Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

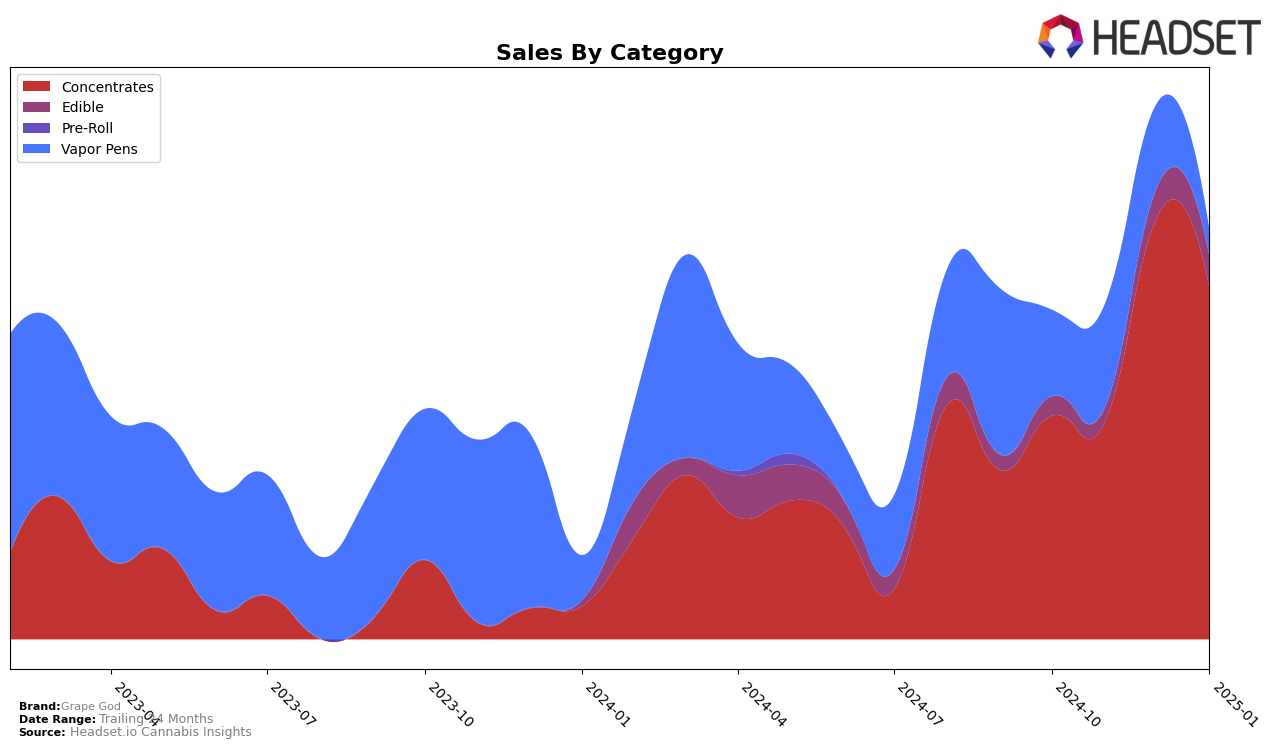

In the Oregon market, Grape God has shown noteworthy progress in the Concentrates category. Despite being ranked outside the top 30 in October and November 2024, the brand made a significant leap to the 24th position by December 2024, though it slightly dipped to 28th in January 2025. This fluctuation in ranking coincides with a marked increase in sales from November to December, suggesting a strong performance during the holiday season. The brand's ability to climb into the top 30 indicates a positive reception and growing demand, which could be a promising sign for sustained success in this competitive category.

Conversely, Grape God's performance in the Vapor Pens category in Oregon has not been as robust. The brand did not break into the top 30 rankings from October to December 2024, maintaining positions in the 90s during the months for which data is available. This suggests a challenging market position and potential areas for improvement or strategic shifts. The absence of rankings in December and January could indicate a drop in competitiveness or market presence, highlighting a stark contrast to their Concentrates category performance.

Competitive Landscape

In the Oregon concentrates market, Grape God has demonstrated notable fluctuations in its ranking and sales performance over recent months. Starting from a rank of 39 in October 2024, Grape God improved significantly to 24 by December 2024, indicating a strong upward trend in sales momentum. However, by January 2025, the brand experienced a slight decline to rank 28. This volatility can be contrasted with competitors like Happy Cabbage Farms, which consistently ranked outside the top 20, indicating a downward trend in sales. Meanwhile, Mule Extracts maintained a more stable performance, fluctuating between ranks 29 and 35, with a notable sales increase in January 2025. Chromatic and Farmers First also showed competitive dynamics, with Chromatic improving its rank from 31 to 27 and Farmers First maintaining a consistent presence in the top 30. These insights suggest that while Grape God has shown potential for rapid growth, it faces stiff competition from brands that are either stabilizing or improving their market positions.

Notable Products

In January 2025, the top-performing product for Grape God was Strawpaya Zittlez Cold Cure Rosin (1g) from the Concentrates category, achieving the number one rank with sales of 373 units. Peaches n' Cream Rosin Gummies 10-Pack (100mg), an Edible, maintained its strong position at rank two, showing a notable increase from previous months. Maple Dunks Cold Cure Rosin (1g) climbed to third place, improving from its fifth-place position in December 2024. Oishii Cold Cure Hash Rosin (1g) and Premium Dark Z Cold Cure Rosin (1g) both shared the third rank, indicating a competitive Concentrates market. Overall, Grape God's product rankings in January 2025 reflect a strong performance in both Concentrates and Edibles, with significant upward movement for several products compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.