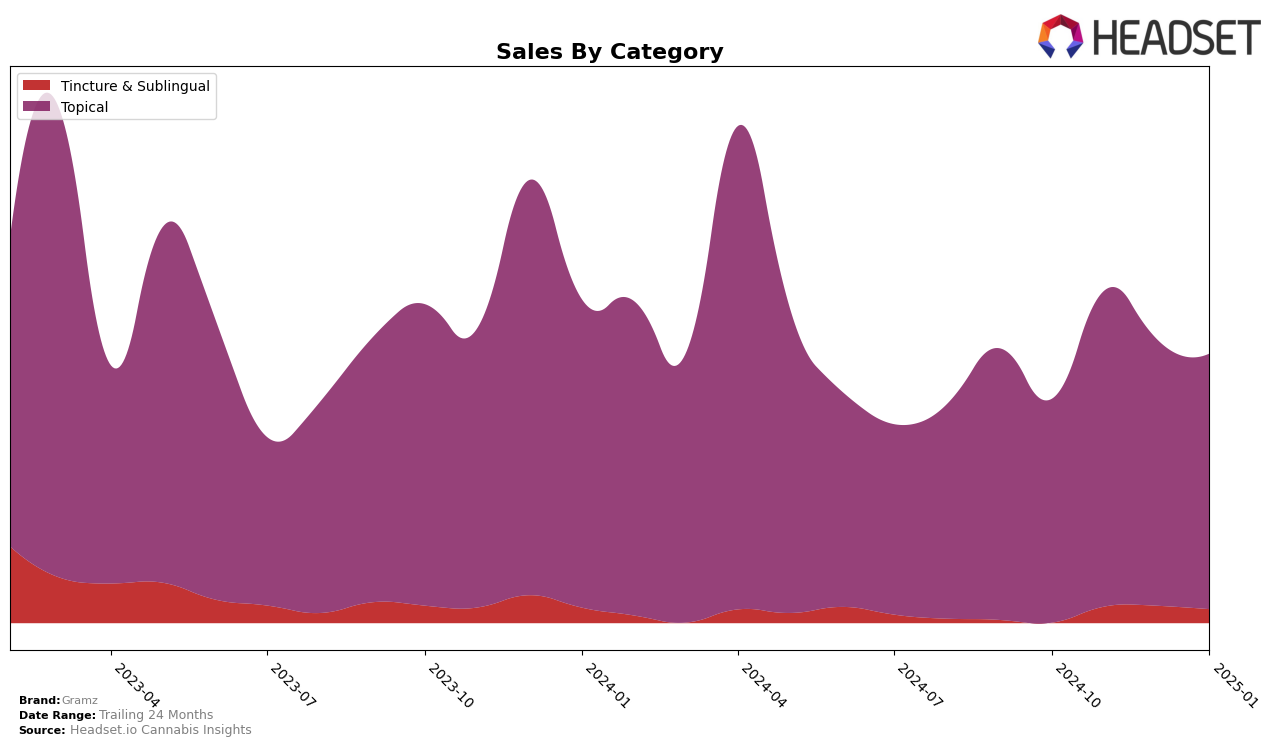

In the state of Arizona, Gramz has demonstrated a consistent performance in the Topical category over the past few months. Starting from October 2024, the brand was ranked 6th, improved to 5th in November, maintained this position in December, and then returned to 6th in January 2025. This indicates a stable presence in the market, with a slight fluctuation that suggests competitive dynamics within the Topical category. The sales figures reflect a peak in November, followed by a gradual decline, which could be attributed to seasonal factors or shifts in consumer preferences.

While Gramz has maintained its footing in the Arizona market, the absence of rankings in other states or categories suggests that the brand may not have achieved significant penetration beyond this specific segment and region. Not being listed in the top 30 brands in other categories or states could highlight opportunities for expansion or areas where Gramz may need to bolster its market strategy. This focused presence in Arizona's Topical category might be a strategic choice or a result of market conditions specific to the region. Understanding these dynamics could provide insights into potential growth areas for Gramz in the future.

Competitive Landscape

In the competitive landscape of the Arizona topical cannabis market, Gramz has experienced a relatively stable yet challenging position over the past few months. Despite a brief rise to the 5th rank in November 2024, Gramz has predominantly maintained the 6th position from October 2024 through January 2025. This stability, however, is overshadowed by the consistent performance of iLava, which has held a top-three position throughout the same period, indicating a strong market presence and consumer preference. Meanwhile, Müv / MUV has shown a slight fluctuation but remains a close competitor, often ranking just above Gramz. The sales trajectory for Gramz shows a peak in November 2024, followed by a gradual decline, which suggests potential challenges in maintaining consumer interest or market share against these formidable competitors. Understanding these dynamics can provide valuable insights for strategic adjustments and targeted marketing efforts to enhance Gramz's competitive positioning in the Arizona market.

Notable Products

In January 2025, Gramz's CBD/THC 1:1 Herbal Lotion (300mg CBD, 300mg THC) maintained its position as the top-performing product in the Topical category, with sales reaching 387 units. The THC Herbal Lotion (300mg) also held steady in second place, consistent with its rankings from previous months. The CBG/THC 1:2 G9 Aphrodisiac Libido Booster (50mg CBG, 100mg THC) continued its strong performance in the Tincture & Sublingual category, ranking third for the second consecutive month. Notably, the CBG/THC 1:2 G9 Herbal Aphrodisiac Libido Booster (50mg CBG, 100mg THC) rose to fourth place, improving from its fifth position in December 2024. Meanwhile, the CBG/THC 1:2 Essential Roll On Oil Cream (50mg CBG, 100mg THC) saw a drop to fifth place, reflecting a decrease in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.